Indian Steel Market Weekly Snapshot

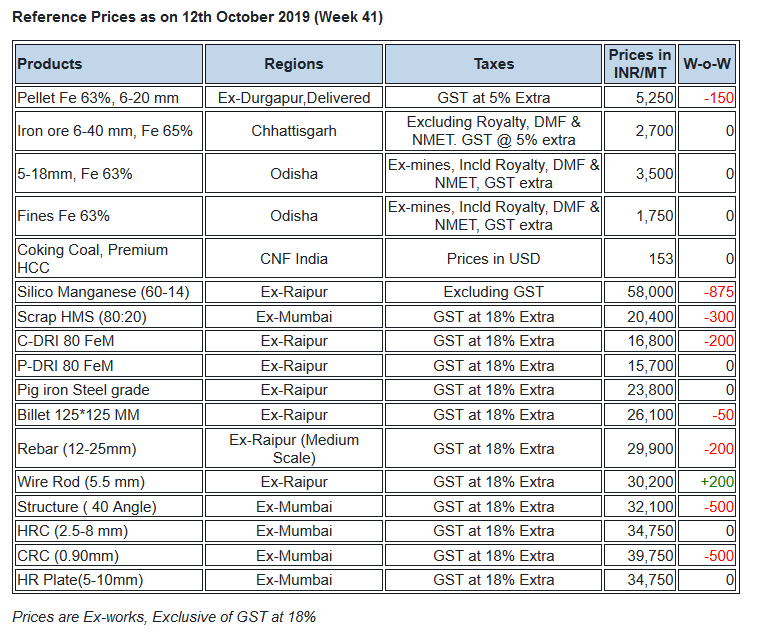

As per assessment made by SteelMint, this week prices of Semis & Finished long steel products have fluctuated by INR 100-400/MT (USD 1-6). Meanwhile the Flat steel prices more or less firm over fewer inquiries from the domestic buyers.

IRON ORE and PELLETS

Odisha Govt permits storage of IRON ORE for 2 yrs to merchant mining leases expiring on 31 Mar'2020. Odisha merchant prices were remain unchanged this week.

PELLEX down by INR 100/MT to INR 5,850/wmt (DAP, Raipur) amid fallen pellet offers. Raipur (central India) based pellet manufacturers have decreased their offers by INR 200/MT for Fe 63% grade stands at INR 5,800/MT (ex-Raipur, GST extra). In Durgapur SteelMint’s reference, pellet price decreased by INR 100/MT to INR 5,200-5,300/MT (ex-Durgapur, GST extra).

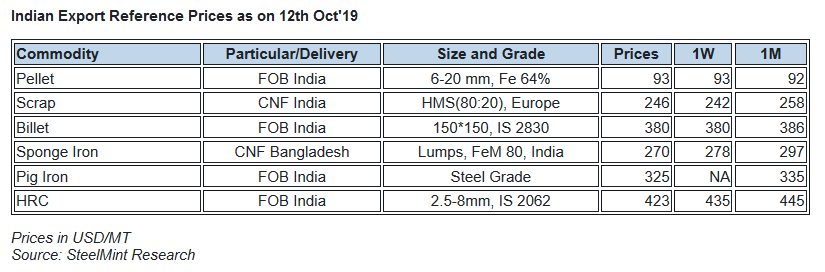

SteelMint’s pellet export assessment stable on weekly basis at USD 105-106/MT, CFR China. As per sources three pellet export deals were reported this week from India at around USD 105-106/MT CFR China for standard grade pellets.

COAL

Australian premium low-volatile hard coking coal prices have jumped over 8 percent from last week, with the return of Chinese buyers following their week-long National Day holidays.

However, spot trading in the Chinese market was thin without any fresh deals observed, while steel mills withheld bids in anticipation of a lower price level. China-based end-users are expected to play an active role for the near-term price outlook at this juncture.

Meanwhile, Indian steel demand has contracted amid the ongoing slowdown in the economy. Latest offers for the Premium HCC grade are assessed at around USD 148.75/MT FOB Australia and USD 164.55/MT CNF India.

FERROUS SCRAP

Imported scrap offers to India rose significantly this week on the global rebound in prices reflecting in the South Asian markets earlier this week, as well as tight supply from the sellers end.

SteelMint’s assessment for containerized Shredded from the UK, Europe and USA to India stands at USD 260-265/MT, CFR Nhava Sheva, increasing by USD 3-4/MT against last week's report.

-- HMS scrap prices too climbed up in the last few days, with HMS 1 from Dubai is now being offered at around USD 260/MT CFR. West African HMS witnessed fresh trades at USD 250/MT CFR Goa, which translates to USD 240-245/MT CFR Nhava Sheva. European origin HMS 1&2 (80:20)offers has now increased to USD 245/MT CFR Nhava Sheva amid limited trades

FERRO ALLOYS

-- Silico Manganese prices are close to the bottom and producers are firm on their prices and only a marginal decrease can be seen in the price trend.

-- Prices of Ferro Manganese are low in line with tepid demand, and the producers are offering at much lower rates in a competitive market.

-- Indian Ferro Chrome prices have increased since last week. Such increases in prices are due to the increased Chrome ore prices and limited inventory with the producers.

-- Ferro Silicon prices have been stable and producers are now getting inquiries. It is expected that the prices may increase after the mid of the month.

SEMI FINISHED

Indian Billet market observed volatility in prices by INR 100-400/MT on fluctuating demand & adjusted production.

Further, as per producers in eastern region, demand was on average mode from the domestic market. However export inquiries were limited for both Sponge iron & Billet. Similarly subdued demand being observed in rest of the major markets in India. Inline sponge offers fell by INR 100-400/MT, W-o-W.

-- Steel Authority of India Ltd (SAIL) has received overwhelming response for its 20,000 MT steel grade pig iron & managed to sell entire quantity in the range of INR 23,300-23,500/MT (USD 327-330) on Ex-Bhilai, Chhattisgarh basis.

-- Indian large scale mills export tender to Nepal received weak response & highest bid for Billet assessed at USD 350-352/MT (ex-mill), eqivalent to USD 490-492/MT CPT Raxaul border, Nepal.

-- Indian mid sized mills export offers to Nepal reported at USD 355-360/MT for Billet & USD 405-410/MT for Wire rod, ex-mill at Durgapur, eastern India.

-- Jindal Steel is offering granulated pig iron (panther shots) at INR 22,000-22,500/MT ex-plant, Odisha & sponge p-dri at INR 15,400/MT ex-Raigarh.

-- Bangladesh has marked no major fresh bookings for Indian sponge iron (DRI) due to fall in local steel prices & lowered production as well. Latest assessment stood at USD 255/MT CPT Benapole, equivalent to USD 270/MT CFR Chittagong, Bangladesh.

FINISH LONG

Indian Finish Long Steel market observed measured trade volume and price range marked fluctuation of around INR 100-400/MT in overall regions, as per weekly comparison.

However slight improvement has seen from last couple of days and future bookings noted for next few days.

-- Current trade reference rebar prices (12-25 mm) through mid sized mills assessed at INR 29,800-30,000/MT Ex-Raipur (central region) & INR 30,700-30,900/MT Ex-Jalna (western region).

-- In line Large scale rebar prices remain unchanged as per weekly assessment and current rebar trade reference price registered at INR 33,700-34,200/MT Ex-Mumbai (Ex-Stock yard & size 12 mm).

-- Central region, Raipur based heavy structure manufacturers have slightly raised their trade discounts by around INR 100-300/MT and currently exist around INR 600-900/MT against last week. The current trade reference prices at INR 33,800-34,100/MT (200 Angle) ex-work.

-- Trade discounts in Raipur wire rod drop by INR 100-300/MT this week and assessed at INR 800-1,000/MT and trade reference prices stood at INR 30,000-30,200/MT ex-Raipur. Meanwhile trade prices in Durgapur stood at INR 29,500-30,300/MT ex-Durgapur, size 5.5 mm.

FINISH FLAT

This week domestic HRC prices continue to remain stable in major markets like Delhi and Mumbai regions, although prices witnessed decline by upto INR 500/MT in other regions owing to tepid demand and thin trades post Dussehra holidays. Consumers have put their purchase activities on hold as they are reluctant to book any high volumes transactions in anticipation of further downside in prices.

As per SteelMint price assessment current trade reference prices in traders segment for HRC (IS2062, 2.5-8 mm) is at INR 34,500-35,000/MT ex-Mumbai, INR 34,500-35,000/MT ex-Delhi and INR 35,500-36,000/MT ex-Chennai. The CRC (0.9 mm, IS 513) trade reference prices on weekly basis are hovering at around INR 39,500-40,000/MT ex-Mumbai, INR 38,800-40,000/MT ex-Delhi and INR 39,000-41,000/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Market sources are expecting domestic HRC prices to remain stable at these levels owing to Diwali holidays scheduled by the end of this month.

Also in the beginning of this month Indian steel mills announced roll over in domestic HRC, CRC prices for Oct'19. However mills are trying to provide price support to escalate sales in domestic market.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming