Rating of Iranian Banks to Be Made Public

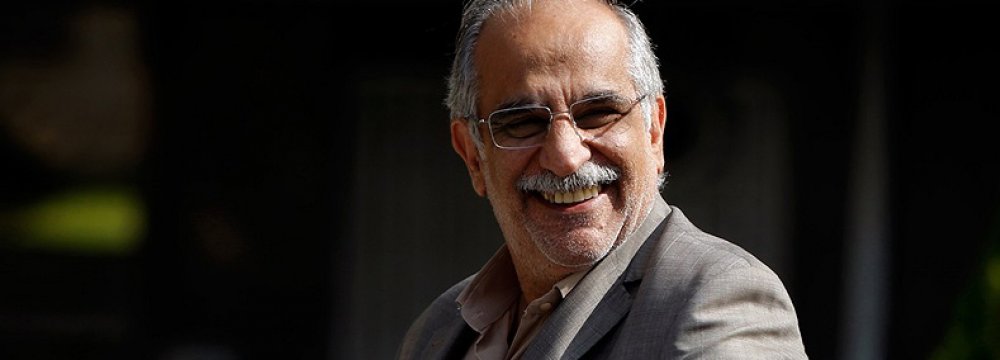

After the illegal financial and credit institutions hurt a lot of depositors, the government put a new plan on its agenda to rate certified banks,” Minister of Economic Affairs and Finance Masoud Karbasian told the Persian newspaper Iran in a recent interview.

According to Karbasian, the banks will be rated in terms of their performance, volume of capital and other indicators and standards, while the ratings will be disclosed publicly “so that people can select their bank with complete knowledge”.

“The plan will be implemented in the next fiscal year that begins on March 21,” he added.

Iran has been planning to rate its banks for a number of years now.

Ali Divandari, the head of Monetary and Banking Research Institute, had said representatives from international rating agencies visited Tehran during the FINEX 2016 event to begin negotiations regarding the rating of Iranian banks and companies.

No further news was published on that front, but officials with the Central Bank of Iran in 2016 announced that a new rating system has been devised locally.

Farshad Heydari, CBI’s deputy for supervisory affairs, said in September 2016 that the results of the ratings will not be made public as “there is no need” for it.

He had also said at the time that banks will be classified under four categories based on their level of risk and the results of the single scheme that will treat all private and public-sector banks equally will influence interbank interactions and the banks’ operations with CBI.

Karbasian’s latest remarks indicate the powerful impact of illegal credit institutions.

These institutions mushroomed during the tenure of the previous administration, held a quarter of the country’s liquidity at one point and left many distraught depositors in their wake.

The economy minister mainly sought to use the bank rating system to reassure the public that “there is now room for concern” and “you will be able to easily trust the big and credible banks of the country and deposit your money with them”.

Iran’s banks are currently experiencing a hefty and crippling credit crunch and simply cannot afford to lose any more money, and Karbasian’s stance shows the government aims to win back the trust of the general public through transparent ratings.

The official also directed the people to only engage with financial institutions endorsed by the central bank.

He also firmly denied all recent reports claiming some of Iran’s biggest banks are bankrupt and referred to them as “completely false” accounts published for creating an atmosphere of “despair and frustration”.

The minister pointed to reports that CBI does not back the country’s major banks because they are bankrupt and people must fend for themselves and their money as another lie, stressing that the government is committed to safeguarding the people’s deposits.

Extending further reassurances that banks will be in safer waters in terms of capital in the immediate future, Karbasian said a new debt swap scheme involving the people, businesses, banks, CBI and the government has been incorporated in the annual budget, which will help clear a significant portion of debt.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions