India: 60% Pig Iron Booked in SAIL's Auction

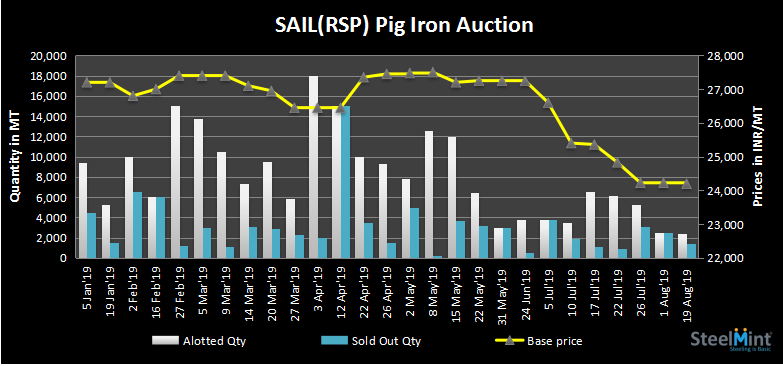

As per sources, in today's auction the company had kept base price similar to last auction at INR 24,200/MT (USD 339) ex-plant (Rourkela), out of which near to 1,400 MT pig iron has been booked by participants while remaining about 1,000 MT(40%) remained unsold which was under PCM - I grade.

Participants believed that, due to competitive offers the response was as per expectations. The landed cost of pig iron from neighboring private producers was heard at near to INR 24,200-24,400/MT which is more or less same compared with RSP's auction prices.

The current prices of steel grade pig iron through the private producers assessed at INR 24,100-24,500/MT ex-Durgapur, INR 23,600-23,800/MT ex-Bokaro (Jharkhand), INR 23,300-23,700/MT ex-Jajpur (Odisha), INR 24,000-24,100/MT FoR Raipur/Raigarh & INR 26,600-27,000/MT FoR Ludhiana, excluding 18% GST.

SAIL Eyes NINL Acquisition to Boost Steel Expansion

In line with SAIL’s massive expansion plan and roadmap to enhance its present capacity from 21.42 MnT to 50 MnT by 2031 in two phases, company has recently planned to set up a second steel plant of 3 MnT capacity in the state of Odisha, SteelMint learned from sources.

In this context, SAIL plans on acquisition of existing running PSU steel plant in Odisha i.e. NINL will give a big boost to its expansion effort.

Neelachal Ispat Nigam Limited (NINL), Odisha, is a joint venture company of MMTC ltd. and Government of Odisha through IPICOL and OMC Ltd. This is a 1.1 MnT integrated Steel Plant. In the past, SAIL had tried to take over NINL several times in 2007, 2010 and 2014; but for various reason it could not materialize. In May 2007 with approval of committee of secretaries, SAIL wanted to take back NINL (which was originally founded by SAIL in 1982) by paying around 1000 crores to promoters. Now that MMTC Ltd, main promoter decided to quit NINL, it will be prudent to revive the earlier proposal, to merge NINL with steel behemoth SAIL.

NINL has a 1.1 MnT operating plant with all auxiliary units, with undisputed land of more than 2500 acres, which is sufficient for expansion upto 5 MnT PA. Also it has a state of art Coke oven battery with dry quenching facility and an already commissioned Steel Melting Shop (SMS) with 110 ton converter, 6 strand billet caster, Argon Rinsing Station and with all other allied units. The biggest strength of NINL is its captive mine of 874.29 hectares, 110 MnT of estimated reserve, having an average iron content of 65%.

Last week SteelMint reported that NINL has gone for a shutdown of its blast furnace at its Duburi plant in Odisha’s Kalinganagar industrial complex. Besides MMTC, the other key promoters- OMC and Ipicol have also withdrawn financial support.

In the recent update received on it, acquiring NINL by SAIL will be a ‘win win’ deal, both for SAIL and NINL. In a request made by Steel Executives Federation of India (SEFI), the transfer of shares by MMTC and other PSUs to SAIL, will just be a transfer from one government to another government entity only. In view of the above, SEFI has earnestly suggested Honorable Prime Minister of India may give direction to concerned official to complete the SAIL and NINL merger at the earliest.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming