Indian Billet Export Offers to Nepal Rally Following Domestic Price Gain

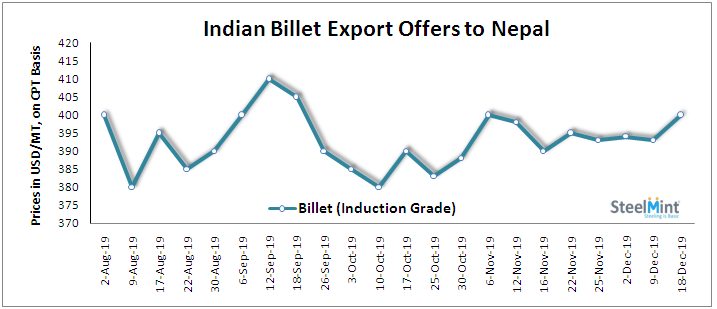

The recent trades for induction grade billet (100*100mm) learned at around USD 376-378/MT ex-mill at Durgapur, this is equivalent to USD 400/MT CPT Nepal. If sources are to be believed close to 2,000 MT deals were concluded yesterday by mid sized mills in eastern India via road route.

Coming to large scale mills, the last quotation was reported at near to USD 420/MT CPT Nepal. However no deals were heard as mills in Nepal are more inclined towards mid scale mills to reduce cost of production as domestic steel prices are maintained at firm levels in Nepal.

Inline wire rod, the mid scale mills offers reported at around USD 430/MT ex-mill at Durgapur, this landed cost to Nepal would be around USD 460/MT CPT Nepal. As per participants, demand is limited for mid scale mills wire rod due to attractive offers from large scale mills.

The offers through the large scale mills wire rod (SAE 1008, size 5.5mm) reported at near to USD 460-465/MT CPT Nepal, however the deals during last week learned at USD 455-460/MT CPT Raxul border for 3-4 rakes (around 8,000-11,000 MT).

Sources believe that, Indian billet prices to remain strong on account of less availability with large scale/primary mills due to healthy export bookings. The last deals for ocean market from India were learned at around USD 415-420/MT FoB India.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming