Chinese Steel Market Highlights- Week 30, 2019

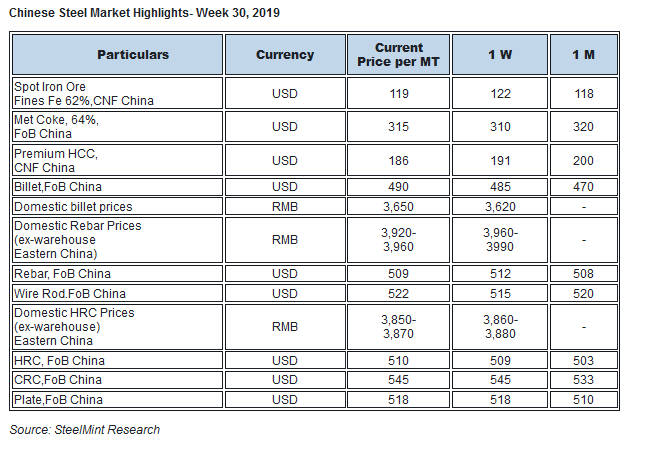

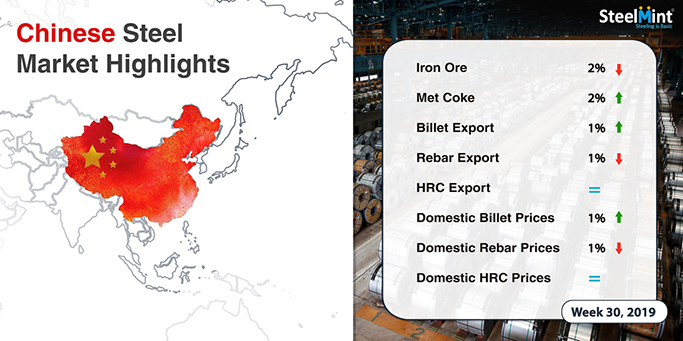

Chinese spot iron ore prices rebound over easing supply from Vale- Chinese spot iron ore prices opened up this week at USD 118.10/MT, dropped to USD 115.10/MT mid week amid easing concerns from Vale. The miner on 23rd July’19 announced authority received from National Mining Agency (ANM) for partial resumption of dry processing at Vargem Grande Complex, which is expected to add 5 MnT of production in 2019. However, towards weekend amid expectation of rising infrastructure projects in China the prices gained to USD 118.75/MT.

As per data compiled by SteelHome consultancy, iron ore inventory at major Chinese ports increased to 119.25 MnT as compared to 118.35 MnT a week ago.

Spot pellet premium fell W-o-W- Spot pellet premium for Fe 65% grade pellets assessed at USD 23.70/MT, CFR China as against USD 21.95/MT, CFR China a week before. Pellet inventory at major Chinese ports witnessed at 5 MnT stable on weekly basis. The production curb in Tangshan have been extended by two months from Aug’19 to Oct’19 paving way for price hike and preference for pellets.

Spot lump premium falls further- Spot lump premium this week witnessed fall to USD 0.2050/DMTU as compared to USD 0.2402/DMTU assessed last week The fall in lump premium may accelerate lump demand in the Chinese markets.

Coking coal offers slump further over low buying from China- Seaborne premium low-volatile hard coking coal prices continued to fall further this week over slowdown in buying activities from China.

Also trading activities in the Chinese market have stalled as a result of ongoing restrictions imposed at several major seaborne coal handling ports.

Meanwhile demand for coking coal from Indian buyers shall resume post monsoon as demand remains dull in domestic market during the season.

Latest offers for the Premium HCC grade are assessed at around USD 171.75/MT FoB Australia which was 179/MT FoB Australia in preceding week.

China domestic billet rose by RMB 30- This week Chinese domestic billet prices in Tangshan settled at RMB 3,650/MT, up RMB 30/MT against last week. This week, billet trade sentiments in China were reported strong.

Chinese HRC export offers remain largely stable- Chinese HRC export offers remained stable this week amid softening demand from overseas buyers.

Currently nation’s HRC export offers stood at USD 507-510/MT FoB unchanged against offers in previous week.

On weekly basis domestic HRC prices in China stood at RMB 3,850-3,870/MT in eastern China (Shanghai) down by RMB 20/MT which was RMB 3,860-3,880/MT in eastern China (Shanghai) in previous week.

However, Chinese steel prices are expected to increase amid ongoing production cuts. Meanwhile moderate demand and slowdown in trading activities both in domestic and export market will make it difficult to sustain increased offers in market.

Chinese rebar export offers inch down as buyers hold sufficient inventories- This week nation’s rebar export offers witnessed marginal fall as buyers are holding sufficient stocks and are unwilling to make fresh bookings with anticipation of further downside in prices.

On an average basis currently nation’s rebar export offers stood at USD 509/MT FoB China which was around USD 512/MT FoB basis last week.Meanwhile domestic rebar prices stood at RMB 3,920-3,960/MT (Eastern China) declined by RMB 30-40/MT which was RMB 3,960-3,990/MT (Eastern China) in last week.

Unpleasant weather conditions in the country has led to subdued demand resulting to higher inventory levels and lower rebar prices in nation’s domestic market.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming