Northern Dynasty shares plunge 55% on insider selling

According to me-metals cited from mining.com, The company’s Toronto-listed shares plunged as much as 55% to C$1.41 before recovering to around C$2.27 in late afternoon. Earlier in the day, trading of the stock was briefly halted as it nosedived. At press time, the company’s market capitalization stood at C$1.2 billion ($870 million).

Its New York-listed shares followed a similar pattern, falling by more than 55% before paring losses.

The company has yet to respond to MINING.com’s request for comment.

The drop comes after various insiders, including VP engineering Stephen Hodgson and chairman Robert Dickinson, sold shares during recent trading sessions.

With Thursday’s move, Northern Dynasty has now erased all gains from July 4, when the company announced it is in talks to settle litigation with the US Environmental Protection Agency, which it said could help the regulatory approval of its flagship Pebble project in Alaska.

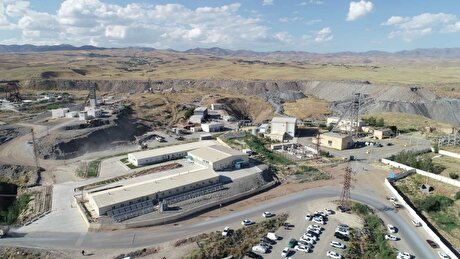

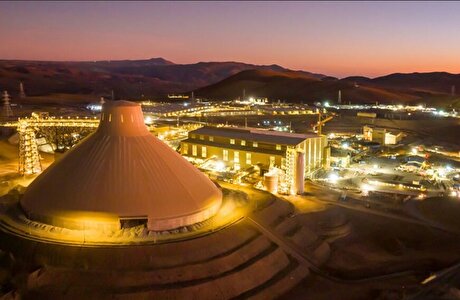

The Pebble project is touted as the world’s largest undeveloped copper and gold resource, with significant endowments of molybdenum, silver and rhenium. However, the proposed mine has been a source of contention for years due to its location near Bristol Bay, home to some of the world’s largest sockeye salmon fisheries.

Northern Dynasty’s stock has gradually rallied this year on optimism that the Trump administration might roll back the project’s regulatory hurdles.

source: mining.com

Navoi saw first half output value double on higher gold prices

BHP to explore battery partnerships with CATL, BYD

Fatalities rise for second year in global mining sector

Smelter mishap stokes shutdown push at Codelco

CHART: Nvidia hits $4 trillion – how do mining stocks stack up?

Gold price forecast gets 15% upgrade for 2025: LBMA poll

Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

Silver price surges to 14-year high amid mounting trade tensions

Taseko more than doubles value of Yellowhead project near Gibraltar

BHP delays Jansen potash project as costs surge; logs record copper output

Northern Dynasty shares plunge 55% on insider selling

Burgundy halts Ekati pit mining, lays off hundreds

US set to impose 93.5% duty on China battery material

Aura Minerals makes US listing debut

Newmont nets $470M from selling Greatland, Discovery Silver stakes

Rinehart urges Rio Tinto to shift main office to Australia

Rio Tinto picks iron ore boss Simon Trott as new CEO

Gold price forecast gets 15% upgrade for 2025: LBMA poll

Apple invests $500M in Pentagon-backed MP Materials

Rinehart urges Rio Tinto to shift main office to Australia

Northern Dynasty shares plunge 55% on insider selling

Burgundy halts Ekati pit mining, lays off hundreds

US set to impose 93.5% duty on China battery material

Newmont nets $470M from selling Greatland, Discovery Silver stakes

Rio Tinto picks iron ore boss Simon Trott as new CEO

Apple invests $500M in Pentagon-backed MP Materials

Namib to spend up to $400M to restart Zimbabwe gold mines

Trump’s 50% copper tariffs jolt US market as buyers slash imports and delay orders