13 Things SteelMint Learned from POSCO Q1CY19 Results

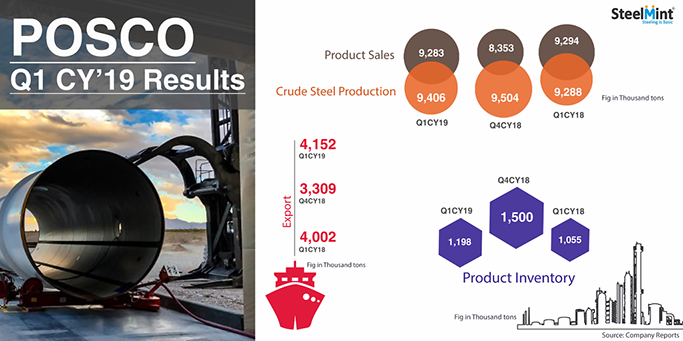

1. Crude steel production inch down 1% Q-o-Q basis- POSCO crude steel production inched down by 1% Q-o-Q basis to 9,406 thousand tons in Q1 CY’19 in comparison to 9,504 thousand tons in Q4 CY’18. However on yearly basis it rose marginally by 1% in Q1 from 9,288 thousand tons in similar quarter of previous year.

2. Sales volumes increases by 11% in Q1 CY’19- Company’s sales volumes increased by 11% on quarterly basis to 9,283 thousand tons in Q1 CY’19 against 8,353 thousand tons in previous quarter. The increase in sales volume can be attributed to rise in exports.Besides this, product sale volumes of HRC expanded by 374 thousand tons and plates by 118 thousand tons in first quarter of CY’19.

3. Carbon steel prices fell in Q1 CY19- Company’s carbon steel prices registered a fall of 3% in Q1 CY'19 to 722/MT thousand KRW from Won 746/MT thousand KRW in Q4 CY'18. However Y-o-Y basis it inched up by 2% against 710K tons in Q1 CY'18.

4. Export sales up in Q1 CY'19- Export sales stood at 4,152 thousand tons in Q1 surge by 25% against 3,309 thousand tons in Q4. However on yearly basis the same went up by 4% against 4,002 thousand tons in Q1 CY'18.

5. Domestic sales decline by 3% Y-o-Y in Q1CY19- Company’s domestic sales witness decline by 3% Y-o-Y basis in Q1 at 5,131 thousand tons against 5,292 thousand tons in Q1 CY'18.

6. Product inventory down by 20% in Q1 CY'19- Company’s product inventory drop by 20% in Q1 to 1,198 thousand tonnes against 1,500 thousand tonnes in previous quarter. On yearly basis the same went down by 14% against 1055 thousand tonnes in Q1 CY'18.

7. Tax reduction may support Chinese steel prices- As per company report Chinese steel prices may increase amid VAT reduction from 16% to 13% and increase in infrastructure spending, investments in railway and roadway projects may support prices. Meanwhile strengthening raw material prices will also lead to uptrend in Chinese steel prices.

8. Global steel demand to remain weak in CY'19- Chinese steel demand is expected to grow at a slower pace of 1%amid China-US trade dispute and slower economic growth. While demand forecasts for India, Southeast Asia and other emerging markets will be around 5-7%. And the demand forecast for MENA region shall remain bleak amid geopolitical risks.

9. Automobile sector likely to increase in Q2 CY’19- As per Korean automobile manufacture association the production of cars stood at 955 thousand cars in Q1 CY’19 which is expected to touch at 1,129 thousand cars in Q2.

10. Decrease in Investments in Construction sector in CY19- Demand from construction sector shall witness a decline in CY'19 due to weak private housing sector.

11. Shipbuilding volumes to increase in Q2- The demand in shipbuilding sector stood at 3.1 million GT in Q1 CY’19 expected to touch at 7 million GT in Q2 CY’19.

12. Global iron ore prices to remain strong- In Q1 CY’19 various disruptions like Vale dam collapse in Brazil in Jan’19 and cyclone in West Australia in Mar’19 leads to uptrend in iron ore prices. Thus in Q2 iron ore prices is expected to remain at USD 82-87/MT amid supply uncertainties among major iron ore suppliers until they recover from disaster.

13. Coking coal prices to remain steady in Q2- Coking prices is expected to remain steady in Q2 CY’19 to USD 190-200/MT with ongoing port maintenance in East Australia from April to May. However in Q1 coking coal prices stood at USD 206/MT amid restrictions on coal imports imposed by Chinese govt and disruptions in transportation caused by rainfall in Australia combined with winter production cuts in China.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming