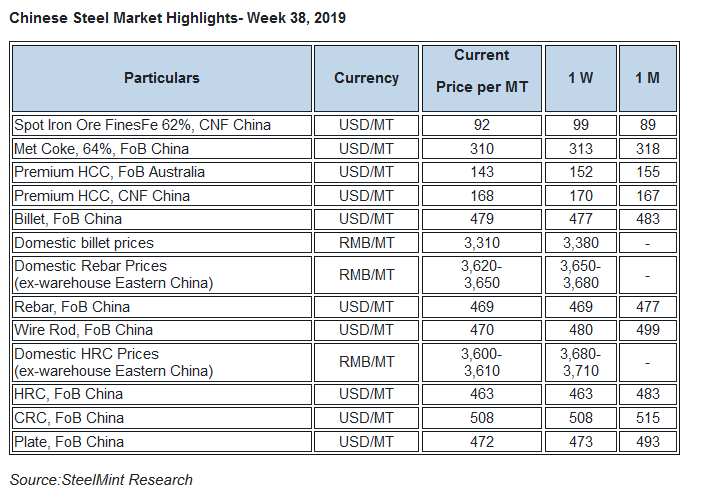

Chinese Steel Market Highlights- Week 38, 2019

China’s HRC and Rebar export offers remained largely supported ahead of Golden week holidays scheduled from 1st Oct ‘19. Iron ore prices declined towards the weekend. Coking coal offers witness further decline over limited buying from China and India. However billet export offers remain supported despite falling prices in domestic market.

Eastern China’s largest private ferrous scrap consumer and EAF steelmaker - Shagang Jiangsu Steel group has slashed its domestic steel scrap prices by USD 6/MT effective from 20th September’19.

Meanwhile National Bureau of Statistics (NBS) also released its data for Chinese crude steel output which has inched up by 2% in Aug’19 at 87.25 MnT which was 85.22 MnT in Jul’19.

Also, China monthly crude iron ore production rose marginally to 74.30 MnT in Aug'19, as against 74 MnT in July'19 amid mills preferring domestic iron ore concentrate and pellet due to high global prices and falling steel margins.

Chinese spot iron ore decline on a weekly basis- Chinese spot iron ore prices opened up this week at USD 97.75/MT CFR China and dropped to USD 91.6/MT CFR China towards the weekend. Prices have dropped down amid sluggish demand.

As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports decreased to 124.1 MnT as compared to 124.9 MnT a week ago.

Spot pellet premium down sharply W-o-W- Spot pellet premium for Fe 65% grade pellets assessed at USD 12.15/MT as against USD 15.50/MT CFR China a week before amid low buying.

Spot lump premium remains firm on a weekly basis- Spot lump premium stood stable on weekly basis at USD 0.1260/MT. However, Chinese mills have depicted recovery in lump demand.

Coking coal offers slide further on weekly basis- Seaborne hard coking coal prices have tumbled further over limited trades. Also buyers are mainly concerned about the governmental import restrictions.

The demand in Indian steel market continues to remain sluggish due continual fall in domestic steel prices amid mute demand.

Latest offers for the Premium HCC grade are assessed at around USD 143.75/MT FoB fell by USD 8/MT W-o-W basis which was USD 152/MT FoB basis in previous week.

Chinese domestic billet prices slide further- This week Chinese domestic billet prices in Tangshan settled at RMB 3,310/MT plunged by RMB 70/MT against RMB 3,380/MT in previous week. This week, billet trade sentiments in China remained bearish over falling prices in the domestic market.

Chinese HRC export offers remain supported ahead of National Day holidays- This week Chinese mills have kept HRC export offers stable with restocking activities ahead of the National day holidays scheduled from 1st Oct’19.

However low priced imports from India and Russia to Vietnam continue to weigh on Chinese origin HRC offers.

Currently, the nation’s HRC export offers are hovering at USD 460-465/MT unchanged over previous week .

However, on a weekly basis domestic HRC prices were slashed by RMB 80-100/MT amid higher inventories and expectations of increased production by major steel makers. Thus, domestic HRC prices stood at RMB 3,600-3,610/MT in Eastern China (Shanghai) which was 3,680-3,710/MT in the previous week.

Chinese Rebar export offers unchanged on weekly basis- This week Chinese mill kept their Rebar export offers steady.

Currently, the nation’s rebar export offers stood at USD 464-474/MT FoB China unchanged over previous week.

Meanwhile, domestic rebar prices witnessed decline over volatile futures market and weakened trades towards the end of the week. Thus, domestic rebar prices stood at RMB 3,620-3,650/MT (Eastern China) down by RMB 30/MT against RMB 3,650-3,680/MT (Eastern China) a week ago.

Market participants expect construction activities to fall further which may result to further decline in nation’s rebar prices.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming