Indian Steel Market Weekly Snapshot

However as the demand was below to average in finished products, inventories have been rise with the mid sized mills, resulted slump in price range by INR 500-1,000/MT (USD 7-14).

Similarly, the Flat steel prices declined this week by INR 500/MT due to sluggish demand on ongoing elections in the country & low cost imports.

Iron ore and Pellets

-- NMDC Karnataka and C.G has announced a roll over in its iron ore prices for both fines and lumps this week.

-- Domestic pellet prices in India has observed a mixed response this week. Few pellet makers in Durgapur (eastern India) have increased offers this week by INR 100-200/MT. However in central, south and western India pellet market sentiments continue to remain dull. Southern India (Bellary) based pellet makers have lowered prices by INR 100-300/MT to 7,000-7,300/MT against INR 7,200-7,400/MT last week.

-- SteelMint has learned from the market sources that western India based steel mills have booked pellet from central India based pellet makers. As per the sources, the landed cost will be around INR 8,000-8,100/MT.

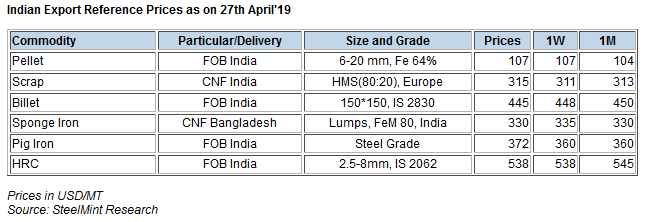

-- India pellet export market remains quiet this week. Indian pellet makers were heard offering Fe 64/63% pellets with 3% Alumina at USD 119-120/MT CFR China but no deals have been reported so far this week.

Coal

Seaborne premium hard metallurgical coal prices have inched slightly lower this week on muted trading activity in the FOB market amidst thin buying interest for spot cargoes from Northeast Asia steelmakers. Nevertheless, delivered prices to China gained strength as end-users exhibited positive sentiments on the grounds of restocking needs.

-- In China, buyers were heard to be actively seeking for low ash coking coal cargoes with prompt laycan, while in the hard coking coal segment, a trade was reported for 85,000 MT of HCC at USD 191/MT CNF China with end April-early May laycan.

-- Latest offers for the Australian Premium HCC grade are assessed at around USD 216.75/MT & for the 64 Mid Vol HCC grade at around USD 194.30/MT CNF India.

Scrap

SteelMint’s assessment for containerised Shredded from Europe, UK and US stand at USD 335/MT, CFR Nhava Sheva. South African HMS 1&2 and HMS 1 from Dubai traded at around USD 334-335/MT, CFR while few trades of Dubai HMS 1 concluded at around USD 330/MT, CFR depending on quality.

According to sources report, India has observed deals for low priced HMS scrap from various origins like West Africa, Brazil and Germany. SteelMint’s assessment of West African HMS 1&2 in 20-21 MT containers remained almost stable at around USD 310-313/MT, CFR Chennai and Goa while around USD 315-316/MT, CFR Nhava Sheva.

-- India's Tata Steel concludes 15,000 MT imported scrap tender. According to sources, out of the total issued quantity through e-auction, 9,000 MT of HMS scrap was booked at around USD 330-335/MT, CFR Vizag and 6,000 MT of Shredded scrap at around USD 340-350/MT, CFR Vizag (India east coast).

Semi Finished

Indian Semi finished market observed volatility in prices on limited demand. Sponge iron & Billet offers fluctuated in the range of INR 200-700/MT (USD 3-10). In this period major price fall in Sponge iron & Billet seen in Durgapur by INR 700/MT on sluggish market trends owing to ongoing elections in the country which has made liquidity crunch.

-- Indian Sponge iron export offers for FeM 78-80 grade lumps more or less firm in current week and stood at around USD 315/MT CPT Benapole (dry land port of Bangladesh & India) and USD 335/MT CNF Chittagong, Bangladesh.

-- Indian induction grade Billet (100*100 mm size) export offers to Nepal is hovering at USD 445-450/MT (ex-mill at West Bengal), equivalent to USD 475-480/MT CFR Nepal (Raxaul border).

-- Tata Metaliks Limited (TML) has declared its yearly results for FY19, in which the company's pig iron sales slightly fell by 2.5% Y-o-Y. However on Q-o-Q the same was surge 13% in Q4 FY19. The company's pig iron sales was about 283,454 MT in FY19 as against 290,902 MT during FY18; down by around 2.5% Y-o-Y.

-- SAIL conducted auction for 9,350 MT steel grade pig iron on 26th Apr’19 in which it further raised base price by INR 100/MT against last auction & only about 1,500 MT (16%) material was booked at base price of INR 27,450/MT (ex-plant), while remaining about 7,850 MT (84%) material failed to fetch any response. However the plant has scheduled a auction to sale of 7,850 MT basic grade Pig iron on 2nd May'19.

-- SAIL has offered basic grade (steel grade) pig iron from its Bhilai Steel Plant (BSP) based in Central India at INR 27,600-27,800/MT ex-plant.

-- NINL has increased its steel grade pig iron prices by INR 750/MT (USD 11) to INR 27,400/MT (USD 392), following hike in offers by private mills. The prices are ex-plant, Cuttack, Odisha(eastern India).

-- Neelachal Ispat (NINL) is offering 2,000 MT Pooled iron (mixed with LRS Scrap) at INR 23,700/MT ex-plant, Cuttack, Odisha.

-- MMTC had floated export tender of 30,000 MT non-alloy Pig Iron on behalf of NINL whose due date was on 15 Apr’19 and as per market sources report to SteelMint, the tender has concluded at around USD 370-372/MT, FoB India. The material likely to be shipped to Bangladesh.

-- Jindal Steel (JSPL) has resumed sales for Panther shots (granulated pig iron) and latest trades reported at INR 26,800-27,000/MT ex-plant, Angul (Odisha).

-- SteelMint's Pig iron export price assessment stood at USD 370-375/MT FoB India, USD 332-334/MT FoB Brazil & USD 344-346/MT FoB Black sea.

Finish Long

Indian Finish long steel market remained quite slow amid inadequate trade activities in across regions and stock levels reported healthier comparison to average maintained, which is a major concern for Industrialists.

Further, market participants are still having curiosity about the market direction as few of them looking stability in prices, meanwhile few are anticipating positive outlook in coming days.

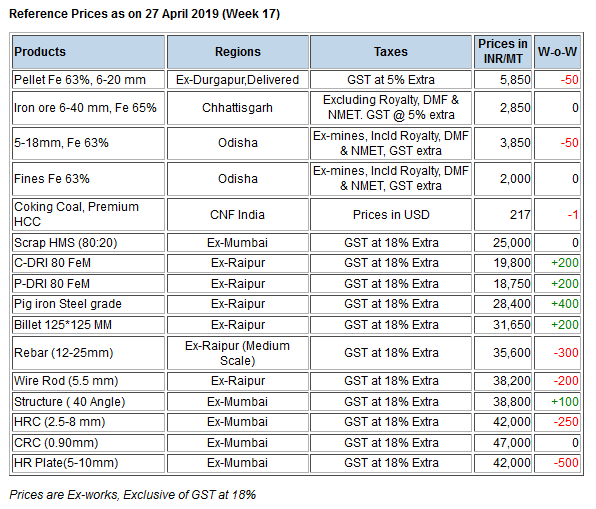

-- Current trade reference rebar prices (12-25 mm) assessed at INR 35,600-35,800/MT Ex-Raipur & INR 37,000-37,300/MT Ex- Jalna. All prices mentioned above are basic & excluding GST.

-- As per sources, Large mills have maintained price range in current week & the trade reference price for 12 mm Rebar registered at around INR 41,000-41,500/MT, Ex-Mumbai & INR 41,000-41,300/MT, Ex-Ahmadabad (Stock Yard).

-- Central region, Raipur based heavy structure manufacturers maintaining trade discount at around INR 400-500/MT which is slightly down by INR 100/MT against last week and current trade reference prices at INR 39,400-39,600/MT (200 Angle) ex-work.

-- Trade discounts in Raipur Wire rod remained healthy and hovering at around INR 1,000/MT which has been lowered against last week i.e. INR 1,300-1,600/MT. Meanwhile basic prices stood at INR 38,200/MT ex-Raipur & INR 36,800-37,500/MT ex-Durgapur.

Flat Steel

Indian HRC prices witnessed marginal decline this week in few markets owing to bearish sentiments and tedious demand prevailing in domestic market.

Traders reported weak buying interest due to ongoing general assembly elections in India. This week domestic HRC prices moved down by around INR 500/MT in few major regions.

-- Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,000/MT ex-Mumbai, INR 41,700- 41,800/MT ex-Delhi & INR 44,000/MT ex-Chennai. Meanwhile, CRC (IS513) 0.9 mm price range is hovering at INR 47,000/MT ex-Mumbai, INR 45,300-47,300/MT ex-Delhi & INR 50,000/MT ex-Chennai. The prices mentioned above are basic, excluding GST@18% on cash payment basis.

Amid sluggish trades and lower sales volumes traders are expecting discounts and rebates to push buying. Thus major Indian steelmakers will revise domestic HRC prices shortly for May deliveries.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming