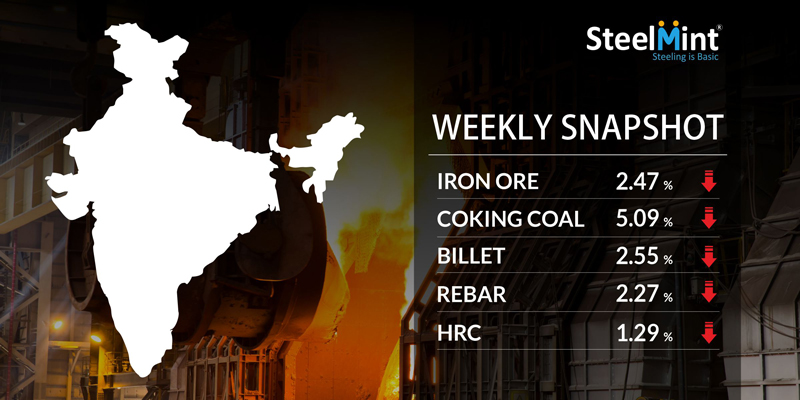

Indian Steel Market Weekly Snapshot

As per producers in major markets, disruption of demand-supply chain amid fall in demand have pressurised them to reduce prices in line to attract buyers.

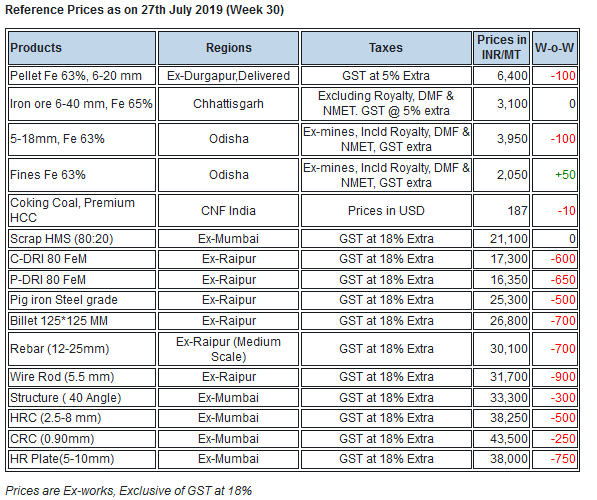

As per SteelMint assessment, during the week, Billet & Rebar prices have declined by INR 200-800/MT (USD 3-12) in across major producing markets. Inline Flat steel, the prices slump by about INR 750-1,000/MT (USD 10-15) in traders market over less buying interest.

IRON ORE & PELLETS

Odisha merchant miners kept the prices unchanged. According to the market, sources report to SteelMint dispatches and operations from Odisha’s Serajuddin mines are not hampered despite the ongoing grievances with internal management.

-- Govt. of Karnataka recently concluded Phase - IV of mines blocks auction in which four blocks were put under hammer.14 companies including JSW Steel, Vedanta, Minera Steel & MSPL were in the race for the same. Out of four mines, JSW Steel won three blocks and one block was bagged by MSPL.

-- Indian pellet market this remain weak amid limited trades reported. Current offers for Fe 63% grade assessed at INR 6,800/MT (ex-Raipur, GST extra), however, no deals were reported so far this week. Durgapur (eastern India) based pellet makers have decreased the pellet prices by INR 100-200/MT on a weekly basis.

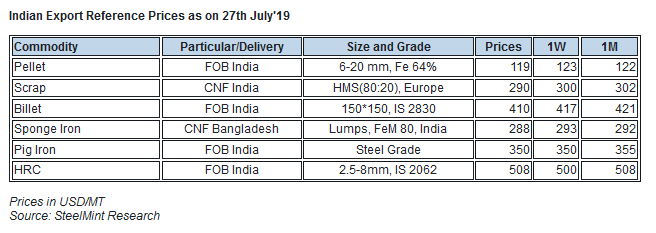

-- SteelMint’s assessment of Indian pellet export offers for standard grade pellet (3% Al) is assessed at around USD 118-119/MT, FoB India (equivalent to USD 132-133/MT CFR China) as compared to USD 121-122/MT, FoB last week

-- Department of Steel & Mines (Govt of Odisha) has permitted storage licenses for intermediate stockyards to state based end user units to facilitate smooth transition of mining leases that are due to expire by 31st March 2020.

-- As per WSA, India’s crude steel output moved up by 5% to 56.95 MnT in H1 CY19 which was 54.2 MnT in same time frame of previous year.

-- JSW Steel - India’s largest steel producing company has announced its Q1FY20 financial year results yesterday. Company’s crude steel output stood at 4.24 MnT in Q1FY20 up by 2% as compared to 4.17 MnT in previous quarter.

COAL

Australian coking coal prices fell sharply this week, after a fresh trade deal was concluded at a lower level in China. Trading activities in the Chinese market have stalled as a result of ongoing restrictions imposed at several major seaborne coal handling ports. Outside China, there has been a persistent lack of buying interest observed amongst both traders and end-user buyers over the past few days.

Indian market fundamentals continue to stay bearish due to lower steel production margins from higher raw material procurement costs, especially of iron ore. A considerable demand from Indian end-user buyers is expected to return post-monsoon in the month of September.

-- Latest offers for the Premium HCC grade are assessed at around USD 171.75/MT FOB Australia and USD 187.30/MT CNF India.

SCRAP

Indian imported scrap market remained very sluggish amid lack of interest on sinking steel prices and heavy rains keeping imported scrap less viable for over a month now. Additionally, significantly cheaper domestic alternatives have lowered the buying interest further. However, with lowering in offers some inquiries have witnessed against that of the previous week.

-- An assessment for containerised Shredded from UK, Europe and USA stands at USD 310-315/MT, CFR Nhava Sheva, down USD 5/MT against the last week. Offers of HMS 1 from Dubai have dropped to around USD 290-295/MT, CFR Nhava Sheva. South African HMS 1 was being offered at around USD 300-305/MT, CFR. Few deals of West African HMS scrap reported at around USD 280-290/MT, CFR with buying interest among secondary steelmakers reported at USD 270-275/MT, CFR.

Average offers in bulk vessels stand at USD 325-330/MT, CFR Kandla but it seems not feasible to conclude at the moment.

SEMI FINISHED

Indian Semis market reported limited trade activities as Billet prices fall by INR 200-800/MT and major slide seen in central India following dropped prices of finished products. Inline Sponge iron marked price fall of INR 600/MT in central India while other market remains at firm level.

Meanwhile pig iron producers being pressurised to reduce prices on account of falling steel prices and as per assessment the prices recorded downfall of INR 200-500/MT in a week in central & eastern regions.

-- Eastern India's mid-sized mills export offers to Nepal stood at around USD 375-377/MT for Billet (100*100 mm, induction grade) & USD 435-438/MT for Wire rod (5.5 mm, commercial grade), ex-mill at Durgapur.

-- Neelachal Ispat Nigam Ltd (NINL), a public sector steel entity in Kalinganagar of Jajpur district and largest merchant supplier of steel grade pig iron is battling raw material crisis on financial issues.

-- Jindal Steel has offered steel grade pig iron at INR 25,200/MT ex-Raigarh & panther shots at near to INR 24,500/MT ex-Angul, Odisha.

-- Indian sponge iron export offers fell by USD 5/MT, price assessment for 80 FeM sponge lumps are at USD 275/MT CPT Benapole (dry land port of Bangladesh & India), equivalent to USD 285-290/MT CNF Chittagong, Bangladesh.

-- SAIL (Steel Authority of India Limited) conducted auction for around 5,300 MT steel grade pig iron on 26th July from Rourkela Steel Plant(RSP) in which the base price reduced by INR 600/MT (USD 9) to INR 24,200-250/MT ex-plant. As per sources the auction receives better response as near to 3,100 MT (58%) Pig iron have been fetched bids.

-- Indian Govt issues mandatory Quality Control Orders (BIS) for Billet and Ingot manufacturers. IS2830 is applicable from immediate effect where as IS2831 will be applicable within 9 months.

-- Vizag Steel had invited a tender for export of 10,836 MT Billets, 8,127 MT Wire rod and 5,418 MT Bloom to Nepal on 13th Jul'19 & the bid due date was 19th Jul'19. As per latest update received from sources, the company has cancelled all lots of exports due to low bids received than the company were expecting.

FINISH LONG

Indian Finish long steel market observed quiet weak demand amid disturbed supply movement along with dull sentiments which led to price contraction by around INR 400-600/MT in most of the regions, whereas southern region observed stability in price range with minor changes.

However central region rebar prices slightly improved from yesterday following strengthening raw materials and price range moved up by INR 300-400/MT but no major trade volume reported through trade associates.

Further, large mills have slashed price range during past week and current week too by INR 1,000-1,300/MT and the latest rebar (12 mm) offers stood at INR 37,000-37,500/MT in Hyderabad & INR 36,800-37,300/MT in Mumbai (ex-stock yard), as per assessment.

Central region, Raipur based heavy structure manufacturers have maintained trade discount by INR 800-1,000/MT against last week and current trade reference prices at INR 35,700-36,000/MT (200 Angle) ex-work and the prices slump by INR 400-800/MT in most of the regions.

Trade discounts in Raipur Wire rod slightly raised by INR 200-300/MT this week to INR 1,600-1,900/MT and fresh offers stood at INR 30,500/MT ex-Durgapur & INR 30,800-31,700/MT ex-Raipur, size 5.5 mm.

FLAT STEEL

Indian HRC prices witnessed further downside this week by INR 750-1,000/MT on the back of mute buying, liquidity issues and inactive demand prevailing in domestic market. Meanwhile prices in northern India like Faridabad and Delhi witnessed significant fall of around INR 800-1,500/MT w-o-w.

As per SteelMint price assessment trade reference prices for HRC (IS2062, 2.5-8 mm) is currently at INR 38,000/MT ex-Mumbai, INR 37,000-37,200/MT ex-Delhi and INR 39,000-40,000/MT ex-Chennai. Meanwhile CRC (0.9 mm, IS 513) prices also fell by INR 750-1,000/MT w-o-w and are currently at INR 43,500-44,000/MT ex-Mumbai, INR 41,000-43,500/MT ex-Delhi and INR 43,500-44,500/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Indian HRC prices continued to remain under pressure in Jun-Sep as these months experience seasonal slowdown amid ongoing rainy season. Also absence of robust demand from auto sector and delayed funding for major projects continue to drag down HRC prices further in domestic market.

-- JSPL (Jindal Steel and Power Limited) concluded a deal of prime quality steel plates of around 8,300 MT from Paradip port in India to Bilbao Port in Spain for August shipments- Sources

-- SAIL has supplied special quality stainless steel from its Salem Steel Plant for the India’s Moon Mission – Chandrayaan 2 meeting the ISRO’s requirements for stringent specifications, superior surface finish and close tolerances.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming