Viridis unveils 200Mt initial reserve for Brazil rare earth project

According to me-metals cited from mining.com, At grades of 2,640 parts per million (ppm) in total rare earth oxides (TREOs) and 740 ppm in magnetic rare earth oxide (MREOs), this reserve reaffirms Colossus as a global leading IAC project, the Australian miner says.

The total tonnage — derived solely from measured and indicated resources — more than doubles the reserve estimate of 98.5 million that underpins its current prefeasibility study, but at a lower MREO grade (936 ppm before). Still, it significantly extends the mine plan from 20 years to at least 40 years.

The mine pits supporting the reserve align with the ultra-high-grade feed that formed the backbone of the PFS, validating the Colossus project as the most economically robust rare earth project globally, Viridis stated in a press release.

As shown in the PFS released last month, the Colossus project, at its previous reserve estimate, could deliver 9,400 tonnes of TREO production annually at all-in sustaining costs of $9.3/kg. The pre-tax net present value (discounted at 8%) was estimated at $1.41 billion with an internal rate of return of 43%.

Doubled scale

“Our robust reserve base now underpins a potential mine life of up to 40 years, doubling the scale of our recent PFS, and provides the platform to establish Viridis as a long-term, tier-one supplier of the magnet rare earths critical to global decarbonization and electrification,” managing director Rafael Moreno said.

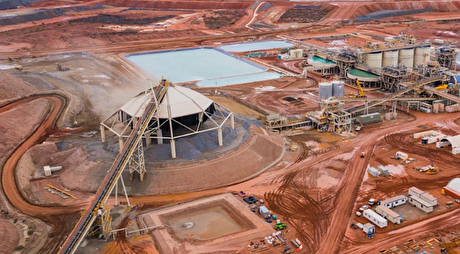

Situated in the state of Minas Gerais, the Colossus project comprises 228.6 km² of licenses within and around the Poços De Caldas alkaline complex, home to some of the highest-grade IAC intercepts recorded globally. Viridis acquired the rights to the project in 2023 and has since conducted multiple rounds of drilling, with rare earths intercepted within all concessions to date.

In Wednesday’s press release, the company noted that the 200.6-million-tonne reserve estimate represents only a small fraction (12%) of the broader Colossus landholding, as it only included converted resource from the Northern Concession, Southern Complex and Capão da Onça deposits. High-grade zones such as the Tamoyo prospect (with the highest MREO content to date at 770 ppm) remain outside this initial reserve, Viridis said.

This, Moreno said, underscores Colossus’ “immense growth potential and strategic significance” as a globally critical source of magnet rare earths.

The total contained TREO reserve of 529,000 tonnes would support a long-duration production of mixed rare earth carbonates. Viridis said it will prioritize magnet rare earth oxides (Nd, Pr, Dy, Tb) to maximize basket value.

Shares of Viridis fell 9.2% in Australia despite the announcement, sending its market capitalization down to A$125.2 million ($80.5m).

Government backing

According to Viridis, the company is positioned to become the first producer of refined rare earths in Brazil through its joint venture with Ionic Rare Earths (ASX: IXR), Viridion, which has exclusive global (excluding Asia and Uganda) rights for the refining of individual rare earth oxides and rights to Ionic’s recycling technology.

Viridis said it is firmly focused on making an investment decision on the Colossus project, supported by the new reserve estimate as well as existing partnerships with Brazil’s investment firms ORE and Régia Capital, which provided $30 million in funding.

In June, the Colossus project was selected for funding by the Brazilian National Bank for Economic and Social Development (BNDES) and the Federal Agency for Funding Authority for Studies and Projects in Brazil (FINEP), which launched a joint public call earlier in the year to invest as much as 5 billion reais ($903 million) across leading strategic mineral projects in the country.

“This funding represents a significant milestone for both Viridis and our joint venture, Viridion, enabling us to accelerate our development timeline and move decisively toward establishing the first fully integrated rare earths supply chain outside of China,” Moreno stated in a June 13 release.

source: mining.com

Glencore seeks $13 billion in incentives for Argentina copper projects

Hindustan Zinc to invest $438 million to build reprocessing plant

Samarco gets court approval to exit bankruptcy proceedings

Gold Fields nears $2.4B Gold Road takeover ahead of vote

Metal markets hold steady as Trump-Putin meeting begins

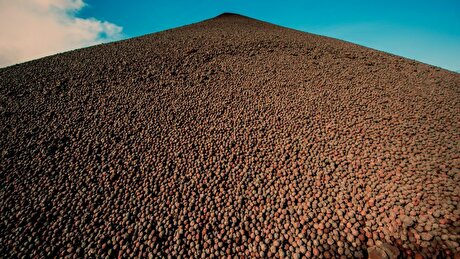

Explaining the iron ore grade shift

Glencore trader who led ill-fated battery recycling push to exit

Trump to offer Russia access to minerals for peace in Ukraine

Gold price edges up as market awaits Fed minutes, Powell speech

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions