Indian Steel Market Weekly Snapshot

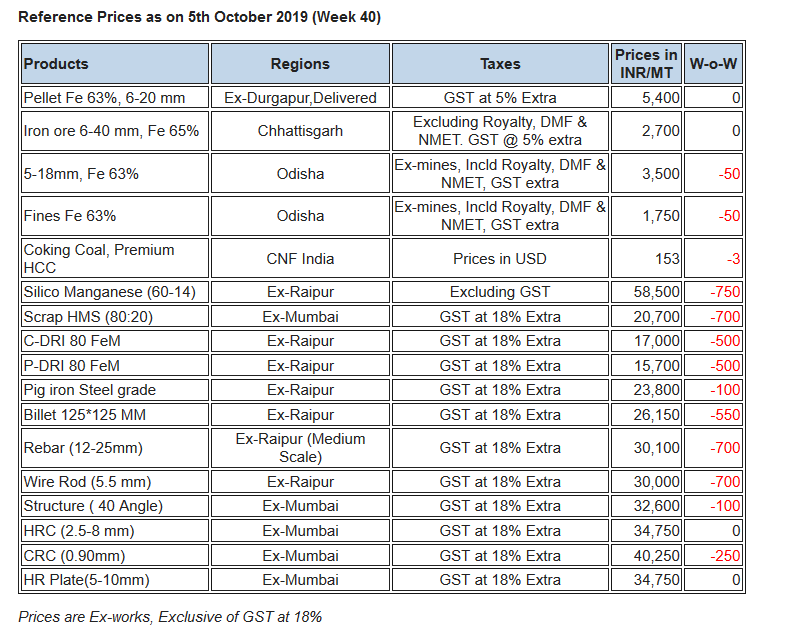

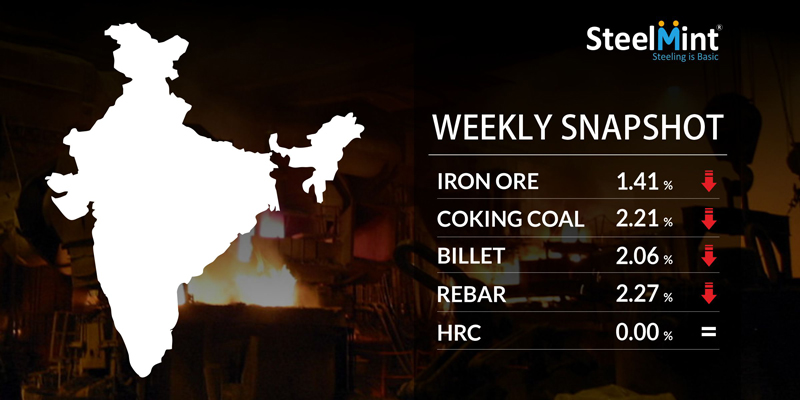

During this week, the prices of semi finished & finished long products in secondary market fell in the range of INR 100-700/MT (USD 1-10) in across major Indian markets.

IRON ORE and PELLETS

Govt. of Odisha on 04th Oct’19 invited bids for grant ten iron ore and manganese mines lease (7 blocks of iron ore and 3 blocks of iron ore and manganese) auction. OMC had received dull responses for iron ore lump e-auction scheduled on 30th Sep’19. Out of the total quantity nearly 23% (183,000 MT) of material fetched bids. Odisha based major merchant iron ore miners are heard to have decreased further offers on bulk quantity purchase of fines against the last offer.

-- PELLEX Stable at INR 5,950/wmt (DAP Raipur) amid weak market sentiments. Raipur based pellet makers have kept pellet offers stable at INR 6,000/MT ex-plant. In Durgapur SteelMint’s reference for pellet price was stable at INR 5,300-5,500/MT ex-Durgapur, GST extra, in with the last week's offer. Southern India (Bellary) based pellet makers to INR 6,400/MT.

-- One pellet export tender of KIOCL concluded yesterday on 4th Oct’19 for Fe 64% grade and, 2% Al at around USD 100/MT, FoB India though the Chinese steel market seems to remain silent over ongoing National holidays. Export Indication at USD 93-94/MT FoB India for regular grade pellet Fe 63% (3% Al).

COAL

Australian coking coal prices were largely unmoved this week, as the Chinese market has been muted for the ongoing Golden Week celebrations; while other major Asia-Pacific markets outside China continued exhibiting subdued demand. Nevertheless, Chinese-delivered seaborne coking coal prices were pushed up at the start of the week, amid substantial buying activity ahead of the country’s week-long National Day holidays.

Indian end-users are gradually resuming procurement activities of seaborne materials, following the delayed retreat of the seasonal monsoon rains in most parts of the country.

Latest offers for the Premium HCC grade are assessed at around USD 137.00/MT FOB Australia and USD 152.50/MT CNF India.

FERROUS SCRAP

Imported scrap trades to India remained active this week, with steel-mills looking to actively restock while the global market is down. Offers remained mostly stable this week, following the successive downtrend in prices for several weeks, while buying activity likely to rise further in coming days.

SteelMint’s assessment for containerized Shredded from the UK, Europe and USA to India stands at USD 250-255/MT, CFR Nhava Sheva, down USD 3-4/MT against last week. Amid active trades, around 5,000 MT of Shredded scrap was sold at around USD 254-255/MT CFR by one major UK supplier alone, while few other European suppliers offered at USD 3-4/MT lower.

HMS scrap offers marginally inched down, as HMS 1 offers from Dubai were reported at around USD 250-253/MT, CFR while HMS 1&2 (80:20) offers from European & Australian origin were reported in the range of 237-240/MT CFR. South African HMS 1 remained at around USD 260/MT CFR, while few bookings for West African origin HMS were heard to Goa, at USD 240/MT CFR Goa, i.e USD 230-235/MT CFR Nhava Sheva.

FERRO ALLOYS

-- Silico Manganese prices are falling fast in the domestic market. Prices could go further down in line with tepid demand. MOIL reduced the Manganese ore prices by 5% for the Oct-Dec'19.

-- Prices of Ferro Manganese are low in line with tepid demand. In line with dull demand, the market is very competitive and the producers are offering at much lower rates.

-- Indian Ferro Chrome prices have skyrocketed post OMC chrome Ore auctions, as the Ore prices increased owing to the unavailability of ores with the manufacturers. Supply situation is tight for both ores and Ferro Chrome, which might raise the prices further.

-- Ferro Silicon Prices have been stable and producers are now getting inquiries. It is expected that the prices may increase after the mid of the month.

SEMI FINISHED

Indian billet trades slow-down this week as prices slump by INR 100-700/MT amid poor off take of finished goods. In these period major fall of INR 500-700/MT in billet seen in central & eastern India.

Similarly, Sponge iron offers dropped by INR 200-500/MT W-o-W following significant fall in Billet prices & strong supply.

-- Indian Sponge iron export offers to Bangladesh drop to over 2 year low and latest assessment stood at USD 260-265/MT CPT Benapole, equivalent to USD 275-280/MT CFR Chittagong, Bangladesh.

-- Indian mid sized mills export offers to Nepal is hovering at USD 360/MT for Billet & USD 410/MT for Wire rod, ex-mill at Durgapur, Eastern India.

-- As per conversation with sources, the steel mills in Mandi Gobindgarh, Punjab - northern India will get rebate of around INR 1.30/unit on power consumption from 10:00 PM to 6:00 AM, which is applicable from 1st Oct'19.

-- India's largest private steel producer has reduced its gas based DRI (sponge iron) offers by around INR 750/MT (USD 11) for Oct'19 deliveries, the fresh offers for Oct'19 is about INR 17,500/MT (USD 246), ex-works, Dolvi, Maharashtra based plant for FeM 80-82%.

-- RINL has invited a tender for export of 8,127 MT Billets, 5,418 MT Bloom and 8,127 MT Wire Rod to Nepal, with bid due date is 09 Oct’19.

FINISH LONG

Indian finish long steel market remained depressed amid limited trade volume and rebar prices fell by around INR 200-600/MT in overall regions. Trade participants are expecting that in near term price range could be range bound with little chances of increase.

-- Current trade reference rebar prices (12-25mm) through mid sized mills assessed at INR 30,000-30,200/MT Ex Raipur (central region) & INR 30,900-31,100/MT Ex-Jalna (western region).

-- Central region, Raipur based structure manufacturers reduced prices by INR 600-800/MT in light and heavy sizes and maintaining the trade discount on heavy structure at INR 400-700/MT. Current trade reference prices at INR 33,700-34,000/MT (200 Angle) ex-work.

-- Trade discounts in Raipur wire rod slightly stretched to INR 900-1,300/MT and trade reference prices stood at INR 29,600-30,000/MT ex-Raipur, size 5.5mm.

FINISH FLAT

Major Indian steel manufacturers have kept HRC, CRC prices unchanged for the month of Oct’19 amid slow off take in domestic steel market. Also with the upcoming festive holidays this month domestic HRC prices will continue to remain under pressure in Oct’19.

Prices of major manufacturer’s are hovering at around INR 35,000/MT ex-Mumbai for HRC (2.5-8 mm, IS2062) and CRC prices (0.9 IS513 Gr O) is around INR 40,000/MT ex-Mumbai. Price mentioned above is basic and extra GST @18% is applicable.

It is to be noted that mills had announced a roll over in prices in Sept but owing dull demand they offered discounts of INR 1000-1500/MT.

However on the other hand current trade reference prices in traders segment for HRC (IS2062,2.5-8 mm) is at INR 34,500-35,000/MT ex-Mumbai), INR 34,500-35,000/MT ex-Delhi and INR 35,500-36,500/MT ex-Chennai. The CRC (0.9 mm, IS 513) trade reference prices on weekly basis are hovering around INR 40,000-40,500/MT ex-Mumbai, INR 38,800-40,000/MT ex-Delhi and INR 40,500- 41,500/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Thus factors like cash crunch, monsoon season and reduction in credit facilities restrict buying activities in domestic market. Also slump in auto and construction sector affected nation’s demand to great extent.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming