US twitch makers hurt by raw material spreads

Argus assessed floated twitch at a 5.5¢/lb premium to US-consumed 95/2 zorba during the third week of October, compared to a 13.5¢/lb premium during the first week of January.

The wider the spread, the greater a payoff separators see for converting the zorba they purchase from US scrap yards.

The 5.5¢/lb spread does not leave much room for processing or freight costs, which combined can cost more than 10¢/lb for high-cost producers with older plants, market participants told Argus.

While both prices have fallen this year along with the wider aluminum scrap complex, twitch's declines significantly outpaced zorba, falling by 19¢/lb since the beginning of the year. Zorba has only fallen by 10¢/lb in comparison, forcing twitch producers to work on progressively thinner margins.

A falling aluminum scrap export market has caused more zorba to stay in the US, but it has also given domestic secondary smelters plenty of material to choose from which would normally be shipped overseas. This has eroded domestic demand for twitch.

Chinese buyers have mostly pulled out of the US zorba market because of their strict import quotas, unless they are buying for plants outside their borders in places like Malaysia, Vietnam or Indonesia.

Indian importers, facing the same automotive weakness affecting Europe and the US and reduced demand for ADC12 castings, have also pared buying prices.

Despite giving twitch producers more buying leverage over domestic shredders, the weak export demand also hurts them. Most heavy media plants sell their "heavies" — the brass and copper metal separated from the zorba — to buyers outside the US.

New tech, new competition

As US dealers come to terms with the reality that China will no longer be long-term home for their nonferrous scrap, they have spent more money on processing.

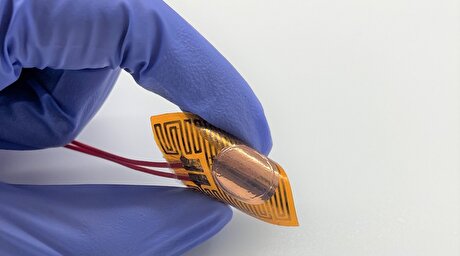

New copper wire chopping lines are one example. X-ray sorting plants are another.

Several US shredders have invested in x-ray sorting equipment in recent years, which is less expensive to operate and capable of producing a twitch-like package that can be melted by some of the same consumers. The barrier to entry is lower to build an x-ray facility than to build a flotation plant.

"What's going to be interesting this go-around is that the last time twitch/zorba spreads were tight like this, there were not a lot of x-ray plants," an industry veteran told Argus.

Although x-ray sorting plants cannot remove magnesium particles like a wet media plant, processors with this technology are able to market their material to some of the same consumers as floated twitch producers, creating more competition.

Their lower cost of operation could allow some of the x-ray plants to continue producing lower-recovery twitch amid raw material spreads that would be prohibitive for older wet plants. This could displace enough demand for floated twitch that some legacy wet media plants could struggle to operate on already-thin spreads.

Mali to restart production at Barrick’s Loulo‑Gounkoto gold mine

Copper price surges to highest since March record

Platinum price surges to 11-year high on supply concerns

Energy Fuels’ rare earth JV in Australia receives regulatory OK

Cobalt price surges after Congo extends ban

CHART: The brutal economics of EV battery lithium

Central Asia Metals ups offer for New World Resources to fend off Kinterra

Gold price falls 2% on US-China trade agreement

Kenorland options three gold projects in Ontario to Centerra

Chile cuts mining permitting times by up to 70%

B2Gold pours first gold at Nunavut’s Goose mine

Russia base metals sales to China surge, signaling deep reliance

Zambia launches 100MW solar plant supplying First Quantum Minerals

Kinterra matches Central Asia’s bid for New World

Panama ships part of stockpiled copper out of closed First Quantum mine

Chile delivers biggest copper output this year in tight market

EQ Resources receives EXIM letter of interest for Mt Carbine tungsten project in Queensland

Gold price rises on dollar weakness, focus on US data ahead

Indonesia offers US critical minerals joint investment as part of tariff talks

Chile cuts mining permitting times by up to 70%

B2Gold pours first gold at Nunavut’s Goose mine

Russia base metals sales to China surge, signaling deep reliance

Zambia launches 100MW solar plant supplying First Quantum Minerals

Kinterra matches Central Asia’s bid for New World

Panama ships part of stockpiled copper out of closed First Quantum mine

Chile delivers biggest copper output this year in tight market

EQ Resources receives EXIM letter of interest for Mt Carbine tungsten project in Queensland

Gold price rises on dollar weakness, focus on US data ahead