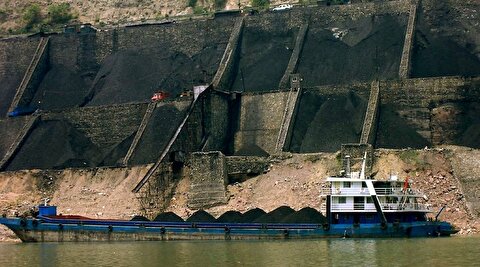

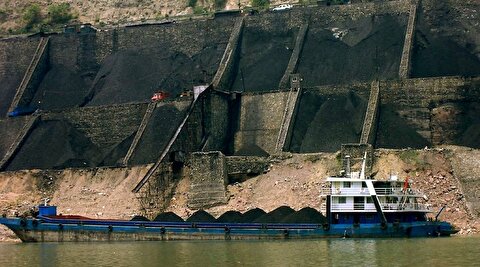

Iran’s coal boosting plan by 2025

Coking coal primarily supplies the needs of steel plants using blast furnace, and Esfahan Steel Company (ESCO) is almost the exclusive customer of the raw material in Iran. Upon setting up a steel plant in near future, Middle East Mines & Mineral Industries Development Holding Co. (MIDHCO) will join in.

Due to the presence of high oil reserves in Iran, thermal coal mines are not taken into account properly. Therefore, the use of thermal coal energy has no place in the country.

Some private-sector manufacturers export the extracted thermal coal to the target markets such as Turkey and Eastern Europian countries.

Generally, coal market is not very thriving in Iran and the main reasons lie in the quality of domestic coal and its monopolistic market.

On the other hand, measures such as setting up coal plants, using Underground Coal Gasification (UCG), as well as producing methane gas are recommended for optimal utilization of coal resources.

According to a Comprehensive Coal Plan defined by Iranian Mines and Mining Industries Development and Renovation Organization (IMIDRO), the overall situation of distribution of coal mines, coal washing and coking workshops are as shown in the below table.

Indeed, there are small mines all over the country with low reserves which are not considered in this report.

At the time being, coal extraction operations in Iran are undertaken based on the traditional methods such as longwall(41%),overhand stoping(38%),cut and fill(11%), open pit(4%),room and pillar (2%),mechanized longwall (1%)and short wall (1%).

As the statistics shows, coal industry in Iran asks for innovation and technology. Thus post-sanctions opportunities should be used to attract investors and technology companies.

Currently, the nominal production capacity of coal in Iran is about 4.1mt, while the production is almost 2.7mt.

Over the preceding Iranian year (ended March 19, 2016), domestic companies have produced a total amount of one million and 470 thousand tonnes of coal showing a low growth (1.43) compared to the previous year.

As projected, the uptrend will continue in the current Iranian calendar year (ended March 19, 2017) and the figure will reach over 1.5mt.

Statistics released by Islamic Republic of Iran Customs suggests that of the total $4.4bn imports in the mining sector in the preceding year, about 1.4% was owned by coal and coke. In other words, ESCO has imported almost a half of its 2mt demand.

Concurrently, the contribution of coal and coke (mostly thermal coal) to $7bn exports in mining industry was 1%.

Coal supply chain in Iran ends in Zarand and Kerman cocking companies, as well as ESCO. This has always caused financial problems for coal producers.

According to the Statistical Center of Iran, the total number of active mines in the country is 5,355 and of these 100 units belongs to coal mines. The figure suggests that coal mines account for1.86% of the total Iranian mines.

Based on the Comprehensive Steel Plan, if the capacity of 55mt steel is realized, the share of blast furnace method will be about 6mt.

Given that for per tonne of cast iron and steel about 550kg and 22kg coke is respectively consumed, Iran requires 6.2mt concentrate coal by 2025.

High priority will be given to Tabas for the supply of coking coal as the region holds over 324mt minable reserves. Granted that the coal power plant will be launched, Iran will call for a total amount of 8.6mt thermal coal per annum.

Concerning the above estimations, as well as the quality of Iran’s reserves, imports of 15% to 20% high-quality coal concentrate should be included in the plans. As a result, in order to achieve the objectives of power plants and Comprehensive Steel Plan, Iran’s coal industry seeks precise implementation of development projects and coming up with new projects.

Utilizing new mechanized methods and new technologies in order to enhance the quality of the produced coal is also a top priority defined in the sector.

Gold price inches higher with spotlight on US-China trade talks

Rio Tinto faces major engineering change at Oyu Tolgoi

Ontario fast-tracks controversial mining law

Trump confirms rare earth deal with China

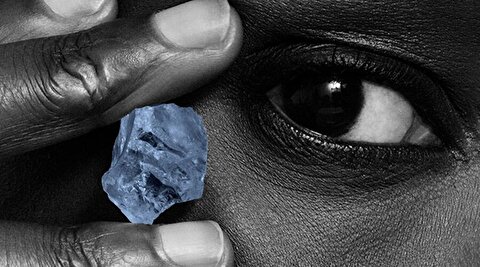

Petra Diamonds rethinks sales tactics as market slump drags on

Talon Metals plummets as it prices financing at discount to fund nickel project

US lawmakers push for comprehensive audit of Fort Knox gold

Ivanhoe slashes 2025 copper guidance by 28% following DRC mine restart

Rare earth startups eye slice of $1 billion bounty from Brazil

Condor-Teck copper project in Peru receives environmental approval

KORITE acquisition in Alberta creates world’s only mine-to-market ammolite producer

Gold price extends rally following Israeli attack on Iran

Dundee Precious Metals to buy Adriatic in $1.25B deal

Perseus forecasts 2.7 million oz. gold production over five years

China coal imports could drop by up to 100mt in 2025, industry group says

Rare earth startups eye slice of $1 billion bounty from Brazil

Gold surpasses euro as second-largest reserve asset: European Central Bank

Glencore halted some cobalt deliveries over Congo export ban

Resolution stakes claim in US critical minerals market

KORITE acquisition in Alberta creates world’s only mine-to-market ammolite producer

Gold price extends rally following Israeli attack on Iran

Perseus forecasts 2.7 million oz. gold production over five years

China coal imports could drop by up to 100mt in 2025, industry group says

Rare earth startups eye slice of $1 billion bounty from Brazil

Gold surpasses euro as second-largest reserve asset: European Central Bank

Glencore halted some cobalt deliveries over Congo export ban

Resolution stakes claim in US critical minerals market

Ivanhoe slashes 2025 copper guidance by 28% following DRC mine restart