Australia: Iron Ore Exports Surge 18% in Q2 CY19

Australian iron ore exports for the month of June’19 dropped to 76.3 MnT, after hitting 1 year high levels at 76.97 MnT in May’19. The exports plunged for the month amid Rio Tinto’s announcement for drop in iron ore Pilbara shipments guidance due to mine operational challenges at the company’s Greater Brockman hub. Rio Tinto 2019 Pilbara iron ore shipment guidance is reduced to 320-330 MnT as against 333-343 MnT previously.

For H1 CY19, the total Australian iron ore exports recorded decline to 410.41 MnT as against 431.3 MnT for H1 CY18. The exports dropped amid hindrance in exports caused due to tropical cyclone in Australia in Mar'19.

Why did Australian iron ore exports pick up in Q2 CY19?

High global iron ore prices:

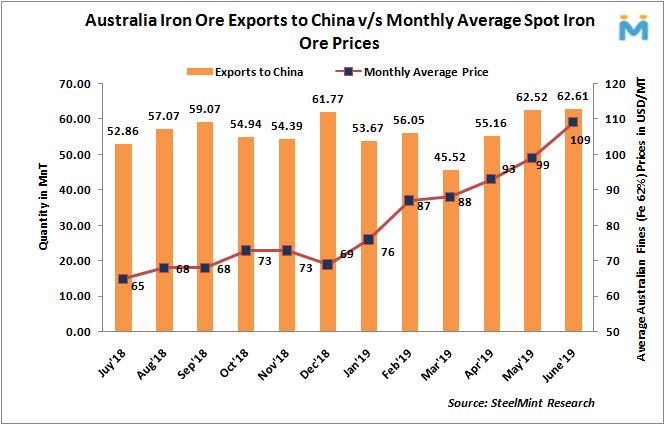

The spot iron ore fines (Fe 62%) index price increased for the quarter and recorded at USD 118/MT, CFR China towards June’19 end, hovering five years high amid material shortage . The monthly average spot iron ore prices for Q2 CY19 witnessed at USD 100/MT as against USD 82/MT in previous quarter. This led to high realization in exports market during the quarter.

Monthly average global iron ore fines (Fe 62%) prices in June’19 recorded at USD 109/MT as against May’19 at USD 99/MT, CFR China.

Fall in iron ore inventory at Chinese Ports:

As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports dropped to 115.25 MnT towards June’19 end as against 147.6 MnT towards end of 1st quarter CY19. The inventory has fallen to lowest levels since around 2017

Australian exports to China surge 16% in Q2 CY19

China marked the largest importer of Australian iron ore in Q2 CY'19 at 180.29 MnT, up 16% against 155.24 MnT in Q1 CY'19. Japan stood second largest importer for the quarter at 17.96 MnT followed by Korea at 15.30 MnT. Australian exports to India stood nil for the quarter.

Chinese imports for the month of June’19 stood 13 Months high at 62.6 MnT, the level was last witnessed in May'18 at 63.7 MnT.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions