Indian bitumen demand faces extended lockdown

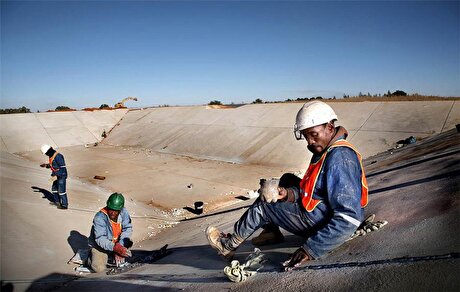

The extension comes on the back of the 21-day lockdown from 25 March. The lockdown has resulted in bitumen inventories building across ports with loading remaining negligible. State-controlled refiners are also facing difficulty in storing bitumen because of high stocks. Hindustan Petroleum has switched to high-sulphur fuel oil production as its look to get rid of the heavy bottom residue.

"This bitumen season is a complete washout," said an industry participant.

India's peak construction season for bitumen is typically January to May. Better weather and the end of the fiscal year on 31 March typically sees strong momentum for roading projects. But India's bitumen consumption for the 2019-20 fiscal year has fallen by 5pc from a year earlier to 6.3mn t. The drop in consumption is largely because the tighter availability of funds for completion of road projects and extended monsoon.

"Funds are expected to be released and pending payments will be cleared," an industry participant said.

Roading works are continuing for projects managed by the National Highway Authority of India, which are typically large-scale road projects overseen by the Road Ministry in India.

Industry participants estimate that around 150,000-180,000t of unsold inventories are at Indian ports. Vessels have been waiting to discharge cargoes as they have to complete a 14-day quarantine requirement before discharging cargoes into tanks. Bitumen vessels are also only able to discharge cargoes into ports with pipeline facilities. Ports that require bitumen to be transferred via trucks are still waiting to discharge.

Negotiations for import cargoes from the Persian Gulf are limited as importers are waiting for domestic loading to resume before concluding new deals. Indian refiners are expected to revise bulk and drum cargo prices tomorrow with new prices effective from 16 April. Domestic prices are expected to see a downwards revision in line with import parity pricing.

The extension of the lockdown has further pressured importers that are already sitting on a huge inventory losses. Even if restrictions are loosened from 20 April onwards, road construction activity may see little momentum. Road projects are only expected to pick up after the end of the monsoon season in September.

By Aabha Gandhi

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

South Africa mining lobby gives draft law feedback with concerns

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014