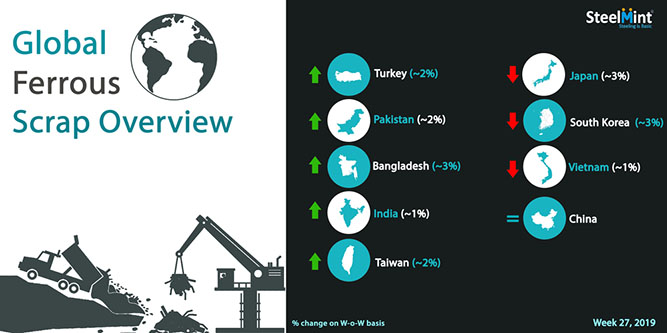

Global Ferrous Scrap Market Overview - Week 27, 2019

Japan’s Tokyo Steel witnessed another price cut in scrap purchase as domestic prices reached 2 year low levels, while South Korea’s Hyundai Steel lowered bids by USD 9. China’s Shagang Steel kept scrap purchase prices unchanged.

Turkey - Turkish imported scrap prices have strengthened further on continued buying activity for July & August shipments, while the market is anticipating prices to remain supported amid positive sentiments globally. Steelmakers booked around 5-6 bulk cargoes comprising almost 200,000 MT scrap this week driving the global trend upward.

SteelMint’s assessment of US origin HMS 1&2 (80:20) scrap increased to USD 300/MT, CFR Turkey, up by USD 6-7/MT against the last week while European HMS 1&2 assessed at around USD 295-296/MT, CFR Turkey.

In a recent deal reported, a steelmaker from Izmir region booked a Baltic origin cargo comprising 26,000 MT of HMS 1&2 (80:20) and 1,500 MT of Bonus at an average price of USD 298.5/MT, CFR Turkey.

Japan - Amid bearish support from country's construction sector and limited end-user demand, Japanese domestic scrap prices have been showing continuous downtrend since last 3 months, while Japan’s Tokyo Steel again lowered the domestic H2 scrap purchase by JPY 500/MT, after observing 7 price cuts in June’19

After the recent price lowering, the company is paying JPY 26,000/MT (USD 240) for H2 scrap delivered at Tahara plant in central Japan and for Utsunomiya plant in Kanto region, while JPY 25,500/MT (USD 235) for Okayama plant. Amid competitive Japanese scrap offers, SE Asian scrap importers increase inquiries for Japanese scrap as global scrap prices on an uptrend again.

South Korea - South Korean leading EAF steel mill Hyundai Steel lowered bids for Japanese scrap purchase by JPY 1,000/MT (USD 9) on 5th Jul’19, amid continued downtrend in Japanese domestic scrap prices since a couple of weeks.

The company's current bids for H2 scrap stand at JPY 27,000/MT (USD 249), FoB Japan as against JPY 28,000/MT (USD 259), FoB presented last week. Other Korean EAF steelmakers including Dongkuk steel had already slashed their bids earlier. No major fresh booking by the company was reported this week.

Taiwan – Taiwanese scrap & rebar prices paused falling down this week. Imported scrap prices turned up USD 5/MT W-o-W to USD 275/MT, CFR Taiwan for US origin HMS 1&2 80:20.

Leading steelmaker Feng Hsin has rolled over its domestic scrap buying prices at TWD 8,700/MT (USD 279) for HMS 80:20 delivered to plant. Rebar prices are expected to find support in the country however, concerns on rains remain in the market

Vietnam – Although US and European scrap offers increased, Vietnamese scrap importers were not interested in paying high amid competitive offers from Japan while Hong Kong observed very tight supply of raw materials with very limited offers in the market.

Recently around 5,000 MT of H2 reportedly sold at USD 290/MT, CFR South Vietnam. While Japanese export prices fell further as HS and Shindachi price in bulk to Vietnam is heard USD 310-315/MT, CFR Vietnam.

India - Imported scrap trades to India remain very limited on non-viability of imports due to low prices of domestic scrap and Sponge Iron, amid negative domestic market sentiments. Imported scrap offers increased following the global uptrend, while industry was looking for the national budget announced on 5th July.

Assessment for containerized Shredded from UK and Europe stands at USD 318-323/MT, CFR Nhava Sheva, up USD 5-7/MT against last week, with no major deals reported, as buying interest remains significantly lower. Dubai origin HMS assessed at USD 315-320/MT CFR, while negligible trades reported on a mismatch in expectation of offers. West African HMS offers assessed at around USD 285-295/MT, CFR and South African HMS sold at around USD 305-310/MT, CFR.

Domestic scrap observed some stability after several weeks of a downtrend as the current assessment of HMS 1&2 (80:20) stands at INR 22,400-22,600/MT (USD 326-329), Ex- Mumbai, similar to last week, with favorable prices encouraging steelmakers to opt for more domestic scrap as compared to imported scrap. Few participants remained apprehensive on successive fall in domestic steel prices and ongoing monsoon season, amid lack of strong support for scrap imports even in the short term.

Pakistan - Imported scrap offers to Pakistan moved up throughout this week on the rebound in Turkey imported scrap prices, while trades in healthy quantity were reported even as domestic market remain uncertain on the new tax regime.

Assessment for containerized Shredded 211 scrap from US and UK stands at USD 323-325/MT, CFR Qasim observing a jump by USD 10/MT against last week. Earlier in the week, few deals were reported at USD 320-322/MT CFR. Assessment for Dubai origin HMS remains in the range of around USD 315-320/MT, CFR as per quality while South African HMS 1&2 assessed at around USD 315-318/MT, CFR Qasim.

Post inclusion of 17% FED, Rebar prices were up sharply and stand in the range of PKR 115,000-116,000/MT, ex-works (USD 733-739) and PKR 116,000-117,000/MT, ex-works for Northern and Southern mills respectively. Several mills lowered production awaiting clarity on taxes meanwhile PKR showed good recovery this week and currently stands at 158 levels while continuing to show volatility.

Bangladesh - Earlier in the week, most of the steelmakers remained slower in ferrous scrap imports seeking clarity on the Budget's impact with the beginning of the new financial year, however, decent deals were concluded in the later half of the week.

Assessment for containerized Shredded scrap from Europe and North America stands at around USD 333-337/MT, CFR Chittagong, up by USD 5-10/MT against the last week, with few suppliers offering at USD 340/MT, CFR. HMS 1 from Brazil was assessed at USD 322-325/MT, CFR Chittagong, while low-grade HMS 1&2 from Europe & Australia reported at USD 315-318/MT, CFR.

With new tariffs being implemented from 1st July, finished steel prices are expected to rise by around BDT 2000-3000/MT while ship recycling sector likely witness an impact of USD 30-35/LTD for scrapped vessel imports, however, the full clarity is awaited and may take another couple of weeks time.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming