Indian Steel Market Weekly Snapshot

However short supply of sponge iron has supported semis market and as per assessment the prices fluctuated by INR 200-500/MT in major locations.

In context to flat steel, the prices registered drop of INR 500-750/MT through the major steel mills on account of weak demand.

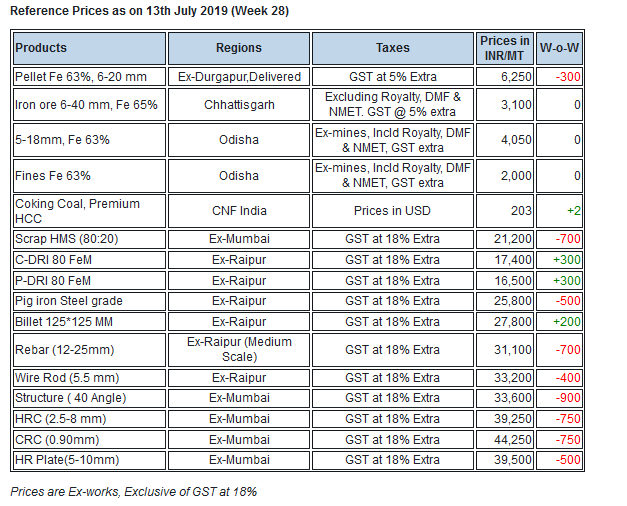

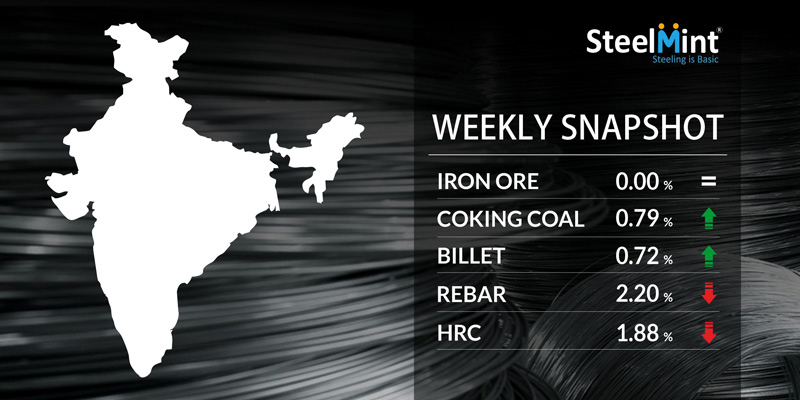

IRON ORE & PELLETS

OMC Iron ore fines e-auction receives bids at base price. Major quantity offered from Gandhamardhan & Koira mines got booked. Odisha merchant miners keep prices unchanged.

-- Domestic pellet offers declined amid falling P-DRI prices this week. Central India based pellet makers have lowered offers by INR 200/MT for Fe 63% to INR 6,800/MT ex-Raipur, GST extra. Durgapur (eastern India) based pellet assessment stands at INR 6,200-6,300/MT as compared to INR 6,500-6,600/MT (delivered) towards the beginning of last week.

-- South India (Karnataka) based - NMDC Donimalai pellet plant has reduced pellet offers by INR 200/MT to INR 6,830/MT (FoT basis) as against INR 7,030/MT (FoT basis).

-- Karnataka High Court had announced its final judgement for the pending Donimalai case on 10th Jul’19. The judgement was in favor of NMDC thus need not pay premium for mining lease renewal at its Donimalai mines.

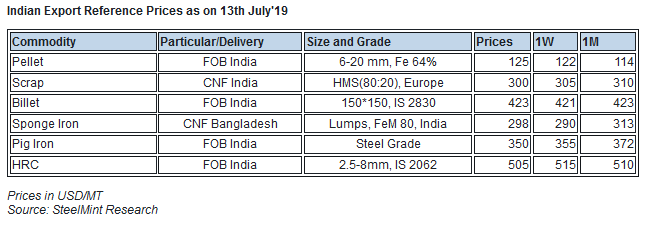

-- Raipur based pellet makers booked over 50,000 MT and 25,000 MT materials to exports for August delivery. As per the sources, standard grade pellets stands at around USD 120-122/MT FOB India east coast. This is equivalent to INR 8,000-8,300/MT FoB basis.

COAL

Australian premium hard coking coal prices edged down this week on fresh bookings concluded at lower levels in the FOB China market. Chinese mills are, however, not looking to buy any large volume of spot seaborne coking coal in recent weeks in the light of persistently tight margins for steel.

Indian steel making margins have also been drastically squeezed, with significantly high iron ore prices, potentially leading to low demand from end-users. Latest offers for the Premium HCC grade are assessed at around USD 184.00/MT FOB Australia and USD 199.25/MT CNF India.

SCRAP

Imported scrap market remained silent throughout the week with very limited viability amid cheaper availability of domestic alternatives. On account of low finished steel sales and successive production cuts, no considerable buying interest for imported scrap was seen in the market. While imported offers inched down following global slowness on a week basis.

Assessment for containerised Shredded scrap from Europe, UK and USA stands at USD 315-320/MT, CFR Nhava Sheva, down USD 3-5/MT W-o-W, but no major deal was reported. HMS 1&2 offers from Dubai & South Africa origin were reported in the range of USD 305-315/MT, CFR Nhava Sheva, while UK origin HMS scrap assessed at USD 280-285/MT, CFR. Trades for HMS 1&2 from West Africa in limited quantity reported at USD 285-290/MT, CFR.

Despite slight volatility shown, domestic scrap prices remained majorly cheaper over landed imported scrap.

SEMI FINISHED

Indian semi finished steel market observed volatility in prices due to fluctuating demand & strong sponge offers which surged in major regions by INR 100-300/MT. However, domestic billet market marked mix trend, where prices volatile by INR 100-500/MT, W-o-W.

-- In Raigarh, Central India 50% (12 hrs) power cut remained by Jindal Power Ltd (JPL) and are expected to continue till Jul'19 end, as per market sources.

-- Indian sponge iron export offers up by USD 10/MT this week due to surge domestic prices & falling rupee against US dollar. Fresh deals reported at around USD 285/MT CPT Benapole (dry port of India & Bangladesh), equivalent to USD 295-300/MT CFR Chittagong, Bangladesh.

-- RINL had floated an ocean billet export tender on 27 Jun’19 of quantity 50,000 MT for 150*150 mm, whose due date was on 02 Jul’19 and as per sources the tender has been concluded at around USD 425/MT, FoB India.

-- Eastern India's mid sized mills export offers to Nepal is hovering at USD 390/MT for billet (100*100 mm, induction grade) & USD 460-465/MT for wire rod (5.5 mm, commercial grade), ex-mill at Durgapur.

-- Rashtriya Ispat Nigam Limited has invited a tender for export of 10,836 MT billets, 8,127 MT wire rod and 5,418 MT bloom to Nepal. Interested bidders can submit their bids till 19 Jul‘19 at 14:00 hrs.

-- Jindal Steel has further lower prices and reported steel grade pig iron at INR 25,500-25,700/MT ex-Raigarh & panther shots at INR 24,000-24,200/MT ex-Angul, Odisha.

-- TATA Metaliks, known as one of the largest foundry grade pig iron manufacturer has cuts price for low silicon(1-1.5%) pig iron by INR 500/MT to INR 28,500/MT ex-Kharagpur, eastern India.

-- SAIL has invited ocean export tender for 16,200 MT prime mild steel non-alloy concast billets, size 125*125 mm from Durgapur Steel plant. The last date for bid submission is 15 Jul’19.

-- SAIL’s Rourkela Steel Plant (RSP) tender held on 10th July'19 to sell about 3,500 MT steel grade pig iron; had received good response. The base price for the tender was quoted lower by by INR 1,200/MT (USD 18) to INR 25,400/MT as against previous auction and near to 55% (1,900 MT) material sold.

FINISH LONG

Finish long steel demand remained limited in Indian domestic market resulting rise in inventories and drop in price range by INR 200-1,000/MT (USD 3-15) with major fall up to INR 1,000/MT in Rebar, INR 200-700/MT in Structures & INR 100-300/MT in Wire rod, as per assessment made by SteelMint.

Participants believe that, the margins (conversion spread) of re-rollers to drop further on account of poor lifting, rising inventories & volatile raw materials.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 31,000-31,200/MT ex-Raipur & INR 32,500-32,800/MT ex-Jalna; prices are basic & excluding GST.

Further with the fall in prices by large scale mills the fresh offers for 12 rebar registered at INR 39,500-40,000/MT ex-Chennai (stock yard), as per trade sources.

-- Central region, Raipur based heavy structure manufacturers have reduced trade discount by INR 200/MT to INR 600-800/MT w-o-w and trade reference prices stood at INR 36,300-36,700/MT (200 Angle) ex-work and the basic offers fell by INR 400/MT.

-- Trade discounts in Raipur Wire rod slightly drop by INR 200/MT to INR 1,200-1,400/MT with fresh offers stands at INR 32,500-33,700/MT ex-Raipur & at INR 32,000-33,000/MT ex-Durgapur, size 5.5 mm.

FLAT STEEL

This week domestic HRC prices in India fell further by around INR 500-750/MT against last week on the back of pessimistic demand, limited trades & falling automobile sales in domestic market.

SteelMint price assessment for HRC (IS2062, 2.5-8 mm) is currently at INR 39,000-39,500/MT ex-Mumbai which is around 1.5 years low and similar levels were last heard in Dec’17. Meanwhile price assessments in other regions are at INR 39,000/MT ex-Delhi and INR 40,000-41,000/MT ex-Chennai.

Currently CRC (0.9 mm, IS 513) trade reference prices are around INR 44,000/MT ex-Mumbai, INR 42,500-44,500/MT ex-Delhi and INR 44,500-45,500/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Thus arrival of monsoon season affects demand as construction activities came to halt. Meanwhile auto sector reported slump in sales volumes which lead to domestic HRC prices under pressure.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming