Pakistan: Imported Scrap Trades Slow Down on High Offers

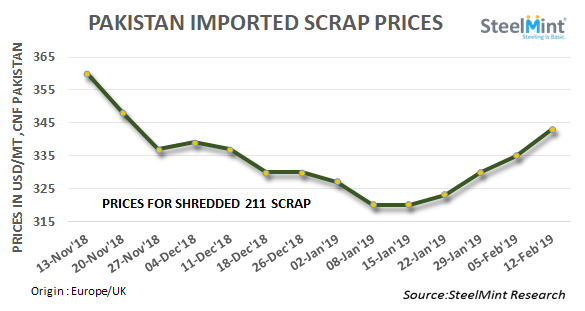

SteelMint’s assessment for Shredded scrap moved up in the range USD 340-345/MT, CFR Qasim. Sellers remained on the higher side following increased restocking in Turkey and recovering global finish steel prices. Asking rates from leading yards in US and UK reported in the range USD 345-350/MT, CFR. This has pulled assessment up USD 5-10/MT on weekly basis.

However, hardly any buyer was able to lift Shredded prices above USD 345/MT, CFR amid no significant recovery in local steel prices and demand.

In recent trades confirmed, Containerized HMS 1 from Dubai sold at USD 330-332/MT, CFR Qasim while Shredded 211 scrap was booked at around USD 338-340/MT, CFR Qasim from Europe and US origin.

The Middle East and South Africa origin HMS 1&2 offers stood stable at around USD 325-330/MT, CFR. HMS offers from UK and Europe assessed at around USD 325/MT, CFR depending on quality.

Increase in electricity tariff rates increases the cost of billet making - Pakistan steel melters association has presented hike in electricity tariff rates for ‘off-peak hours’ from PKR 9/Unit to PKR 13/Unit while for ‘peak hours’ from PKR 16/Unit to PKR 20/Unit. This may increase the cost of construction of 1 ton of billet by PKR 3,200/MT.

“Local steel market shows signs of work starting to pick-up with the weather warming up slowly. Also, the last two quarters of fiscal year (i.e. Jan-Jun) generally remain faster as government budgetary spending increases before the budget closes. This will bring upward momentum in prices in near terms” - a source shared.

There is no major improvement in local steel demand yet, while, local steel prices slightly turn up as compared with last week.

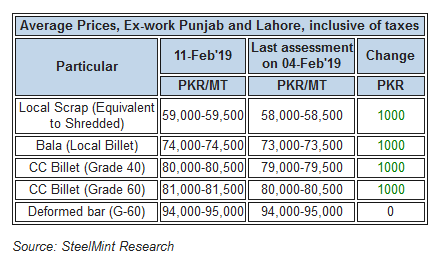

SteelMint’s local steel price assessment

Turkey imported scrap prices for HMS 1&2 (80:20) stand stable at USD 330/MT, CFR for US origin. In a deal concluded for Apr’19 shipment recently, Marmara region based steel mill booked 23,000 MT HMS 1&2 (80:20) at USD 330/MT and 2,000 MT Bonus scrap USD 340/MT, CFR.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming