EU HRC: Appetite brisker in the north

Argus' daily northwest Europe HRC index rose €3.25/t today to €417.75/t ex-works, while the daily Italian index nudged €0.75/t higher to €407/t ex-works.

Tier-one mills in the north are targeting €430/t ex-works and higher for base material. Lead times have nudged out a touch across Europe, with mills reducing capacity and trying to firm their pricing stance during contractual negotiations. One steelmaker said €430/t base had been achieved in Germany, but this was not confirmed, and it was not clear whether it was spot business.

A mill is readying an increase announcement in the UK too, following similar efforts on the continent.

German buyers suggest lower prices are harder to come by, and mills allude to brisker intake for the first quarter; given the heavy destocking witnessed across the automotive supply chain this year, despite the fairly mild drop in European production, many suggest apparent demand from the sector should feel firmer headed into 2020. Contractual talks for half- and full-year 2020 deals are still ongoing.

Traders suggest import inquiries are starting to increase, as buyers look for alternatives to domestic material. German production slipped by 6.8pc in October compared to the same month last year, as mills reduced output on slow demand.

In Italy there is still a lot of talk about higher prices and rising offers, but the panic of recent weeks has abated somewhat. Import offers from Turkey are as high as €440-445/t cif, but the latest deals were closer to €415/t cif effective S235 for larger tonnage. One domestic Italian steelmaker is offering €415/t ex-works base, and looking to push to €420/t and above for the first quarter. Another has been offering around €410/t but is targeting €420-430/t for the first quarter.

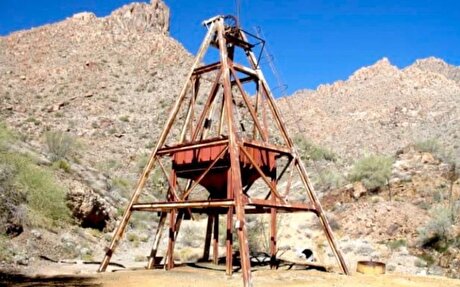

Mali to restart production at Barrick’s Loulo‑Gounkoto gold mine

Copper price surges to highest since March record

Platinum price surges to 11-year high on supply concerns

Energy Fuels’ rare earth JV in Australia receives regulatory OK

Cobalt price surges after Congo extends ban

Central Asia Metals ups offer for New World Resources to fend off Kinterra

Gold price falls 2% on US-China trade agreement

Highland Copper gets local support for $50M grant to build Michigan mine

CHART: The brutal economics of EV battery lithium

Critical minerals to top Modi’s agenda in five-nation tour

Lupaka Gold skyrockets on arbitration win against Peru

Peru copper transport disrupted as informal miners block roads

Highland Copper gets local support for $50M grant to build Michigan mine

Kinterra takes bidding war for NWR to takeover panel

HSBC ups gold price outlook for 2025 and 2026

Copper price rises to three‑month high amid supply squeeze and trade optimism

Mineral smuggling from Congo to Rwanda at ‘unprecedented levels’, UN says

Chile cuts mining permitting times by up to 70%

B2Gold pours first gold at Nunavut’s Goose mine

Lupaka Gold skyrockets on arbitration win against Peru

Peru copper transport disrupted as informal miners block roads

Highland Copper gets local support for $50M grant to build Michigan mine

Kinterra takes bidding war for NWR to takeover panel

HSBC ups gold price outlook for 2025 and 2026

Copper price rises to three‑month high amid supply squeeze and trade optimism

Mineral smuggling from Congo to Rwanda at ‘unprecedented levels’, UN says

Chile cuts mining permitting times by up to 70%

B2Gold pours first gold at Nunavut’s Goose mine