Indian Steel Mills Cheer on Active Billet Export Demand

Apart from rising export volumes, mills have been able to capitalize on rising global prices. It is to be noted that billet prices in global market have increased by USD 30-40/MT in last one month as a result of rising seaborne scrap prices.

Recent deals from a private mill have been heard at USD 415-420/MT FoB levels for Feb shipments. There are few tenders expiring next week, which will set the market direction further.

Factors driving billet demand globally:

1. Rising scrap prices globally and tight supply amid winters is lending support to billet prices and demand. Turkey imported scrap prices have surged by USD 40/MT M-o-M.

2. Active buying from China: Chinese traders have been very active buying billets in last few months as Chinese domestic prices remain relatively high against imported billets.

3. Falling billet supply from Iran is another factor which is supporting demand from other countries like India, Russia, Malaysia and Vietnam. Last week SteelMint reported that all major Iranian mills are booked for billet exports till Jan’20. Thus mills are lower allocations for billet exports this month.

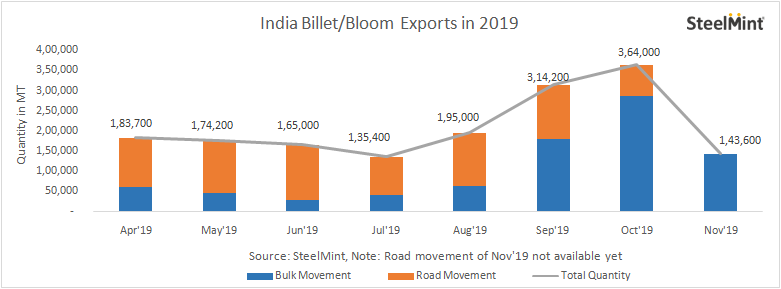

Indian billet export shipments

According to bulk movement data maintained with SteelMint, Indian bulk billet & bloom exports were recorded at 143,600 MT in Nov'19. Major exporters were JSPL, SAIL, JSW Steel and Vizag Steel.

Billet deals reported from India this week

1. SAIL had booked two parcels of 105mm and 125*125 mm each in the beginning of the week at around USD 402-403/MT and USD 409-410/MT FOB levels respectively

2. RINL's billet export tender was concluded at USD 406-408/MT FoB levels

3. JSPL alone sold over 100,000 MT in last few days for February shipment

4. A slab deal of 20,000 MT reported from India to Taiwan at USD 410/MT CFR levels for Jan shipment

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Three workers rescued after 60 hours trapped in Canada mine

Gold price could hit $4,000 by year-end, says Fidelity

Chile’s 2025 vote puts mining sector’s future on the line

US targets mine waste to boost local critical minerals supply

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Glencore workers brace for layoffs on looming Mount Isa shutdown

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming