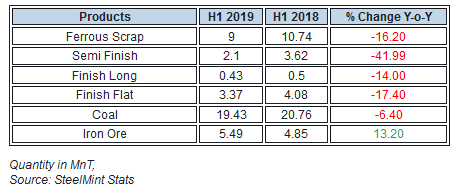

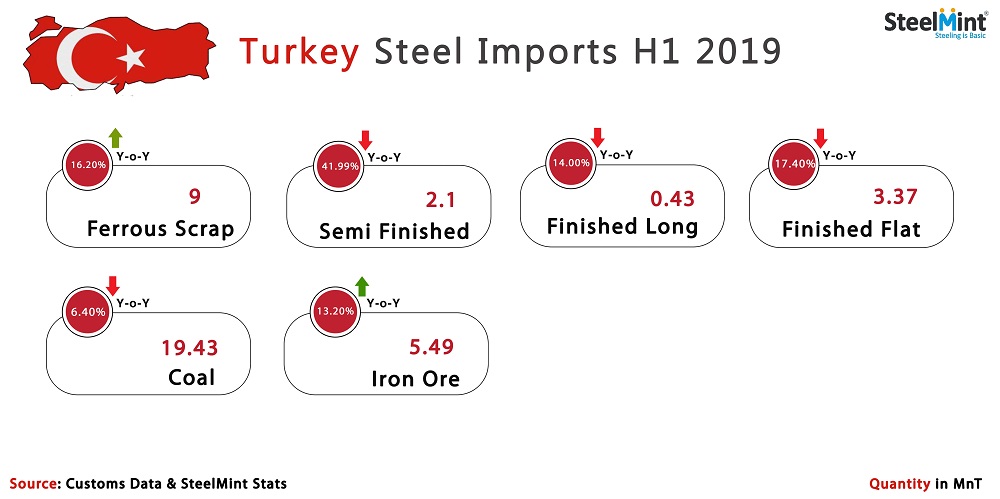

Turkey: Steel Import Statistics H1 2019

Ferrous scrap: The country imported 5.11 MnT ferrous scrap in Q2’19 which is increased by 31% as compared to 3.89 MnT in Q1’19. On yearly premises, the imported volume has slightly decreased by 5% as against 5.38 MnT during the Q2’18.

Country-wise: United States remained the largest supplier of ferrous scrap to Turkey. US scrap supply to Turkey increased by 20% to 0.89 MnT in Q2’19 as compared to 0.74 MnT in Q1’19. Netherland stood at the second largest exporter position as its exports slightly increased by 5% to 0.65 MnT in Q2 as compared to 0.6 MnT in Q1’19. Followed by other prominent ferrous scrap suppliers were the United Kingdom at 0.74 MnT (+80% Q-o-Q), Russia at 0.54 MnT (+22% Q-o-Q) & Belgium at 0.34 MnT (+21% Q-o-Q) in Q2'19.

Coal: Coal imports by Turkey have fallen 6% on the year to 9.56 MnT during the second quarter of CY19 (Apr-Jun’19), as per the data provided by Turkish customs. Imports volume had also decreased 3% Q-o-Q from 9.87 MnT noted in Q1 CY19. Over the period, the country had witnessed a slack demand for coal, wherein only Anthracite coal imports had noted an appreciable growth Q-o-Q among the major coal/coke commodities during Q2 CY19.

Country-wise: Colombia remained the largest coal supplier to Turkey in Q2 CY19, with intake from the country rising 7% Q-o-Q to 4.24 MnT, but had fallen 4% on the year from 4.41 MnT in Q2 CY18 period. The imposition of tax on US coal significantly hampered Turkish coal sourcing from the country which had fallen 43% on the year to 1.11 MnT in Q2 CY19. At the same period, Australian coal supplies had doubled Y-o-Y to 0.55 MnT, as the country emerged as the preferred source for Turkish coking coal demands.

Iron ore: Turkey iron ore imports for the quarter ending June’19 witnessed marginal decline to 2.67 MnT as compared to 2.81 MnT in the quarter ending Mar’19. On a yearly basis, imports depicted 10% rise as against 2.43 MnT in Q2 CY18.

However, on monthly basis imports picked up on June’19 to 1.12 MnT as against 0.99 MnT a month ago.

Imports from Brazil fell 16% Q-o-Q: Turkey imports from Brazil fell about 16% for the quarter Q2 CY19 to 1.33 MnT, when compared to Q1 CY19 imports 1.59 MnT. Brazilian exports have picked up in the quarter amid resumption at Vale’s Brucutu mines in June’19. Also, the miner has resumed operations at Vargem Grande Complex which is expected to push up the exports further in next quarter.

Imports from Canada increased two folds to 0.34 MnT, as against 0.17 MnT in last quarter, followed by Sweden at 0.3MnT, and South Korea at 0.17 MnT.

Semi Finish: Turkey imported 1.01 MnT of semi-finish in Q2’19 as compared to 1 MnT in Q1’19. On the other hand, semi-finish imports were reported at 1.7 MnT in the preceding year during the same period.

Country-wise: Russia remained the largest exporter to Turkey as it exported 0.68 MnT semi finish in Q2’19 slightly down 18% as against 0.83 MnT export reported in Q1’19. Imports from Ukraine reported at 0.15 MnT in Q2’19 as against 0.13 MnT semi-finish imported in Q1’19. Followed by other prominent exporters were Brazil & Georgia with 0.5 MnT & 0.02 MnT semi-finish exports respectively in Q2’19.

Finish Flat: Turkey finish flat imports jumped by 28% Q-o-Q in Q2CY’19 to 1.89 MnT in comparison with 1.48 MnT in the preceding quarter. It mainly imports finish flat steel from CIS nations like Russia & Ukraine. Softening domestic demand in CIS regions resulted in increased exports and in turn led to a surge in finish flat steel import volumes in Q2.

However on the monthly premise, the same fell by 13% in Jun’19 to 0.53 MnT as compared to 0.61 MnT in May’19 owing to Ramadan festival observed from May to the first week of June.

Country-wise: Russia stood as the major finish flat exporter with 0.45 MnT in Q2CY’19, reducing by 20% over 0.56 MnT in the previous quarter. Turkey’s imports from Ukraine increased by 21% to 0.17 MnT in Q2CY’19 as compared to 0.14 MnT in Q1CY’19. Following this Turkey also imported finish flat from France at 0.17 MnT, Germany at 0.16 MnT and Romania at 0.14 MnT in Q2CY’19. Meanwhile, it also imported from Netherlands, South Korea and Italy in smaller quantities in Q2CY’19.

Finish Long: The country finish long imports reported at 0.23 MnT in Q2’19 as compared to 0.20 MnT in Q1’19. Turkey witnessed rise in its finish long imports by 15% in Q2’19. On a yearly basis, finish long imports marginally decreased by 8% to 0.25 MnT in Q2 in the preceding year.

Country-wise: Iran supplied the largest quantity of finish long at 0.04 MnT during the Q2’19, witnessed a decrease by 55% against 0.09 MnT exports reported in Q1’19. Followed by the other prominent suppliers like Russia & Spain at 0.05 MnT & 0.03 MnT respectively in Q2’19. However, Russia increased its exports & Spain observed stability in finish long exports as compared to Q1’19 to Turkey.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming