China’s steel stock build slows on output cuts, sales

Steel mills accelerated production cuts in mid-February to reduce pressure on supply caused by the loss of demand that resulted from restrictions aimed at slowing the coronavirus outbreak.

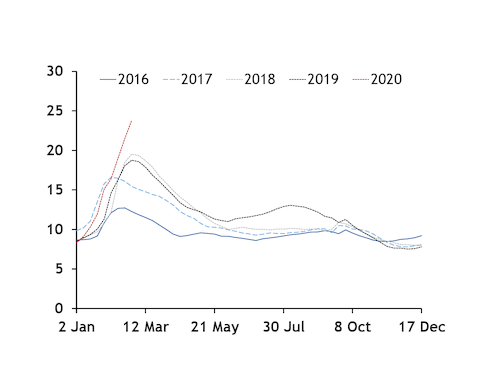

Steel stocks peak in late winter every year before the construction season restarts in March, but they are rising to record levels this year, especially for mills' long product inventories.

Mills held about 13.4mn t of steel in the week to 27 February, roughly 68pc above the previous five-year high, a China-based analyst said. Mills' rebar inventories rose by 6.5pc to more than 7mn t this week.

China's warehouse steel stocks held by traders rose by 11pc to nearly 24mn t in the latest week, exceeding previous highs of about 20mn t that are typically reached in late February or early March. Combined with mill inventories, China's total steel stocks rose by 8pc from last week to more than 37mn t, according to industry data that includes rebar, wire rod, hot-rolled coil (HRC), cold-rolled coil and plate.

The increase marks a slowdown from the 13pc increase for mills and trading firms last week.

Output cuts were a factor, with market participants pointing to output data for a subset of mills that shows a 2.5pc week-on-week decline in the week to 20 February, or around 11.8pc below pre-holiday levels.

Chinese domestic steel prices fell today as the data showed supply pressures are still building and the pace of construction restarts remains uncertain. Shanghai HRC ex-warehouse prices fell by 10 yuan/t to Yn3,540/t ($505/t), while rebar ex-warehouse prices fell by Yn30/t to Yn3,380/t in Beijing and Yn3,440/t in Shanghai.

Production cuts have been most aggressive for rebar, so there is limited downside for rebar output levels in the near term, while HRC output will continue to edge lower as many large mills are announcing maintenance outages in late February or March.

Around 80pc of businesses have restarted in 24 cities in China, but steel demand has not increased enough to absorb the high inventories. Transportation links are slowly reopening to allow workers to return to construction sites in early March, but in some cities such as Beijing they will be required to undergo a 14-day quarantine.

There will still be more downside pressure on steel prices, with steel inventories rising and mills and traders running out of storage space, a Shanghai-based trader said.

By China staff

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

Cochilco maintains copper price forecast for 2025 and 2026

Gold price stays flat following July inflation data

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Glencore seeks $13 billion in incentives for Argentina copper projects

HSBC sees silver benefiting from gold strength, lifts forecast

Hindustan Zinc to invest $438 million to build reprocessing plant

Samarco gets court approval to exit bankruptcy proceedings

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Abcourt readies Sleeping Giant mill to pour first gold since 2014

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper