Indian Steel Market Weekly Snapshot

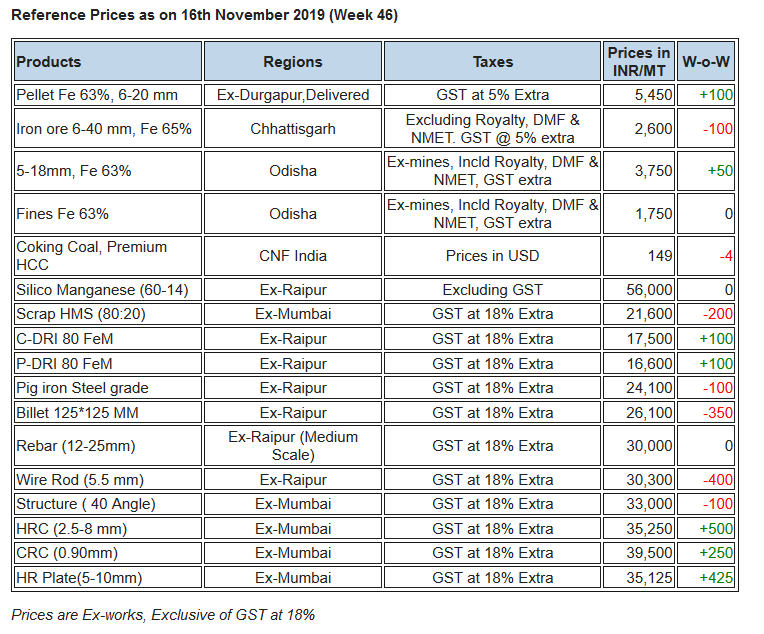

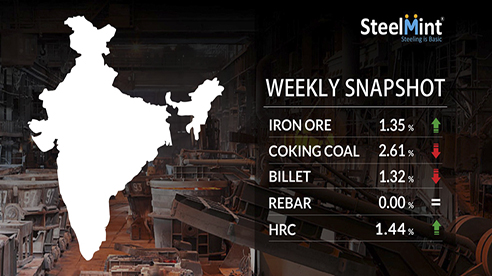

As per assessment, during the week prices of Semis & Finished steel products through the mid sized mills fell near to INR 100-400/MT (upto USD 6) in across major Indian markets.

However the Flat steel prices surged by INR 500-750/MT on account of active demand from Indian domestic & global buyers, following hike in global prices.

IRON ORE and PELLETS

Serajuddin - Odisha's major merchant iron ore miner had increased iron ore lump offers for 5-18 mm (Fe 63%) by INR 300/MT to INR 3,700/MT (ex-mines, including Royalty, DMF, & NMET). Another miner RP Sao also increased offers for 5-18mm at INR 3,900/MT MT (ex-mines, including Royalty, DMF, & NMET) this week.

NMDC Ltd - India's biggest iron ore producer decreased iron ore fines and lumps price by INR 100/MT and in DR-CLO price cut is about INR 120/MT and ROM by INR 90/MT. National Mineral Development Corporation (NMDC) based in Dantewada district recently got mining lease extension.

PELLEX (DAP Raipur), 63.5% Fe this week increased by INR 200/MT to INR 6,100/wmt in recent deals. Raipur based pellet makers raised offers by INR 300/MT to INR 6,100/MT Ex-plant. Durgapur based pellet maker reported 3,000 MT pellet deal at INR 5,500/MT Ex-plant and the offers hike by around INR 100-200/MT to INR 5,500/MT from INR 5,300-5,400/MT. Bellary based pellet makers also hike offers by INR 200/MT to INR 6,300-6,400/MT this week.

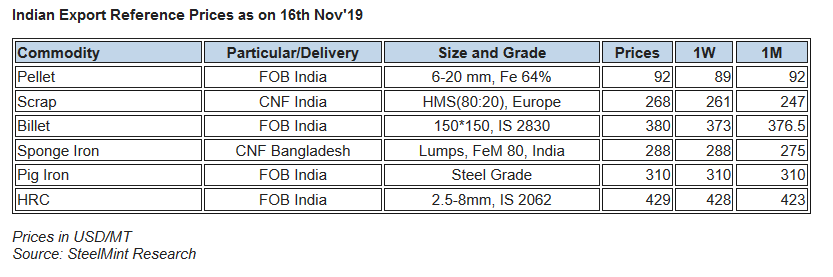

-- An Odisha based pellet maker reported an export deal for Fe 64% grade pellets and, 3% Al to China at USD 103/MT, CFR China this week.

-- SteelMint assessment for pellet export offers for Fe 64% grade and, 3% Al at around USD 92-93/MT, FoB India equivalent to USD 103-106/MT CFR China.

COAL

Australian coking coal prices have increased slightly this week, with new trades concluded at higher levels in the spot market.

However, the Chinese market was mostly quiet amid concerns over stringent import restrictions imposed at several major ports across China. Trading activities remained subdued in markets outside China as well. Sources reported that there were December-laycan cargoes remaining available with producers, but no fresh offers were indicated this week.

Buyers suggested that the producers are waiting for a possible improvement in prices before they start to sell their late-December cargoes.

-- Latest offers for the Premium HCC grade are assessed at around USD 136.00/MT FOB Australia and USD 149.00/MT CNF India.

FERROUS SCRAP

Imported scrap trades to India remained slow this week on high offers from global suppliers. No significant booking for Shredded scrap was concluded, while HMS scrap from different origins were sold at further increased prices.

SteelMint’s offers for containerized Shredded from the UK, Europe and the USA to India have inched up to USD 290/MT, CFR Nhava Sheva. However, most bids remained at or below USD 275-280/MT levels, thus no major trades for shredded have concluded in a recent couple of weeks.

On the other hand, average trades for imported HMS scrap were observed, with few bookings for South African origin HMS 1 being concluded at USD 275/MT CFR, while HMS 1 from Australian origin was sold at USD 270/MT CFR.

Trades for HMS 1 (no ci gi) from Dubai were also concluded earlier in the week at around USD 275/MT, while the offers for the same have now inched up further to USD 280/MT CFR. West African Origin HMS (1&2) was also sold in significant quantity at USD 264-265/MT CFR Goa, later in the week.

SEMI FINISHED

On weekly comparison, billet offers drop slightly by INR 100-400/MT, however Sponge iron prices uptick by INR 100-200/MT.

As per market participants, billet supply has improved in merchant market due to weak demand in finished steel. Hence the prices of billet were under pressure this week.

However as the raw materials are high cost, the sponge iron producers have kept their offers strong amid average trade inquiries.

-- TATA Steel's pig iron auction of 1,200 MT from its Bhushan Steel Plant conducted on 15th Nov'19, had received no participation due to higher base price at INR 23,500/MT ex-plant.

-- Vizag Steel (RINL) concludes 20,000 MT Pig iron export tender at around USD 310/MT, FoB India - Sources.

-- Vizag Steel invites Ocean export tender for bloom, 30,000 MT(150*150mm) & 20,000 MT (200*200mm). The bid due date is 21st Nov'19, which will remain valid until 28 Nov’19.

-- TATA Metaliks has raised Low Silicon (1-1.5%) pig iron price by INR 500/MT to INR 25,200/MT (USD 351), the prices are ex-plant, Kharagpur, eastern India.

-- SAIL has kept pig iron (steel grade) offers unchanged at INR 24,000/MT ex-works, Bhilai Steel Plant (BSP), Central India.

-- SAIL has schedule an auction to sale of about 6,100 MT basic grade Pig iron on 18th Nov'19 from its Rourkela Steel Plant (RSP).

-- Indian large mills export offers to Nepal is hovering at USD 405/MT for Billet & USD 450/MT for wire rod, CPT Raxaul/Jogbani border, Nepal.

-- In the beginning of week, Indian exporters concluded sponge iron (80 FeM, 100% lumps) export deals to Bangladesh for 5,000 MT at near to USD 275/MT CPT Benapole, equivalent to USD 288-290/MT CFR Chittagong.

-- Indian sponge iron export offers to Nepal remained firm at around USD 240/MT loaded to rake in eastern region. Freight cost to Nepal is about USD 25/MT, CPT Raxaul border, Nepal.

-- Mid sized mills export offers to Nepal slightly drop on declined domestic prices & currently reported at USD 390-395/MT for Billet & USD 445-450/MT for Wire rod, CPT Raxaul border.

FINISH LONG

Indian Finish Long steel market observed measured trade volume in most of the regions, hence price range contracted by INR 100-400/MT, W-o-W. However, southern India observed increase in price range due to surge raw material (melting scrap) prices but trade remains limited, as stated by participants.

Finished steel inventories has been slightly increased in most of the regions, which could the factor for elongating trade discounts in coming days. Further trade participants anticipating that, rebar price range might come down up to specified range in few locations.

-- Current trade reference rebar prices (12-25mm) through secondary mills assessed at INR 29,900-30,100/MT Ex-Raipur & INR 31,300-31,700/MT Ex-Jalna.

-- Central region, Raipur based heavy structure manufacturers have maintained trade discount by INR 900-1,300/MT and Current trade reference prices at INR 33,400-33,700/MT (200 Angle) ex-work.

-- Trade discounts in Raipur wire rod is currently at INR 1,000-1,500/MT and trade reference prices stood at INR 29,800-30,300/MT ex-Raipur and INR 30,500-30,700/MT ex-Durgapur, size 5.5mm.

FINISH FLAT

This week Indian HRC prices witnessed further uptrend in traders segment by INR 500-750/MT as market sentiments remained positive amid improved demand along with increase in trade activities in the domestic market. Prices in major markets have witnessed increase of around INR 500/MT W-o-W.

-- As per SteelMint's price assessment current trade reference prices in traders segment for HRC (IS2062,2.5-8mm) is at INR 35,000-35,500/MT Ex-Mumbai, INR 34,500-35,00/MT Ex-Delhi. Meanwhile, domestic CRC (0.9mm, IS 513) trade reference prices on a weekly basis are hovering around INR 39,000-40,000/MT Ex-Mumbai, INR 38,500- 39,000/MT Ex-Delhi. The prices mentioned above are basic and GST@ 18% will be applicable.

Demand is fairly good as buyers have resumed restocking activities. Meanwhile positive market sentiment coupled with active buying may result to further uptrend in domestic HRC prices in the near term.

However few of them still remain pessimistic about recovery in payment cycles as liquidity issue is another major factor which affect trades in the domestic market.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming