Global HRC Market Overview - Week 26, 2019

According to the notification issued, steelmakers have to cut production by 20-50% on blast furnaces. This notice on suspension and limit of production of steel enterprises in order to control emission and curb air pollution.

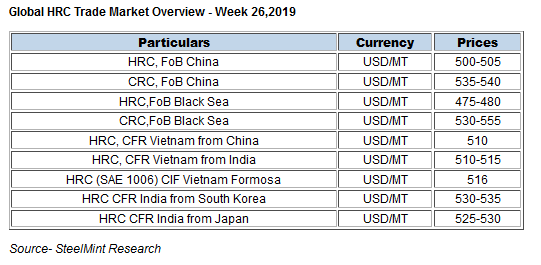

Currently nation’s HRC export assessed at USD 500-505/MT FoB basis. Last week the offers stood at USD 485-490/MT FoB basis.

Meanwhile domestic HRC prices spiked by around RMB 130-140/MT since the beginning of the week and is hovering at RMB 3,910-3,920/MT in eastern China (Shanghai).However last week the prices was around RMB 3,730-3,750/MT D-o-D basis in eastern China (Shanghai).

Also prices in northern China shoot up by RMB 90-100/MT and hovering at RMB 3,850-3,860/MT.

Thus exporters are trying to secure cargoes amid fear of further increase in prices.

- Market sources based in Vietnam shared that Kobe steel booked around 5,000 MT of HRC with Vietnam at around USD 510/MT CFR basis.

This week imported HRC offers to Vietnam witness marginal rise following increase in export offers from China.

Thus imported HRC offers to Vietnam from China moved up by USD 5-10/MT and are heard at USD 510/MT CFR basis which was USD 490-500/MT CFR basis in previous week.

Also Vietnam based domestic steel mill Formosa Ha Tinh announced to cut sales volumes in order to prevent losses. Company is planning to reduce sales volumes amid increased cost of production and prevailing losses at current prices.

Currently Formosa is offering HRC (skin pass,SAE1006) at USD 516/MT CIF basis for July Aug shipments down by USD 25/MT on monthly basis.

CIS nation’s export offers remained largely stable- CIS nation’s HRC export offers remained largely stable at USD 475-480/MT FoB black sea. Meanwhile Ukraine is also offering HRC at around USD 470/MT FoB basis.

Thus slow demand and sluggish buying have kept export offers of HRC largely stable.

Indian steel mills raise HRC export offers for Vietnam - Indian steel mills have raised HRC export offers for Vietnam by USD 5-10/MT amid improved demand in overseas market.

Current HRC export offers from India to Vietnam is heard around USD 510-515/MT CFR Vietnam for July August shipments which was USD 495-500/MT CFR basis in previous week.

However no major deals have been reported yet in revised offers since importers based in Vietnam are bidding on lower side.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming