Outlook of graphite electrodes in China

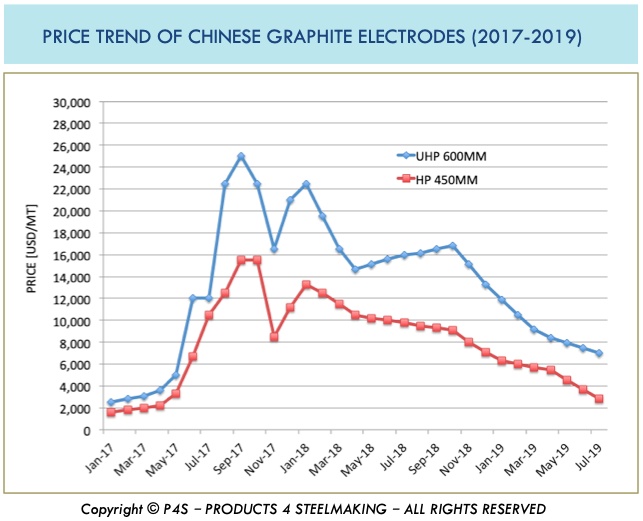

Due to the strict environment regulations that have affected the whole Chinese industries (especially the carbon one), a serious shortage of graphite electrodes turned out into a sudden increasing in prices starting in February 2017. Prices of UHP grade Chinese electrodes jumped from about 2.000-2.500 USD/MT (December 2016) to achieve the highest value around September 2017 with an unexpected price of about 25.000-30.000 USD/MT. Afterwards prices started to decline due to the recover on capacity of graphite electrodes production. Nowadays (August 2019) the price of UHP 600MM electrodes is on the range of 6.000-8.000 USD/MT.

From that period of time we've learnt that the graphite electrodes industries is mainly governed by the Chinese balance between real production and related internal consumption that can easily affect the entire worldwide carbon industries.

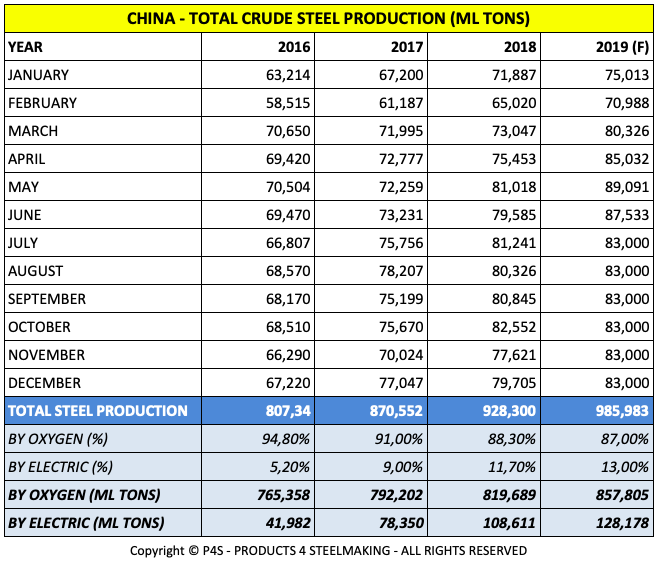

CHINESE CRUDE STEEL PRODUCTION

To analyze the question of price soaring in details we can take a look about the Chinese steel production starting from 2016 considering the breakdown between Oxygen processing route (also known as BOS) and Electric processing route (based on EAF production).

SHARE OF ELECTRIC STEELMAKING ROUTE

From the table above it's obvious that two important parameters have to be considered while making an outlook of graphite electrodes in China:

TOTAL CRUDE CHINESE STEEL PRODUCTION that jumped from about 800 ML TONS (in 2016) to about 1.000 ML TONS (expected in 2019);

TOTAL CHINESE SHARE OF EAF PRODUCTION it's clear that the increasing in the Electric Steelmaking route brought an increasing of demand of graphite electrodes to be used for melting steel in Electric Arc Furnace. In this case we're mainly talking about high quality electrodes (mainly UHP = ULTRA HIGH POWER). From the table above it's clear the increasing of percentage of EAF production that has moved from about 5% (around 42 ML TONS in 2016) to about 13% (around 130 ML TONS in 2019).

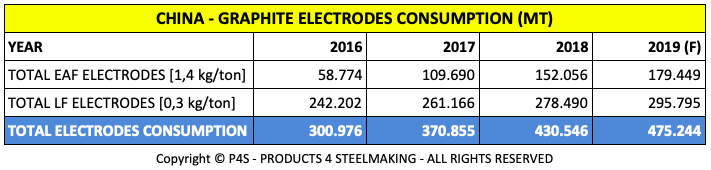

CHINESE GRAPHITE ELECTRODES INTERNAL DEMAND

To calculate the Chinese internal graphite electrodes demand we've considered the following average consumptions:

CONSUMPTION OF ELECTRODES IN EAF, estimated to be around 1,4 kg/ton of liquid steel produced;

CONSUMPTION OF ELECTRODES IN LRF, estimated to be around 0,3 kg/ton of liquid steel produced;

From the parameters listed above it's easy to calculate the internal consumption of graphite electrodes in China and the results are shown in the table here below:

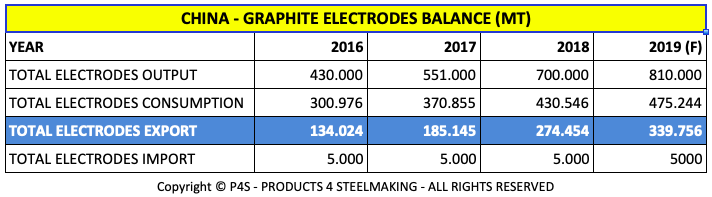

It's evident that the graphite electrodes consumption in China raised from about 300.000 MT (in 2016) to about 475.000 MT (expected in 2019). This increase is mainly due to the usage of graphite electrodes into the EAF.

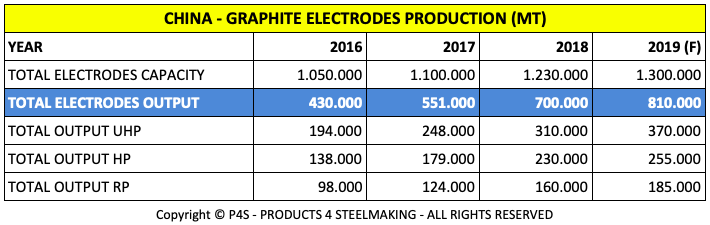

CHINESE GRAPHITE ELECTRODES PRODUCTION

It's extremely difficult to calculate the nominal total capacity of graphite electrodes production in China as several mills are not working at 100% of their capacity while some of them are even not in operation. On the other hand it's possible to calculate the real production that can be summarized in the table here below:

From the table we can see that the total output almost doubled from 2016 (around 430.000 MT) to 2019 (expected to be around 810.000 MT),

CHINESE GRAPHITE ELECTRODES BALANCE

Based on the total crude steel production, the relevant internal demand of graphite electrodes and the Chinese electrodes production we can evaluate the total amount of the export of Chinese graphite electrodes that can be summarized in the table here below:

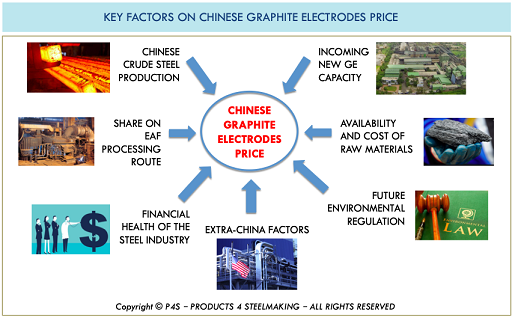

PARAMETERS TO BE CONSIDERED WHILE PREDICTING PRICES OF GRAPHITE ELECTRODES

Here below a detailed list of the main key parameters that have to be considered while predicting the future price of Chinese graphite electrodes:

- TOTAL CHINESE CRUDE STEEL PRODUCTION, of course the future performance of the crude steel production will have a primary effect on the internal demand of graphite electrodes;

- INCREASING OF SHARE ON EAF PROCESSING ROUTE, at this moment China is one of the country with the lowest EAF steel ratio in the world. It's expected that by 2030 the total share of EAF Chinese steel production will be around 28% of the total crude steel production. This should bring a total Chinese demand of graphite electrodes to be around 700/800.000 MT;

- FINANCIAL HEALTH OF THE STEEL INDUSTRY, we know very well that the steel market is always subjected to positive and negative cycles. It's obvious that a trend of low marginality related to the steel products can easily effect the prices of the main raw products used into the steelmaking process (included the graphite electrodes);

- FUTURE ENVIRONMENTAL REGULATIONS The strict regulations adopted by the Chinese government can eventually determinate a new possible future restrictions in graphite electrodes productions;

- INCOMING NEW GE CAPACITY, several new projects are on the way for increasing the capacity of existing graphite electrodes production or brand new productions;

- AVAILABILITY AND COST OF RAW MATERIALS, the main raw materials involved into the graphite electrodes production is coke (either petroleum or needle coke). Future availability of this material could easily play a big role into the variation of prices in the future;

- EXTRA-CHINA FACTORS, Some of the other extra-China producers are pretty active in the expansion projects of their capacity into production of graphite electrodes (especially for UHP grade). This could have some impact in the prices worldwide. The trade war (especially the one between USA and CHINA) can also play a major role on variation of graphite electrodes prices.

Matteo Sporchia

Sales Export Manager on Steel products |

Refractory, Graphite Electrodes Technical Expert |

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions