Price forecast for steel industry based on marginality

Firstly, determine costs of raw steel basket. I’ll do it very simple use only iron ore and coking coal global benchmarks and usage ratio for each other.

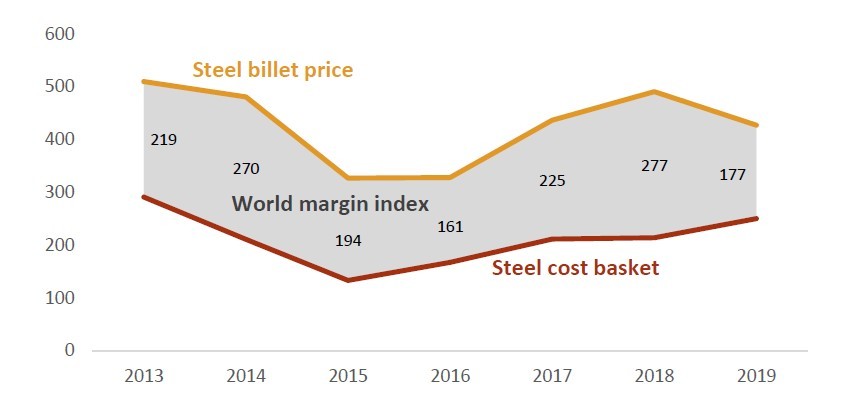

Secondly, we need to compare real price and steel cost basket to determine the spread between this two data series. In the graph we can see ups and downs of prices, but spread (world margin index) is quite logical. In 2017-2018 world margin index was too high, and reduction was predictable. The same situation was in 2016 when world margin index declined to 161, instead of 270 in 2014.

A year ago, when bubble in margin was detected, I successfully predicted a drop in profitability. Seeing that the tool is working, I decided to go further. If we dive dipper in this topic, we will find much more interesting graph.

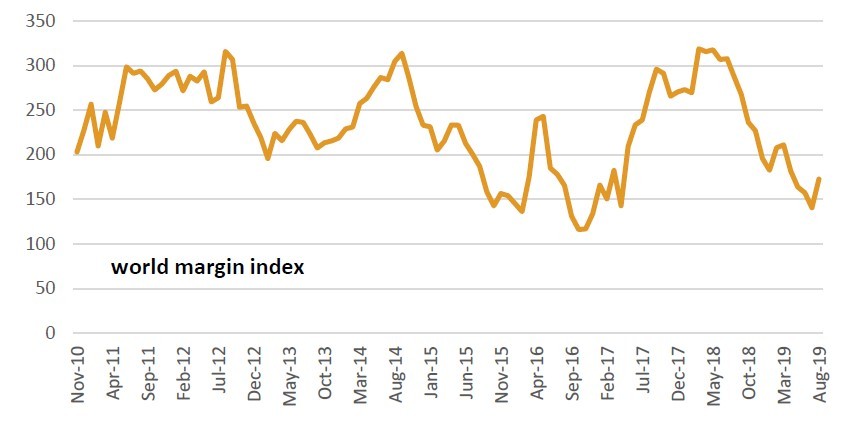

Farther world margin index graph on monthly basis.

In general nothing interesting, but pay attention to the period March 16 to March 17. It's phase between fall period and rise period. Inner in this phase we can see index fluctuation but start and finish is at the common level. The same index behavior starts in October 17.

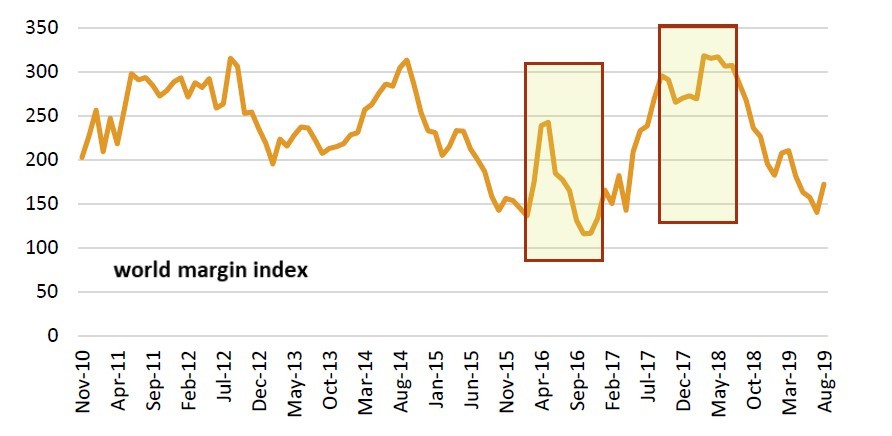

Let’s erase this two periods but we will come back to thats marked periods farther.

As a result, we get a certain cycle of 24 months: 12 months of decline, 12 months of growth.

FORECAST

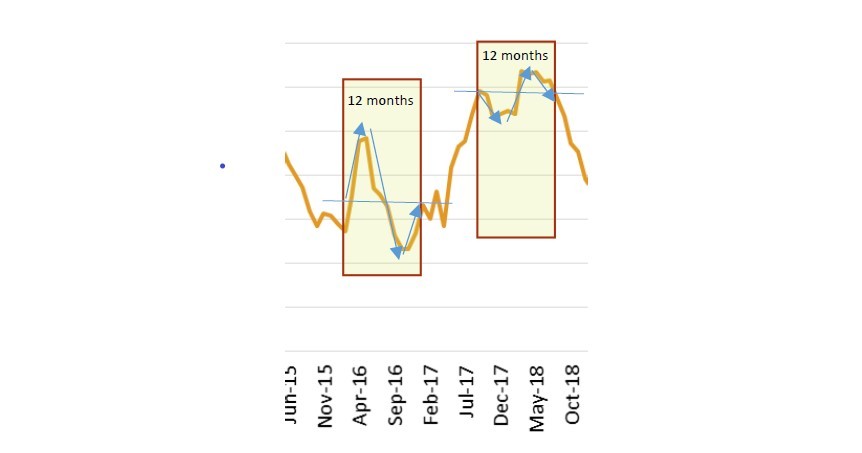

In accordance with the fact that the last two bifurcation points we saw the marked earlier periods. It can be assumed that in the nearest future we will also enter to that phase. It is characterized by a sharp trend change for several months, followed by 2 times reversal, followed normalizing correction.

Farther we will see 12 months of growth wave of circle.

… due to current market conditions …

Iron ore downstream to October 2019;

Iron ore prices upward correction; Coking coal price rising; Cheap finished steel products to April 2020;

Finished steel products price upward correction to Jul 2020;

Steady increase of steel prices; Cheap raw materials to August 2021.

Positive scenario

Market could missed fluctuation phase and tern to 12 months of growth period, like it was in 2012-2015.

For the forecast calculation in real price any raw materials forecast will be acceptable for steel cost basket estimations. Add the world margin index and you will get the benchmark price for your sales material.

You can't find truthful price forecast for raw materials and your sales goods, but in that methodology financial result for your company will be cloth to the truth.

Artem Segen

Chief Marketing and Analytics Specialist

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming