Trump tariff surprise triggers implosion of massive copper trade

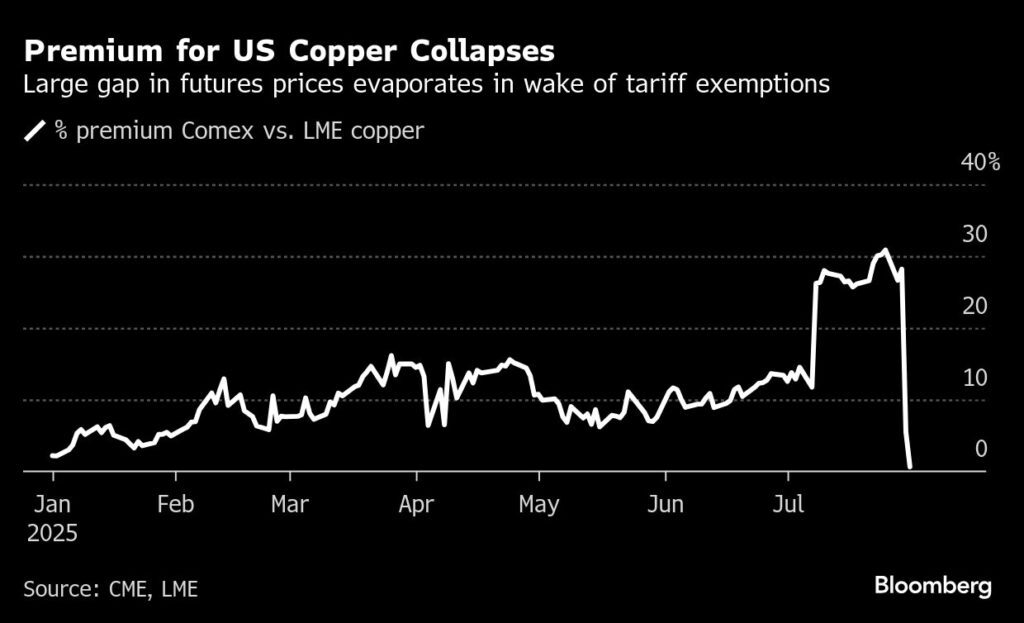

According to me-metals cited from mining.com, US President Donald Trump went ahead with 50% tariffs on copper imports but exempted refined metals, which are the mainstay of international trading. The move triggered a record plunge for US prices after a period of fat profits for traders who hurried metal to America before the levies kicked in. A large premium for New York futures over London evaporated.

“The blow-out in the CME-LME spread has been touted as one of the most profitable commodity trades in modern history,” Daniel Ghali of TD Securities Inc. wrote in a note. “In a single session, the White House’s proclamation on copper tariffs annihilated the spread and catalyzed CME copper’s largest intraday fall on record.”

Copper futures on Comex in New York fell by 22% as traders recalibrated the value of metal in the US versus the rest of the world. With prices on the London Metal Exchange falling by a much smaller margin, Comex front-month futures swung to a discount against the LME benchmark from a premium of more than 30% a week ago.

The decision to exempt refined copper will roil global trade of the metal, which plays a crucial role in the world economy thanks to its use in electrical wiring. Massive volumes now sit in US warehouses, and there’s already speculation about potential re-exports.

Copper rush

When Trump first flagged the likelihood of tariffs early this year, US prices soared relative to the rest of the world, and major traders scurried to get metal to American ports in a trade that some industry veterans said was the biggest of their lifetimes.

Early in July, Trump said the tariff would be a higher-than-expected 50%, ratcheting up the potential rewards. That spurred a last-minute rush, with at least one copper-laden ship heading for Hawaii before the end of this month.

“This has badly deviated from market expectations,” said Li Xuezhi, head of research at Chaos Ternary Futures Co., a unit of a commodities hedge fund in Shanghai. Those betting on higher US prices have “wasted all their efforts,” and global copper flows will return to normal, he said.

Analysts at Goldman Sachs Group Inc. said they were “surprised” by the exemptions but added that they don’t see it changing market fundamentals and don’t expect large-scale re-exports from the US. Comex prices should stay at least on a par with LME prices, they said.

Copper fell 0.9% to settle at $9,611 on the LME 6:08 p.m. London time, while Comex copper was 22% lower at $4.371 a pound.

Supply security

The President’s announcement — less than 48 hours before tariffs were due to start — illustrates his white-knuckle approach to trade policy and the challenges he faces in revamping America’s metals industry. Some key players in the US copper sector had argued that the country simply didn’t have sufficient capacity to replace all its imports so quickly.

The 50% tariff announced Wednesday will apply to semi-finished products such as pipes, wires, rods, sheets and tubes, and to copper-intensive goods like pipe fittings, cables, connectors and electrical components, according to the White House statement.

Less-processed goods — including ore, concentrates, mattes, cathodes and anodes — aren’t subject to the tariffs.

Still, the prospect of import tariffs on refined copper hasn’t entirely disappeared. The Department of Commerce instead recommended delayed imposition, with a rate set at 15% starting in 2027 and rising to 30% in 2028. Trump directed the department to provide an update on US copper markets by the end of June 2026.

“While we are surprised by the near complete roll-back on the proposed copper tariffs, we think this shows the Trump Administration is still focused on security of supply for copper,” the Goldman Sachs analysts, including Eoin Dinsmore, head of industrial metals research, said in the note.

source: mining.com

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming