Vietnam: Imported HRC Offers Remain Firm; Limited Trades Reported

Vietnam trade sources shared that, "Market remain quiet today as buyers have adopted a 'wait & watch' approach before making fresh bookings."

Further, Vietnam's domestic integrated steel maker Formosa Ha Tinh announced a price hike of USD 15/MT last week, and the mill will also take up maintenance shutdown in its hot strip mill for 20 days, starting from 30th Dec'19 until 17th Jan'20. This is likely to increase the dependency on imports and in turn, increase the offers from major exporting nations in the near term.

In addition to this, sources said that Indian mills are eyeing to raise HRC export offers to Vietnam for Feb-March shipments as they are already booked for Jan deliveries.

Current HRC export offers to Vietnam- Week 51, 2019-

1. HRC (SAE 1006) 2mm, Japan- Nippon Steel offering at USD 490/MT CFR basis.

2. HRC (SAE 1006) 2mm, South Korea- Hyundai Steel’s offers stand at USD 485/MT CFR basis.

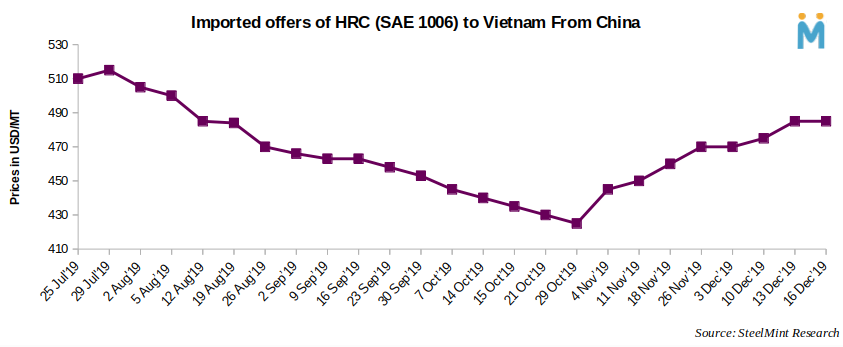

3. HRC (SAE 1006) 2mm, China- Rizhao steel mill is offering at USD 485/MT CFR basis.

4. HRC (SAE 1006) 2mm, India - Indian steel mills offering at USD 480-485/MT CFR basis.

5. Vietnam's domestic integrated steel maker Formosa Ha Tinh revised offer for HRC (SAE 1006, skin pass) assessed at USD 485/MT CIF Ho Chi Minh, which was USD 470/MT CIF basis for Jan'20 deliveries.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming