Walkabout Resources' stock rises as it tees-up Asian off-takers for its graphite

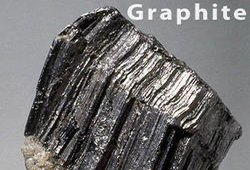

Under an agreement announced that morning, Walkabout has contracted to sell 10,000 tonnes of large and jumbo flake graphite concentrate to Qingdao Rising Dawn Graphite Technology (QRGT). QRGT is a private company in China’s Shandong province that manufactures graphite pipes and super fine graphite powders. Walkabout signed an earlier agreement on April 2 to supply Inner Mongolia Qianxin Graphite with 10,000 to 20,000 tonnes of large and jumbo flake graphite concentrate

Walkabout signed an earlier agreement on April 2 to supply Inner Mongolia Qianxin Graphite with 10,000 to 20,000 tonnes of large and jumbo flake graphite concentrate.

The binding offtake term sheets with both companies “substantially reduces the demand-side risk of the project and is very important for our ongoing funding discussions,” Walkabout’s executive chairman, Trevor Benson, commented in a press release.

In addition to the two binding agreements, Walkabout has non-binding agreements in place for between 50,000 and 60,000 tonnes a year of graphite products with Jixi Puching Graphite, Qingdao Adtech Technical Engineering, and Georg H. Luh GmbH.

The Lindi project is about 200 km from the Tanzanian port of Mtwara.

The company took the project from discovery in October 2015 to a definitive feasibility study in February 2017.

The definitive feasibility study was based on production of 40,000 tonnes of graphite concentrate a year, with a high-grade feed to the plant at an average of 230,000 tonnes a year over an estimated mine life of 24 years.

Upfront capex was estimated at $27.5 million and a payback period of less than two years.

Lindi has proven and probable reserves of 5.5 million tonnes grading 17.9% total graphitic carbon (TGC).

At market close Tuesday, Walkabout's shares were trading at A20 cents, a 52-week high. The company has a A$59.3 million market capitalization.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions