Bangladesh: Imported Scrap Prices Rangebound; Market Awaits Clarity on Budget

However, concerns over new budget are still looming in the industry as the steelmakers anticipate that the new tax tariffs imposed on imports of raw materials will significantly increase finished steel prices. On the other hand, local ship recyclers seek clarity on VAT that could lead to a USD 25/LDT decline in scrapped ship import prices.

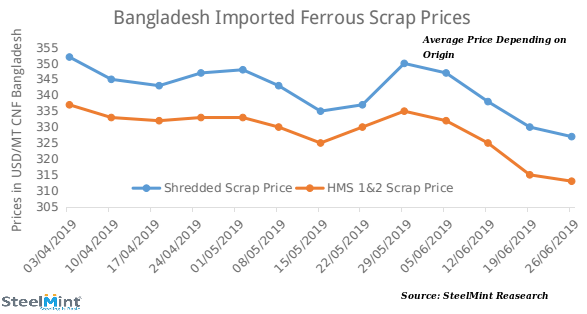

SteelMint’s assessment for containerized Shredded scrap from Europe and North America stands at around USD 325-330/MT, CFR Chittagong, slightly down against the last week’s report of USD 330/MT,CFR levels, with reasonable number of deals getting concluded at lowered prices as steel mills continue to restock. Few USA based scrap yards were reported to offer in the range of USD 330-332/MT, CFR.

Containerized HMS offers were reported to marginally decline against last week, as South American origin HMS 1 is being assessed at USD 315-320/MT, CFR Chittagong while lower grade HMS 1&2 from Australia and USA is being offered at around USD 310-313/MT, CFR.

Amid limited demand, offers for P&S scrap majorly have withdrawn by the suppliers in containers but a few offers heard in the range USD 330-335/MT, CFR, while overall imported scrap prices to Bangladesh remain at 6 months low levels.

Bangladesh domestic steel market has seen improvement in terms of finished steel demand and industry is keeping a positive outlook, although the impact of recent budget especially the new taxes is being carefully watched. According to steelmakers, the expected increase in rebar prices, as a result of the new tax tariffs on ferrous scrap and billets, might affect steel sales in short term as well as infrastructural growth of the country in the long term.

Local shipyard scrap also witnessed downturn with prices falling by around BDT 1,000/MT on the week and currently standing at BDT 34,000-34,500/MT (USD 402-408), as against BDT 35,500/MT reported last week.

Ship plate prices in Chittagong’s market remained more or less stable with local (16 mm & 12 mm) ship plates' offers reported at around BDT 43,000-43,200/MT (USD 509-511) and BDT 42,000-42,200/MT (USD 497-499) respectively ex-works inclusive of local taxes. However, no news of new sale has been reported in the country’s ship-breaking market so far amid nearing fiscal year close.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming