Downtrend Continues in Iranian Domestic Billet Offers

Steel manufacturers are receiving limited enquires from the buyers which has affected export offers as well. Iranian billet export offers has further come down to USD 390-395/MT from around USD 400-405/MT FoB Iran.

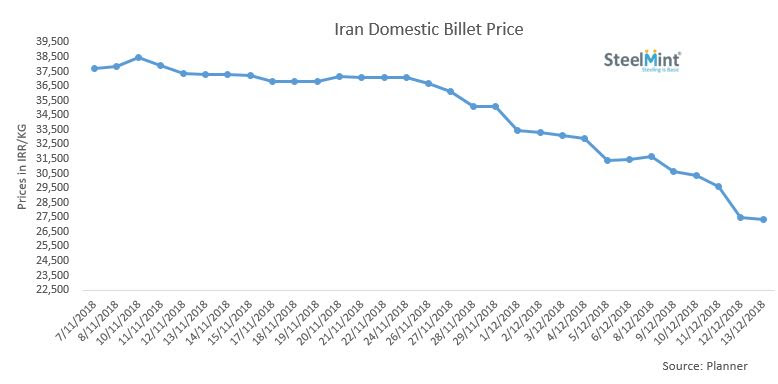

As per SteelMint’s assessment, domestic billet offers during the beginning of week 50 (08 Dec-13 Dec’18) was noted to be around IRR 31,690/KG (USD 755/MT). On next day, offers decreased further to IRR 30,660/KG (USD 730/MT). During the mid-week, offers went down to IRR 29,600/KG (USD 705/MT). Towards the end of week billet offers dropper further by USD 50/MT, in domestic market offers were noted to be around IRR 27,380/KG (USD 652/MT).

According to Planner Iran, “The recession is dominant in Iran market. IRR is still strengthening and the prices are adjusted downward. But still buyers are not so much interested in buying.”

IR Steel quoted, “Actually market participants are waiting for Khouzestan Steel co new offer price, therefore, DRI offer at IME ( Iran Mercantile Exchange) at base price of USD 378 /MT ex-work excluding 9% VAT had no buyer. Based on current price of billet, DRI price should be lower than USD 309 /MT. If current rumors about new price of USD 681 /MT for Khouzestan Steel co billet becomes true, DRI price would drop to around USD 286 /MT.”

Domestic Scrap and Rebar Offers Witness Downfall

Domestic scrap offers during week 50 were noted to be around IRR 23,990- 27,540/KG (USD 571-565/MT). Scrap offers fall almost by 15% W-o-W against USD 673/MT noted in last week. On parallel line, rebar domestic offers were down in week 50. As per SteelMint’s assessment domestic rebar offers were noted to be around IRR 34,830- 38,360/KG (USD 829-913/MT)

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions