Rare earth startups eye slice of $1 billion bounty from Brazil

According to me-metals cited from mining.com, Brazil is set to unveil on Thursday a shortlist of strategic minerals projects eligible for financial support from its development bank BNDES and government funding agency Finep. The state-owned entities have spent weeks sifting through 124 pitches for initiatives totaling $15 billion, including many by firms seeking to churn out rare earths used in magnets, batteries and high-tech gear.

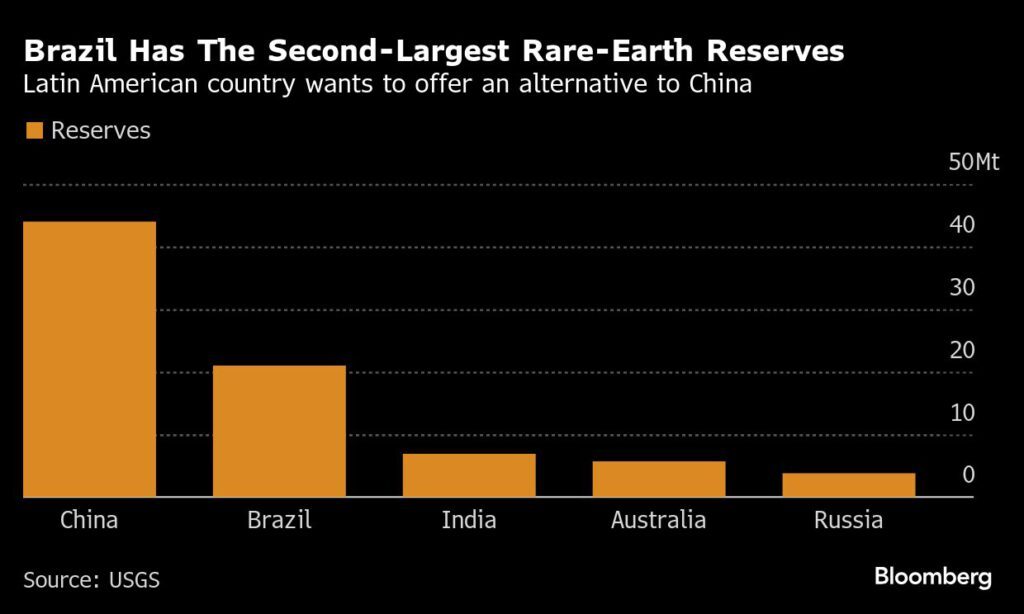

The South American nation is looking to turn years of rare earth promise into reality when China is using its dominance in the industry as leverage in trade relations, prompting the US and other governments to seek stable supplies elsewhere as a matter of national security. Trade tensions over these obscure elements have created opportunities for startups.

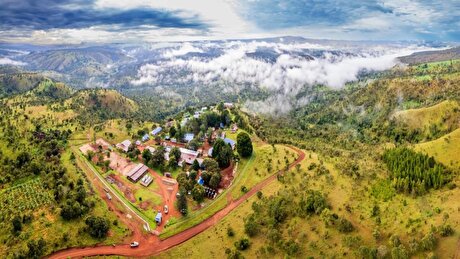

Firms with early-stage projects in Brazil include Aclara Resources Inc., Viridis Mining and Minerals Ltd. and Meteoric Resources NL.

While a slice of the state funding may not be enough to get projects over the line, BNDES is also open to bringing in international institutions such as the Japan International Cooperation Agency — as long as projects offer a refining component. It could also mobilize private partners as well as Brazil’s climate change fund.

“The world has realized it can’t rely on just one country,” said Jose Luis Gordon, director of development, foreign trade and innovation at BNDES.

Brazil has 23% of global reserves, second only to China, according to the US Geological Survey. The country’s production is limited to Serra Verde Group — a company backed by US investors that has signed up mostly Chinese buyers.

“Brazil is copy-paste geologically to what the Chinese have,” Aclara Chief Executive Officer Ramon Barua said in an interview. “The difference is we’re doing it in a super environmentally friendly way.”

Rare earths are in the spotlight after China rolled out export restrictions while the US pushes for resource deals in Ukraine, Greenland and the Democratic Republic of the Congo. US President Donald Trump said Wednesday that a trade framework with Beijing has been completed, with China supplying rare earths and magnets.

It’s not the first time rare earths have captured global attention. In the early 2010s, companies including Molycorp Inc. and Lynas Rare Earths Ltd. rode a wave of investor interest on the obscure elements, until the market crashed as more supply came on stream and consumers switched to cheaper alternatives.

The global industry still faces plenty of hurdles beyond pulling elements out of the ground. One is competing with China in processing. Another is creating a price benchmark outside China’s opaque market. Consulting firm Wood Mackenzie estimates prices would have to double to encourage ex-China guaranteed supply.

“Investors are not willing to run all that risk, so there is a need for incentives, most likely from governments, that help them de-risk,” said Johann Schimd, head of metals consulting at Wood Mackenzie.

Prospective producers in Brazil are looking to engage with buyers in the US and other Western nations in a bet they’ll be able to tap low-cost funding. Aclara, for example, wants to mine and process in Brazil to supply a magnets plant in South Carolina.

Viridis has held talks with state banks in the US, Canada, Germany, France, Japan, Korea and Australia. The Perth-based firm is looking to diversify its pool of financiers and customers for more flexibility.

“The entire industrial chain still needs to be structured,” said Klaus Petersen, Viridis’ country manager in Brazil. “We’re only talking to development banks.”

source: mining.com

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

Teck approves $2.4B expansion of Highland Valley Copper

Gold price eases after Trump downplays clash with Fed chair Powell

BHP, Lundin JV extends useful life of Argentina copper mine

BHP delays Jansen potash mine, blows budget by 30%

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions