Chinese Stainless Steel Mills Reduce May Ferro Chrome Tender Prices

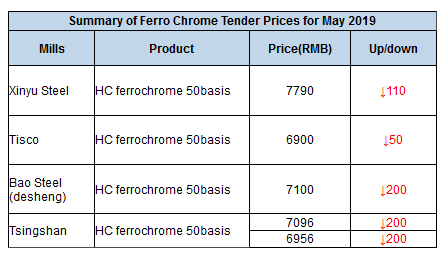

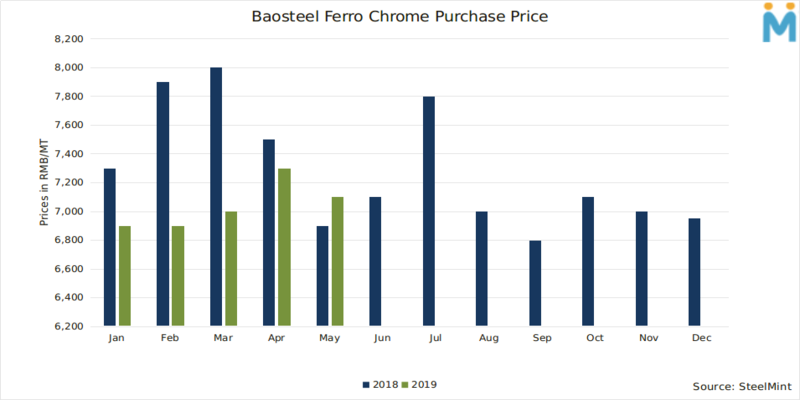

Following Tisco, two days later Tsingshan and Baosteel released their May tender prices for HC Ferro Chrome with a drop of RMB 200/MT (USD30/MT) as compared to April Tenders. Tsingshan has declared purchase price of HC Ferro Chrome at RMB 7,096/MT (USD 1054/MT) and Baosteel at RMB 7,100/MT (USD1055/MT). The tender prices are on a duty-paid cash basis, including delivery, for 50% HC Ferro Chrome.

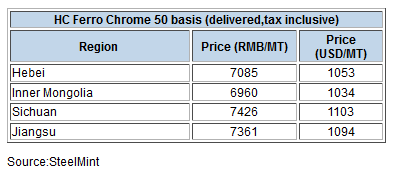

In mid-April, many Chinese Ferro Chrome producers sat on the sidelines in the ore markets with expectation of further price falls amid weak demand owing to thin buying interest from the Chinese Stainless Steel mills softening domestic Ferro Chrome prices. However, the peak season of March and April has come to an end, and tender prices for May has basically established its direction for the market. However, due to the market inclination of “pursuing upswing and staying away from decline”, the market inquiries are still inactive regardless of the downward adjustment of stainless steel prices and transaction performance remain sluggish. The market price is still temporarily at RMB 6,900-7,100/MT (USD 1025-1055/MT), 50 basis. The focus should be on the opportunities emerging from dynamic change in demand-supply fundamentals.

Market participants said that they were expecting a higher level of decline in the tender prices, but a marginal decline of RMB 50/MT (USD 7.43/MT) was not expected. However, such lower level of adjustments may be attributed to the concern over possible Ferro Chrome production reductions in Inner Mongolia in May’19. Although, the production didn't suffer in April, there is uncertainty in the market regarding power disruption in May and no one can estimate how severe the production shortage can be.

Stainless steel market:

Mainstream 201 cold-rolled uncut sheet reported at RMB 8,150-8,300/MT (USD 1211-1233/MT), and coils of uncut edge mostly seen at RMB 8,200-8,250/MT (USD 1218-1226/MT). Mainstream 304 four-foot cold rolled offered at RMB 14,400-14,850/MT (USD 2140-2206/MT) by state-owned mills, while private mill products of uncut edge is around RMB 13,900-14,050/MT (USD 2065-2088/MT). 304 five-foot hot rolled resources by private mills have been firm in the past two days, with Wuxi and Foshan markets offering at 13,500-13,600/MT (USD 2006-2021/MT).

At present, with the domestic Ferro Chrome factories being in normal operation, there is limited scope for further decline in chrome ore price, plus with the active participation of the stainless steel, the Ferro Chrome market will not change significantly in the near future.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions