Imported Scrap Prices Soften in South Asia on Bearish Trades

Indian scrap importers remained away from buying amid limited cash flow on ongoing elections while Bangladesh steel mills observed dull demand in finish steel markets. Amid Ramadan holidays trading has remained weak in Pakistan & Bangladesh.

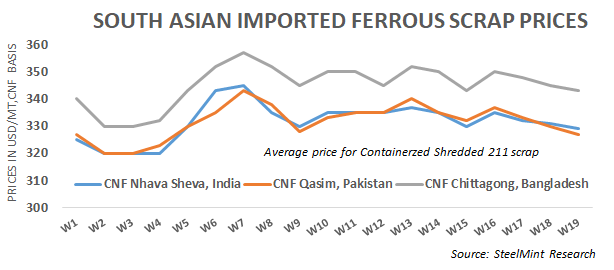

Imported Shredded scrap prices fall in Pakistan - Pakistan scrap importers remained comparatively more active than on limited inventories in hand. As per reports received from a leading trader, decent quantities of Shredded scrap have been booked in containers from Europe and UK at around USD 328-330/MT, CFR Qasim. While Shredded 211 scrap now being offered at USD 325-328/MT, CFR Qasim with buying interest majorly around USD 323-325/MT, CFR.

Indian scrap trades in containers remain low - Buying interest among Indian scrap importers has remained low on lowered local steel prices. Many steelmakers preferred local scrap and sponge iron on easier availability as per requirements and convenient payment terms over imported scrap.

“Buying interest for imported scrap has turned drastically down amid bearish sentiments in local finish and semi-finish markets, depressed automobile sales and low cash flow amid elections. Added to which many buyers remain skeptical on upcoming monsoon to pull demand in the market down further” shared a steelmaker based in southern India.

SteelMint’s assessment for containerized Shredded from Europe, UK and US stand at USD 328-332/MT, CFR Nhava Sheva. Offers from scrap yards in US and Canada reported at USD 328-330/MT, CFR that of EU and UK at USD 330-332/MT, CFR. Buying interest for Shredded among few buyers was learned to be around USD 325-327/MT, CFR but hardly any major deal was reported in the market. Many European scrap yards are facing issues on lessened inflow and collection rates keeping offers limited.

Dubai based scrap suppliers stood away from offering amid Ramadan festive holidays. Few offers for HMS 1 heard around USD 327-330/MT, CFR Nhava Sheva and South African HMS 1&2 remained almost stable in the range USD 330/MT, CFR. Buying interest for sheared HMS from Europe has dropped below USD 300/MT, CFR.

SteelMint’s assessment of West African HMS 1&2 in 20-21 MT containers stands at USD 305-310/MT, CFR Nhava Sheva and USD 307-315/MT, CFR Chennai with very limited availability of offers in the market.

Indian domestic scrap prices soften amid dull sentiments - Price assessment of local HMS 1&2 (80:20) has slightly lowered by INR 200/MT on weekly basis to INR 24,800-25,000/MT (USD 359-362), ex- Mumbai and by INR 400-500/MT to INR 23,600-23,800/MT, CFR Chennai amid continued fall in semi-finish prices. Despite strengthening of Indian Rupee against US Dollar by around 1% over this week, was not enough to improve sentiments considerably. USD/INR exchange rate stands at 69.9 levels today against 69.1 levels a week back.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming