Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

According to me-metals cited from mining.com, On Thursday, the battery metals developer announced plans to convert approximately $40 million of its outstanding debt into equity, with its lenders receiving shares priced at $0.60 each. This exchange would result in a 60% reduction in Electra’s total debt to $27 million. Its remaining notes will take the form of a new three-year loan.

The company will also launch a $30 million equity financing, offering units priced at $0.75 each. The units each contain one common share and one share purchase warrant, with the latter exercisable for three years at $1.25 a share. Existing lenders have committed to $10 million of the financing.

Electra’s shares closed at $0.95 apiece on the NASDAQ at Thursday’s close, giving the Toronto-based company a capitalization of $17 million. The stock opened Friday’s session one cent higher at $0.96.

Together, the debt conversion and equity financing are designed to strengthen Electra’s capital structure and provide the funding required to advance the commissioning of its cobalt refinery project, the company stated.

“Today marks a turning point for Electra,” Electra’s CEO Trent Mell said in a press release. “By equitizing a majority of our debt and securing bridge financing, we are taking decisive action to create a sustainable capital structure and advance the steps required to complete the cobalt refinery.”

Stalled refinery project

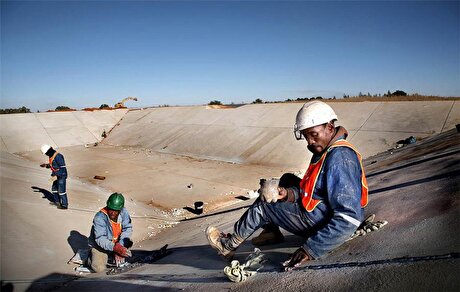

The $250 million refinery in Temiskaming Shores, Ontario, has been on hold since its construction was halted in August 2023 due to cost overruns and supply chain disruptions. At the time, approximately $60 million was still required to complete the project.

Electra has been focused on raising this capital to finish building the facility, from which it expects to produce about 6,500 tonnes of battery-grade cobalt per year, enough to support the manufacturing of a million electric vehicles.

To date, it has received federal government support from both sides of the border, including a $20 million award last year from the US Department of Defense and a recent funding on a similar scale (C$20 million) from the Canadian government.

“With shareholder approval, lender participation, and government support, we will soon be in a position to complete construction of North America’s first cobalt sulfate refinery,” Mell said, acknowledging that the note restructuring is “undeniably dilutive and difficult” for shareholders, but it is “both timely and necessary” for the company.

“By significantly reducing our debt and securing new capital, we are strengthening our financial foundation and aligning our funding with a clear, executable path to production,” Electra CFO Marty Rendall added.

The financing package will also include $2 million in short-term loans to fund working capital. In return, the lenders will have the right to appoint a director to Electra’s board, which will be expanded to seven members post transaction.

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

South Africa mining lobby gives draft law feedback with concerns

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study