Pakistan: Imported Scrap Offers Fall; Local Steel Prices Continue Downtrend

Almost 50% of furnaces and many rerolling mills in the country are still closed amid poor economic stability. While major steelmakers stand slow going amid the possibility of production cuts to avoid forecasted losses on high production cost and weak demand at the moment.

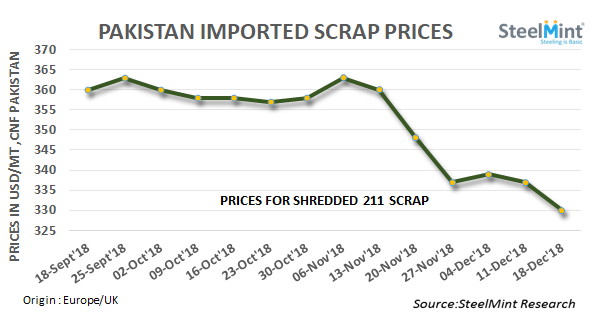

Imported scrap offers continue downward correction. Offers for containerized Shredded 211 from Europe and UK heard in the range USD 325-330/MT, CFR Qasim. Minor trades for European containerized shredded scrap was concluded at around USD 325-327/MT, CFR Qasim during closing last week.

Moreover, Dubai origin HMS 1 is being offered in the range of USD 320-325/MT, CFR Qasim. Most of the buyers are waiting before making new purchases.

Local scrap remains a preference over imported scrap amid cost effectiveness - According to sources, local scrap prices have come down by around PKR 3500-4000/MT (USD 25-29) in last one weeks’ time. Local scrap equivalent to Shredded stands at around PKR 52,000-53,000/MT (USD 374-377) including all taxes. Some buyers are likely to prefer cheaper local scrap for time being expecting a further correction in global prices.

“Local scrap is cheaper by around USD 20/MT over imported” shared a source.

Sentiments in Pakistan's local steel market remain bearish - The current situation of steel markets is likely to prevail till the end of December, which may also extend till mid of Jan 2019. December month is a closing month for most of audits and seasonality concerns may affect activities further.

Many of the construction projects of CPEC which are on hold right now, will be starting from the next month after clearing audit from New Government. It is expected that recommencement of high rise building construction would generate some movement in upcoming days and the Government would start metropolitan intercity projects in the upcoming months, which will help steel markets to stable down again in Pakistan.

In Punjab region, average selling rates of branded deformed bar assessed in the range PKR 96,000-97,000/MT, ex-works, down PKR 1,000/MT as against last report varying on quality and thickness. In Sindh region price assessed at PKR 99,000-100,000/MT, ex-works. Deformed G-60 bar prices heard in the range PKR 100,000-101,000/MT, ex-Karachi inclusive of taxes.

Almost 50% of furnaces and many rerolling mills in the country are still closed amid poor economic stability. While major steelmakers stand slow going amid the possibility of production cuts to avoid forecasted losses on high production cost and weak demand at the moment.

Imported scrap offers continue downward correction. Offers for containerized Shredded 211 from Europe and UK heard in the range USD 325-330/MT, CFR Qasim. Minor trades for European containerized shredded scrap was concluded at around USD 325-327/MT, CFR Qasim during closing last week.

Moreover, Dubai origin HMS 1 is being offered in the range of USD 320-325/MT, CFR Qasim. Most of the buyers are waiting before making new purchases.

Local scrap remains a preference over imported scrap amid cost effectiveness - According to sources, local scrap prices have come down by around PKR 3500-4000/MT (USD 25-29) in last one weeks’ time. Local scrap equivalent to Shredded stands at around PKR 52,000-53,000/MT (USD 374-377) including all taxes. Some buyers are likely to prefer cheaper local scrap for time being expecting a further correction in global prices.

“Local scrap is cheaper by around USD 20/MT over imported” shared a source.

Sentiments in Pakistan's local steel market remain bearish - The current situation of steel markets is likely to prevail till the end of December, which may also extend till mid of Jan 2019. December month is a closing month for most of audits and seasonality concerns may affect activities further.

Many of the construction projects of CPEC which are on hold right now, will be starting from the next month after clearing audit from New Government. It is expected that recommencement of high rise building construction would generate some movement in upcoming days and the Government would start metropolitan intercity projects in the upcoming months, which will help steel markets to stable down again in Pakistan.

In Punjab region, average selling rates of branded deformed bar assessed in the range PKR 96,000-97,000/MT, ex-works, down PKR 1,000/MT as against last report varying on quality and thickness. In Sindh region price assessed at PKR 99,000-100,000/MT, ex-works. Deformed G-60 bar prices heard in the range PKR 100,000-101,000/MT, ex-Karachi inclusive of taxes.

Chile’s 2025 vote puts mining sector’s future on the line

Copper price hits new record as tariff deadline looms

Gold price could hit $4,000 by year-end, says Fidelity

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Glencore workers brace for layoffs on looming Mount Isa shutdown

US targets mine waste to boost local critical minerals supply

Column: EU’s pledge for $250 billion of US energy imports is delusional

Torex Gold buys Prime Mining in $327M Mexico expansion

Gold price retreats to near 3-week low on US-EU trade deal

Agnico stock rises on record quarterly profit, free cash flow

EnergyX expands US Smackover acreage to cut lithium costs

Anglo American posts $1.9B loss, cuts dividend

Silver remains attractive investment, with potential ‘squeeze’ scenario: Sprott

The world’s biggest iron ore windfall is fading for Australia

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Agnico stock rises on record quarterly profit, free cash flow

EnergyX expands US Smackover acreage to cut lithium costs

Anglo American posts $1.9B loss, cuts dividend

Silver remains attractive investment, with potential ‘squeeze’ scenario: Sprott

The world’s biggest iron ore windfall is fading for Australia

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks