India’s coal sector reform faces delays

The country's coal ministry is now targeting to launch the auction document in the next two months compared with earlier plans to start the tender process by the end of December. This means that it is going to be increasingly difficult to stage the actual auction of mines in the 2019-20 fiscal year that ends on 31 March, government officials said.

The delays are mainly linked to the proposed national coal price index, which has been recommended by an official committee but has yet to get a final seal of approval from the government.

The proposed index has been created to help determine the government's share of revenue from coal blocks. Companies that bid to give the highest share of revenue to the government for a block stand a better chance of winning blocks, according to the planned revenue-sharing model.

The index comprises three main components, the notified price of coal produced by state-controlled Coal India (CIL), the value of coal sold via electronic auction and the landed cost of imported coal compiled by the Directorate General of Commercial Intelligence and Statistics, an Indian government body that gathers trade statistics.

Some coal ministry officials said that the pre-dominance of domestic prices might weigh on revenue generation possibilities, while the complex import component of the proposed index may hurt investor sentiment.

Getting international investors in the Indian mining sector to help the country raise output and cut imports is a key aim of the government. But a pricing index that is not market linked may not encourage big mining firms to enter the fray.

Domestic coal-consumer industries such as power, cement and steel groups regret the lack of clarity over government plans, given that they were part of only one round of discussions that happened in August. But there is a possibility that a second round of discussions will take place.

The coal ministry is expected to soon start seeking stakeholder comments on the draft plan before giving it a final shape, an official said. Plans for domestic and international roadshows to lure investors are also still possible.

The coal ministry may only make bigger coal blocks available for the first round to lure prominent companies, potentially reducing the list of around 15 blocks it initially identified for the auction. The coal ministry expects a large share of imports to be replaced by domestic coal as production rises over the next four to five years, the official said, underscoring a key aim of the overall reform.

The government is already working on separate plans to fast-track approvals and clearances and cut the time taken into bringing mines into production, as delays in land acquisition and environment and forest-related regulations have for years hampered Indian coal output. It will also set up a so-called sustainable development cell to promote environmentally sustainable coal mining and address environmental concerns during the closure of mines.

The reform process comes as dominant producer CIL has faced five straight months of output contractions up to November and is likely to miss its 660mn t production target for 2019-20. This has prompted consumers, including utilities, as well as steel and cement manufacturers, to seek seaborne supplies.

The broad theme of the country's mid- to long-term energy security revolves around increasing self-reliance and reducing import dependence, with the proposed coal sector reforms the central part of the plan.

By Saurabh Chaturvedi

Gold price inches higher with spotlight on US-China trade talks

Rio Tinto faces major engineering change at Oyu Tolgoi

Ontario fast-tracks controversial mining law

Trump confirms rare earth deal with China

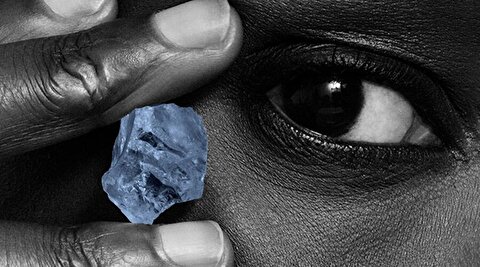

Petra Diamonds rethinks sales tactics as market slump drags on

Talon Metals plummets as it prices financing at discount to fund nickel project

US lawmakers push for comprehensive audit of Fort Knox gold

Ivanhoe slashes 2025 copper guidance by 28% following DRC mine restart

Rare earth startups eye slice of $1 billion bounty from Brazil

Condor-Teck copper project in Peru receives environmental approval

KORITE acquisition in Alberta creates world’s only mine-to-market ammolite producer

Gold price extends rally following Israeli attack on Iran

Dundee Precious Metals to buy Adriatic in $1.25B deal

Perseus forecasts 2.7 million oz. gold production over five years

China coal imports could drop by up to 100mt in 2025, industry group says

Rare earth startups eye slice of $1 billion bounty from Brazil

Gold surpasses euro as second-largest reserve asset: European Central Bank

Glencore halted some cobalt deliveries over Congo export ban

Resolution stakes claim in US critical minerals market

KORITE acquisition in Alberta creates world’s only mine-to-market ammolite producer

Gold price extends rally following Israeli attack on Iran

Perseus forecasts 2.7 million oz. gold production over five years

China coal imports could drop by up to 100mt in 2025, industry group says

Rare earth startups eye slice of $1 billion bounty from Brazil

Gold surpasses euro as second-largest reserve asset: European Central Bank

Glencore halted some cobalt deliveries over Congo export ban

Resolution stakes claim in US critical minerals market

Ivanhoe slashes 2025 copper guidance by 28% following DRC mine restart