Chinese Billet Prices Drop 18-Months Low, Can it Flood the Global Market?

Spot billet prices continue to drop in Chinese domestic market on bearish sentiments and de-stocking by traders. Price for 150mm Q235 grade billet assessed at Yuan 3120/MT (Ex-Tangshan-China, Including 17% VAT) which is equivalent to USD 450/MT.

Market participants expect a possibility of Chinese billets getting back in export market. Some traders heard offering 150mm Q235 grade billet at around USD 4500/MT FOB China levels.

Can China Flood the Market with Low Cost Billet?

In our recent visit to steel mills in China, we learned that not many traders and mills are willing to export billets declaring it as alloy square bar and claiming a rebate of 13% on exports. This is due to tight check by China custom officials.

It is to be noted that Chinese government offers a tax rebate of 13% and VAT refund on exports of alloy square bars or value added steel where as commercial billets attract an export tax of 15% and no refund of VAT.

This means, if a mill wants to export billet as commercial billet, export price would be around USD 520/MT FOB China, however if he exports it as square bars (or value added steel) export price will be around USD 450/MT FOB China.

In 2015 Chinese billet exporters have been taking advantage of this tax rebate to export billets in the name of alloy square bar by adding a small percentage of chromium.

Navoi saw first half output value double on higher gold prices

BHP to explore battery partnerships with CATL, BYD

Fatalities rise for second year in global mining sector

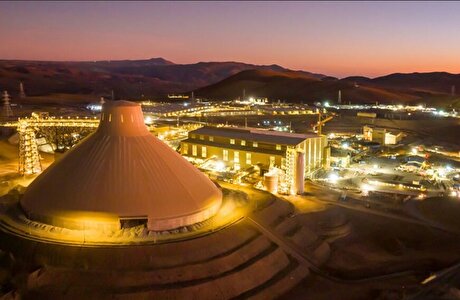

Smelter mishap stokes shutdown push at Codelco

CHART: Nvidia hits $4 trillion – how do mining stocks stack up?

Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

Taseko more than doubles value of Yellowhead project near Gibraltar

Silver price surges to 14-year high amid mounting trade tensions

Lockheed Martin reboots Pacific seabed mining plans

Aura Minerals makes US listing debut

Newmont nets $470M from selling Greatland, Discovery Silver stakes

Rinehart urges Rio Tinto to shift main office to Australia

Rio Tinto picks iron ore boss Simon Trott as new CEO

Gold price forecast gets 15% upgrade for 2025: LBMA poll

Apple invests $500M in Pentagon-backed MP Materials

Namib to spend up to $400M to restart Zimbabwe gold mines

Critical Metals soars as it begins drilling to boost Greenland rare earth resource

Trump’s 50% copper tariffs jolt US market as buyers slash imports and delay orders

Friedland backs Trump’s copper tariff as wake-up call

Rinehart urges Rio Tinto to shift main office to Australia

Newmont nets $470M from selling Greatland, Discovery Silver stakes

Rio Tinto picks iron ore boss Simon Trott as new CEO

Apple invests $500M in Pentagon-backed MP Materials

Namib to spend up to $400M to restart Zimbabwe gold mines

Trump’s 50% copper tariffs jolt US market as buyers slash imports and delay orders

BHP to explore battery partnerships with CATL, BYD

Silver price surges to 14-year high amid mounting trade tensions

CHART: Nvidia hits $4 trillion – how do mining stocks stack up?