China’s 1H DRI, HBI imports soar

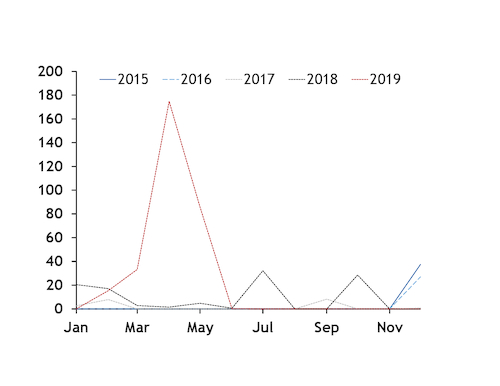

China's January-June imports of direct-reduced iron (DRI) and hot-briquetted iron (HBI) rose by 555pc from a year earlier to 309,506t. The first-half pace puts 2019 on track to exceed the 605,589t of imports in 2013.

Russia at 189,367t was the main source at more than 60pc of imports, followed by Malaysia at 97,792t or 32pc. Other suppliers were Egypt, Mongolia, Oman and Trinidad and Tobago, home to a Nucor DRI plant.

While the volumes are small compared with China's 1bn t/yr of iron ore imports, it could mark a shift in strategy by larger steel mills to reduce pollution and improve steel quality.

Most of the import interest is for HBI, a more stable form of DRI, because it can be used as an alternate to scrap in the basic oxygen furnace (BOF), importers said.

China's pollution control efforts are targeting sintering and blast furnace operations that mills can partially sidestep by increasing scrap charges in the BOF. But any supply upside for China's domestic scrap remains limited until its regional scrap markets fully mature. Many Chinese mills are not aware of the option to use HBI in the BOF, but more mills may start to import after they learn that larger mills are seeking it out, said an official at a key steel producer.

Favourable freight rates during March-April also were a factor in boosting imports. Customs data show the surge of imports occurred during March-May before falling to only 259t in June.

The June pause may be limited. A steel mill buyer said HBI imports will be used during expected strict pollution restrictions during the People's Republic of China 70th anniversary celebrations in early October. Spot sales of Middle East-origin HBI support this outlook.

July saw HBI August deliveries trade at $257-258/t cfr China, while prompt deliveries sold at $220/t fob or $253/t cfr China basis.

Further demand for HBI may come from electric arc furnaces (EAFs). China is reducing its installed steel production capacity and encouraging mills to swap out blast furnaces with EAFs. If China continues to get more serious about its pollution and further limits sintering and blast furnace operations, mills will look to use more scrap and its alternatives if supplies are limited, mill buyers said.

The demand may be significant enough to lead to new investment in HBI production. A Chinese mill official told Argus that larger mills may seek partnerships or investment in HBI production because it can be used to make high-quality steel and make up for limited scrap supplies. Another Chinese mill official said they it is also exploring options for HBI supplies but will not directly invest in a facility, instead buying from a supplier potentially funded by Chinese investment.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming