Turkey Ferrous Scrap Imports Hit 9 Year Low in Feb'19

Imports of finish long steel dropped significantly while imports of finish flat steel remained almost stable in Feb'19 on monthly premises, the recently released data by Turkey's customs department showed.

According to World Steel Association, Turkey's crude steel output recorded at 2.64 MnT in Feb'19, up 3% M-o-M against 2.57 MnT in Jan'19. On yearly premises, crude steel output fell 12% as against 3.01 MnT in Feb’18.

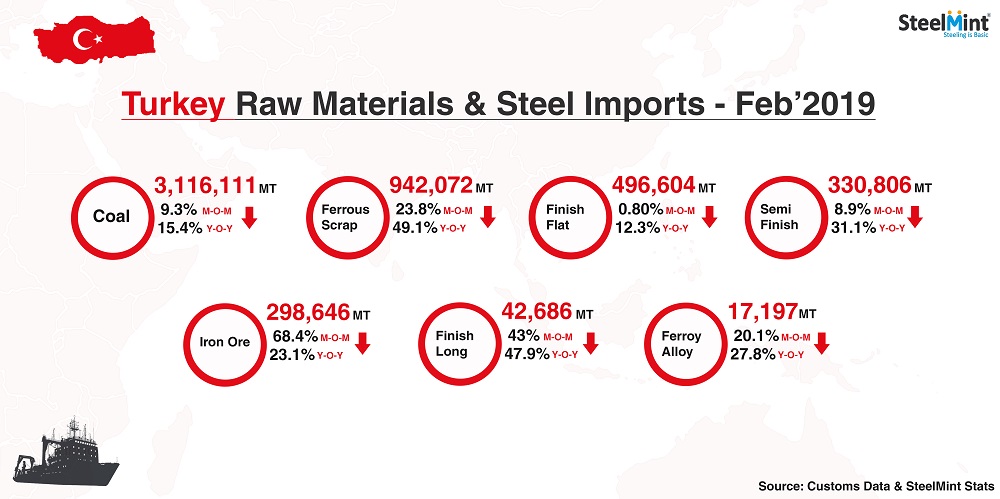

Ferrous scrap imports hit last 9 years low - Turkey imported 942,072 MT ferrous scrap in Feb'19, down 23.8% M-o-M against 1,236,445 MT in Jan'19 while imports sharply dropped by 49.1% Y-o-Y against 1,852,579 MT during the same month last year. As per data maintained with SteelMint, prior to this, Turkey's imports recorded lowest at 819,271 MT in Feb'2010 thus, scrap imports hit last 9 years low in Feb'19.

Average import price of USA origin HMS 80:20 was recorded at USD 325/MT, CFR Turkey in Feb'19 against USD 290/MT in Jan'19. A sharp recovery in global scrap prices by USD 30-35/MT, poor demand in finish steel market and volatile political situation kept Turkish scrap importers away from bulk cargo bookings in Jan-Feb'19.

The largest supplier United States exported 185,296 MT, down 14% M-o-M occupying 20% share. Followed by Netherland (115,664 MT, down 40% M-o-M), Russia (108,301, down 40% M-o-M) and United Kingdom (96,997 MT, down 3% M-o-M) occupying 12%,11% and 10% respectively.

Coal imports drop 9% M-o-M - Turkish coal imports dropped 9% M-o-M in Feb’19, following a hefty decline in non-coking coal shipments. Preliminary data from customs indicate that the country has imported 3.12 MnT coal in Feb'19 against 3.44 MnT in Jan'19. Imports also continued its decline on the yearly basis for the second successive month, down 15% from 3.68 MnT in Feb'18. A grade-wise break-up indicates that imports of non-coking coal in Feb’19 had fallen to its lowest monthly total since Apr’17, decreasing 25% on the month to 2.08 MnT in Feb’19.

Finish Flat Steel imports almost stable M-o-M - Turkey's finish flat steel imports recorded at 496,604 MT in Feb’19, which remained nearly stable on a monthly basis against 500,710 MT in Jan’19. Meanwhile the same registered drop by 12% Y-o-Y basis in Feb’19 as compared to 566,558 MT in Feb’18. Major suppliers of flat steel to Turkey in Feb’19 were Russia at 0.18 MnT, Ukraine (0.05 MnT) and Netherland (0.05 MnT), France (0.04 MnT) and Brazil (0.03 MnT) in Feb’19. Followed by other major exporting countries were South Korea, China and Romania in Feb’19.

Turkey's finish flat import volumes remained steady ahead of uncertainty in political elections scheduled for 31 Mar’19 and the demand in the domestic market also remained lukewarm.

Iron ore imports fall 68% M-o-M - The tenth largest importer of Iron ore, Turkey has recorded 68% fall in iron ore imports at 298,646 MT in Feb’19 as against 946,312 MT in Jan’19. Brazil stood the largest exporter at 0.25 MnT (down 63% M-o-M) followed by Ukraine at 0.05 MnT. On a yearly basis, imports dropped 23% against 388,444 MT in Feb’18.

Semi-finish imports fall 9% M-o-M - Turkey imported 202,168 MT of Billet in Feb’19, down 25.1% M-o-M as against 270,084 MT in Jan’19. On yearly basis, imports declined sharply by 49.1% as against 396,825 MT in Feb’18.

Russia stood as the largest billet exporter to Turkey, exporting 159,810 MT in Feb’19, followed by Ukraine (27,161 MT), Georgia (12,170 MT) & Azerbaijan (1,448 MT). Fall in imports could be attributed to fall in exports from Russia by 30.83% M-o-M added to which no major billet imports from Iran & Italy were recorded in Feb'19.

Further, Pig iron imports rise by 38.4% M-o-M in Feb’19 & stood at 128,637 MT.

Finish long imports fall significantly by 43% M-o-M - High average prices could have attributed to falling imports of finish long in Turkey in Feb'19. Finish long imports recorded at 42,686 MT in Feb'19 against 74,946 MT in Jan'19. While on a yearly basis, imports fell 47.9% in Feb’19 as against of 81,905 MT in Feb’18.

Average domestic price for rebar assessed at USD 486/MT in Feb'19 as against the monthly average of USD 445/MT in Jan'19 which moved up around 9%. Imports of rebar & structure observed sharp downfall by around 44% to 47% respectively while that for wire rod by around 22% in Feb'19 on M-o-M basis. Iran stood as the largest finish long exporter to turkey at 21,192 MT followed by Spain at 5,569 MT in Feb’19.

Ferro Alloy imports drop 20% M-o-M - Turkey's total Ferro Alloy imports recorded at 17,197 MT in Feb'19 against 21,511 MT in Jan'19. Silico Manganese imports fell by 40.6% M-o-M to 11,040 MT in Feb'19 which was also 50% down on yearly premises at 22,338 MT in Feb’18. Imports from Ukraine were dropped to almost half for Silico Manganese. However, unlikely to Silico Manganese, Ferro Manganese imports increased and recorded at 6,157 MT jumping almost double against the previous month.

While graphite electrode imports recorded at 1,968 MT in Feb'19, up 13.9% M-o-M in Feb'19.

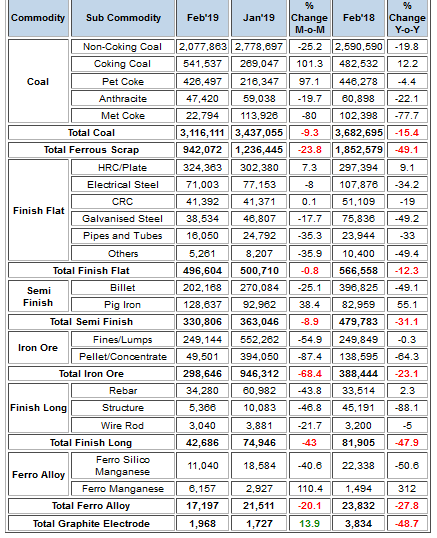

Turkey Raw Materials & Steel Import February 2019 -

Quantity in MT,

Source: SteelMint Stats

Barrick’s Reko Diq in line for $410M ADB backing

Pan American locks in $2.1B takeover of MAG Silver

US adds copper, potash, silicon in critical minerals list shake-up

Gold price gains 1% as Powell gives dovish signal

Gold boom drives rising costs for Aussie producers

Giustra-backed mining firm teams up with informal miners in Colombia

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

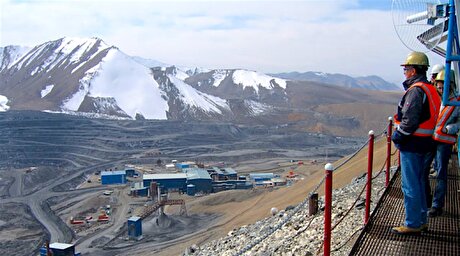

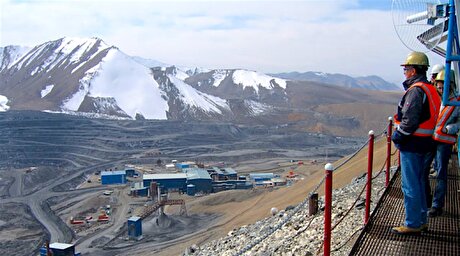

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook