Highlight: China’s Needle Coke Market Dynamics in 2019

As per the industry participants, earlier country’s domestic needle coke quality was not found to be quite suitable for the manufacturing of high grade electrodes, however, the Chinese manufacturers made improvements in the same over a period of time and even started catering to the overseas market for the electrodes manufacturing.

In the first half of 2019 (H1) from Jan-Jun, the country’s needle coke output stood at 210,000 tonnes, up by 29% y-o-y basis whereas its exports were recorded at 21,000 tonnes, as per IC Carbon’s data. The highest needle coke exports by China are being made to India followed by Japan and Korea. For the year 2019, it is being estimated that China’s total needle coke exports would stand at 50,000 tonnes, thus recording a surge of 100% against 2018.

The country’s domestic needle coke supply in 2019 is estimated to be around 76,000 tonnes whereas its domestic demand is estimated to be around 71,000 tonnes.

In terms of usage, along with GE, needle coke has increased demand from electric vehicles’ battery industry. While in 2014, the proportion of needle coke’s usage in battery industry was 7%, in 2019, the same is estimated to increase to 46%.

China’s graphite electrodes output for 2019 is estimated to be around 125,000 tonnes for which its domestic needle coke availability for the sector will be around 41,000 tonnes. This indicates that to further meet its requirement, country has to import the same. As per the country’s customs data, China’s needle coke imports in the first eight months of 2019 (Jan-Aug) stood at around 165,000 tonnes (up by 13% y-o-y basis) out of which the percentage of coal-based needle coke imports is around 37% and that of petroleum based is around 63% with highest imports coming from U.S. followed by Japan.

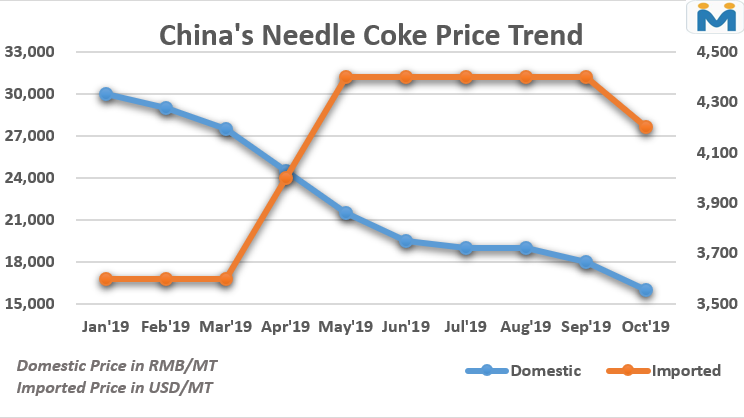

In terms of prices, despite the fall in GE prices, China’s domestic and imported needle coke prices had remained stable amid tight domestic supply in the first half of the ongoing year and usually half yearly or quarterly contracts signed with the overseas needle coke suppliers. However, the situation changed from Sep’19 as the fall in domestic as well as global GE prices finally took toll on the same and also new needle coke capacities became operational in the domestic market.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Chile’s 2025 vote puts mining sector’s future on the line

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Finland reclaims mining crown as Canada loses ground

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price down 1% on strong US economic data

Trump’s deep-sea mining push defies treaties, stirs alarm

Chile’s 2025 vote puts mining sector’s future on the line

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions