South Korean Ferrous Scrap Imports Hit 4 Year High Amid Increased Bulk Imports

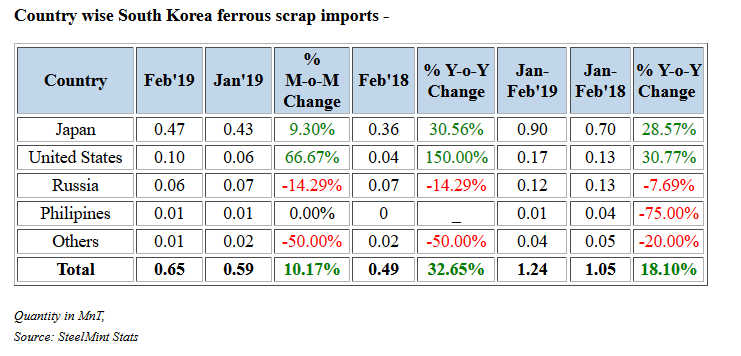

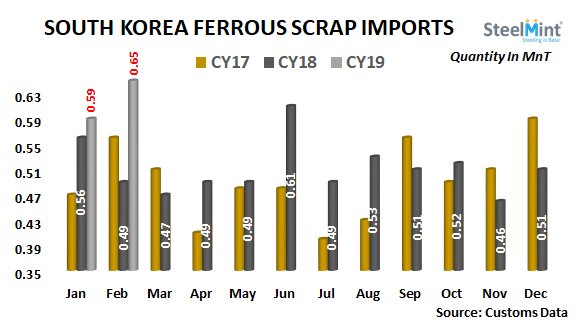

South Korea - the world’s 2nd largest ferrous scrap importer after Turkey has witnessed the third successive rise in monthly scrap imports in Feb’19. As per recently released customs data, South Korea imported 651,714 MT ferrous scrap in Feb’19, up 10% M-o-M against 590,506 MT in Jan’19. On a yearly basis, imports climbed up 33% Y-o-Y against 489,599 MT ferrous scrap in Feb'18.

Notably, scrap imports recorded in Feb'19 hit last 53-month high against earlier record at 671,974 MT in Sept'14. The arrival of bulk scrap vessels that were booked in early-Jan'19 could have resulted in increased imports in Feb'19.

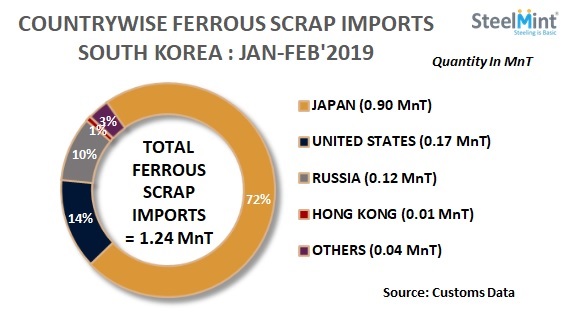

Japan remained the largest ferrous scrap supplier - South Korea imported 465,357 MT ferrous scrap from Japan in Feb'19, up 8% M-o-M against 429,893 MT in Jan’19. Japan occupied the highest 71% share in total scrap imports in Feb'19. Japanese scrap exports have been recorded above 0.4 MnT mark successively for the second month in Feb'19 while previously it was recorded at 416,943 MT in May'13.

The US remained second largest supplier occupying 16% share and exported 104,989 MT ferrous scrap in Feb'19, up 69% M-o-M against 65,995 MT in Jan’19. US scrap export hit 5 months high against 166,480 MT in Sept'18. Russia supplied 60,314 MT in Feb’19 marginally down against 62,656 MT recorded in Jan’19.

South Korean scrap prices recover in Feb'19 - As per Steeldaily’s reports, monthly average prices for Japanese H2 FoB, US mix grade and Russia A3 scrap imported to South Korea stood at USD 300/MT (+USD 5), USD 310/MT (+USD 4) and USD 310/MT (+USD 9) respectively in Feb'19.

Outlook - Amid high inventories in hand South Korean steel mills turned silent for bulk imports in Feb'19. however, following a recovery in global scrap prices, US bulk HMS 1 offers assessed at around USD 335-340/MT, CFR South Korea. Japanese H2 suppliers eye similar levels following high bids of Kanto's tender in Mar'19 and tight supply-strong local demand situation.

However, the largest buyer Hyundai Steel hasn't presented open bids for Japanese scrap since more than a month and expected to raise bids following the jump in global prices.

According to World Steel Association, the country produced 6.21 MnT crude steel in Jan'19 marginally up 1% M-o-M against 6.16 MnT in Dec'18 while down 2% Y-o-Y against 6.30 MnT in Jan'18.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions