Indian Mills Aiming to Produce DR Grade Pellets to Offset Vale Shortfall ?

DR Pellet short supply in MENA region

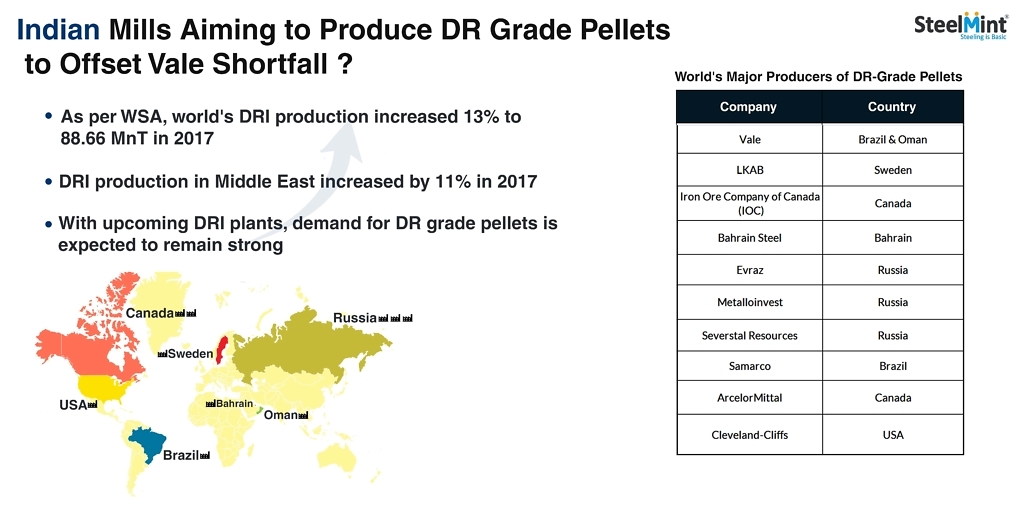

Filling up the gap of DR grade pellets supply is a matter of concern especially for DRI producers in the Middle East and North Africa region such as Saudi Arabian steel major Emirates Steel and Ezz Steel and Beeshay Steel in Egypt who are mostly reliant on Vale shipments.

Samarco has been the Brazilian iron ore producer closely identified with DR grade pellets production touched 24.6 MnT in 2015 but the resumption of production looks difficult before 2020.

Who will make up for the Vale pellet shortfall?

In 2017, Vale’s sales of DR grade pellets exceeded 12 MnT – almost 41% of its total pellet sales that year. Jindal Shadeed, Vale’s Oman plant that specializes in DR grade pellets, recorded production at 9.203 MnT in 2017 and combined production was expected to soar subsequently. However, the Feijao dam rupture has put paid to all such hopes.

So, although MENA manufacturers are exploring alternative supply sources, particularly Swedish mining giant LKAB, supply tightness persists. The MENA region’s combined contribution to global DRI production accounted for 40.53 MnT almost 50% out of total global production at 88 MnT in 2017. If we keep Iran out of the picture (the Islamic Republic – the biggest gas-based DRI producer in the world – produced 20.55 MnT in 2017). It can be asserted that productive volumes are expanding rapidly with each passing year.

Can India capitalize the opportunity emerging for DR Pellets?

MENA abundant availability of cheap natural gas bolsters the DRI potential of the region. Also, importing scrap is costly, so DR Grade pellets still remain the best feed.

As per WSA, India produced a whopping 29.5 MnT of DRI in 2017, almost two-thirds, which was produced in rotary kilns, which employ coal as the reductant and fuel. The few pellet majors that produce DR grade pellet, with around Fe 67% and less than 1.5% Al, feed the requirements of domestic manufacturers. Therefore, currently, the export of DR grade pellets is empty.

Technical Concerns:

India’s vast iron ore reserves are mostly low-grade hematite – concentrated along the east coast of the country, particularly Odisha. The Fe content of standard BF grade pellet in India is much lower than the desired DR grade of 67% and the Cold Crushing Strength (CCS) of average iron ore pellets in India is in the range of 220-250 Kgf/pellets. While Essar, KIOCL, and GPIL can produce up to 270 Kgf/pellets, the predominantly rotary kiln and coal-based Indian DRI market don’t have a pressing need for high grade.

While interacting with SteelMint an official from India’s major pellet exporting company said that the company is producing DR grade pellets at its Vizag plant but all for its captive consumption.

MENA manufacturers look for DR grade pellets with Fe content in the range of 63-67% and less than 1% Al, is hardly possible owing to the cost of production concerns involved in beneficiation.

Another major pellet maker GPIL (Central India) speaking to SteelMint shared: “ It is true that Indian DR Grade pellets don’t meet the quality requirements of MENA manufacturers but try to plug the gap. They can try to diversify their focus to export 1.5-2 MnT of DR grade pellets to MENA region. Although final deals are yet to be struck shipments could begin from June 2019

It would be interesting to see if Indian pellet makers try to catch up with the technical specifications and get into DR grade pellet exports.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions