Bangladesh: Imported Scrap Offers Fall; Buyers Eye Further Correction

Meanwhile, with new tax alterations in the recently announced national budget, domestic finished steel prices are up sharply, while the industry remains watchful for more clarity.

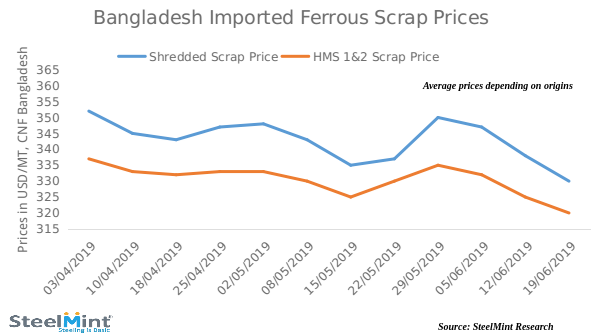

SteelMint’s price assessment for containerized Shredded scrap from North America and Europe stands at USD 330/MT, CFR Chittagong, down by USD 8-10/MT against the last week’s report. Few prominent suppliers were reported to in the range of USD 332-335/MT CFR, however buying interest remains lower, with the market expecting a further marginal drop in prices in coming days.

Containerized HMS offers also reported to decline by USD 7/MT against last week, as South American origin HMS 1 price is being assessed at USD 318-320/MT, CFR while low-grade HMS 1&2 from Europe & Australia being offered at around USD 310-312/MT CFR Chittagong. Offers for P&S scrap in containers currently stand in at around USD 340/MT, CFR however no deal reported for the same, on an expectation of further lowering from buyers.

As per data maintained with SteelMint, the current prices for imported shreddded and HMS scrap to Bangladesh have reached 6 months low levels.

Bangladesh domestic steel market has turned positive in terms of finished steel prices post-Eid and new budget announcement, with finished steel prices increasing by around BDT 2,500-3000/MT (USD 32-36) on account of the tax changes in this year’s proposed national budget, while steelmakers are understanding further impact of the budget on the steel sector.

Local shipyard scrap also witnessed an upturn with prices increasing by around BDT 1000/MT and currently standing at BDT 35,000-35,500/MT (USD 414-420), as against BDT 34,000/MT levels reported 2 weeks ago, however, suppliers are shying away from selling in large quantities amid less clarity in the market.

There is a healthy demand for Ship-breaking scrap in the market although the supply remains limited. Although Global scrap prices seem to have bottomed now, market is expecting further decline in offers to Bangladesh, on competitive prices from Indian origin sponge iron as well as local scrap.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming