India: Pellet Export Interest Slides as Chinese Buyers Prefer Port Stock

Buying interest for Indian pellets in seaborne market remains dull this week as market seeks more clarity on impact of Vale supply disruption. Chinese mills prefer port stock over seaborne cargoes, SteelMint learned from market sources. Besides, the steel mills tend to stock material in January before approaching week long new year holidays in Feb to ensure sufficient raw material availability post holidays.

No deal was reported this week except a pellet export tender of 50,000 MT by state owned unit consisting of Fe 64% content and less than 2% alumina. The deal was heard to have concluded at bids around USD 116/MT, FoB India. However confirmation from company was still awaited till the time of publishing of report.

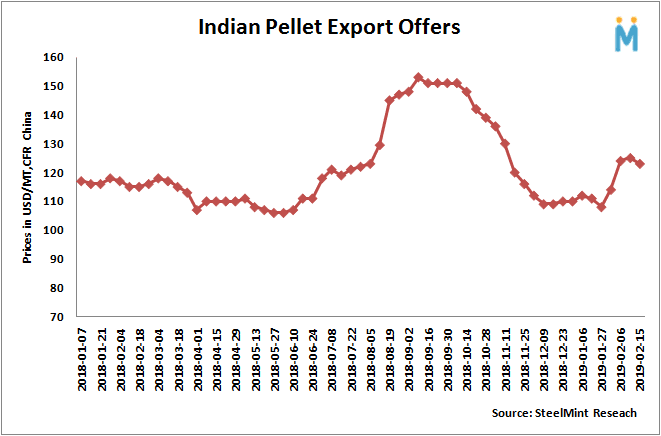

According to SteelMint's assessment for regular grade pellets the prices have decreased on weekly basis to around USD 122-123/MT, CFR China as against USD 124-125/MT, CFR China last week.

Indian Pellet export tender

Last week, Odisha based major pellet maker had concluded 50,000 MT pellet export deal for Fe 64% and 3% Alumina. The deal was heard to have concluded at USD 124/MT, CFR China.

What lifted market sentiments in pellet export?

After the recent mishap, iron ore miner- Vale has announced plans to halt 40 MnT of iron ore production and 10-11 MnT of pellet production, so that it can decommission dams similar to the one that burst. This resulted in sharp hike in iron ore & pellet prices in global market anticipating shortage in seaborne supply in near term.

The Vale dam tragedy had resulted in surge in iron ore prices. The spot iron ore prices shot up sharply from end Jan'19 at around USD 75/MT, CFR China to USD 87/MT, CFR China towards early Feb and to USD 94/MT, CFR China last weekend. However, the iron ore prices depict a downward trend this week amid awaited clarity on amount of supply disruption.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming