Brazil: Iron Ore & Pellet Exports Down 12% in H1 CY19

China continued to be largest importer of Brazilian iron ore in H1 CY19 at 86.25 MnT, down 17% compared to 103.72 MnT in H1 CY18. Malaysia stood second largest importer at 16.22 MnT, up against 7.04 MnT for H1 CY18. Other major importers were Oman at 6.38 MnT, Japan at 5.97and Netherland at 5.96 MnT.

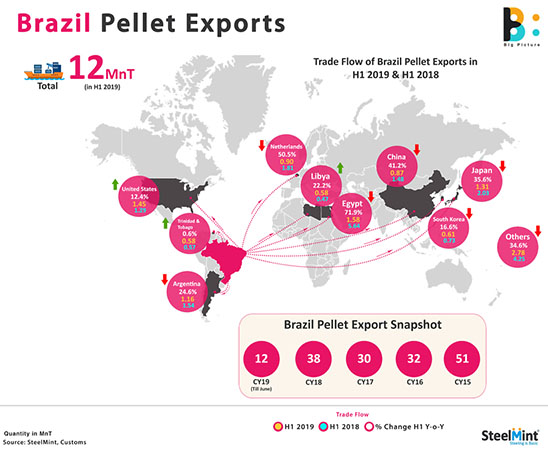

Brazilian pellet exports down 40% in H1CY19

Brazilian pellet exports for CY19 (Jan-June) witnessed at 11.82 MnT, down as against 19.82 MnT in H1 CY18.

Brazil pellet exports to Egypt stood largest at 1.58 MnT, down 72% compared to 5.68 MnT CY18 (Jan-June). US stood second largest at 1.45 MnT followed by Japan at 1.31 MnT.

Brazilian exports have dropped in first half CY19 due to Vale mishap in Jan’19. Vale underwent collapse at its dam at Corrego do Feijao mine in Minas Gerais in Brumadinho, Brazil on 25th Jan’19. The miner later declared force majeure, and put to halt various mines and dams. It’s only in June’19 that the miner resumed operations at its Brucuctu mines but at reduced capacity.

Brazil Pellet Exports

Vale accounts for about 90% of total Brazilian iron ore exports. Hence, the Vale mishap resulted in significant decline in exports from Brazil for the year. The miner total pellet output for Q1CY19 witnessed at 12.2 MnT, down 23% compared to 15.8 MnT in Q4 CY18. The drop was owing to operation hault at Fabrica and Vargem Grande pellet plants due to dam rupture and scheduled maintenance at Tubarao and Oman.

Vale Iron ore & pellet sales fell 30% in Q1CY19 to 67.7 MnT against 96.5 MnT in Q4 CY18. The decline in sales is attributed to production stoppage in Jan'19, and rains impacting shipments from the Ponta da Madeira port in the Northern System. Also, new inventory management procedures at Chinese ports impacted sales by reducing port operational capacity.

During H1 CY19, the global material crises, majorly caused due to Vale dam disaster led the spot iron ore prices reaching five year high levels at USD 118/MT, CFR China. Also, Dalian iron ore future witnessed record high levels of 837 yuan/MT, assessed on 20th June.

Sao Luis Port accounted half of total Brazilian exports in H1 CY19

Sao Luis port exported around 50% of total Brazilian iron ore and pellet exports at 77.37 MnT followed by Itaguai 40.93 MnT and Vitoria at 31.43 MnT.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions