Copper output at Ivanhoe’s Congo mine jumps in second quarter

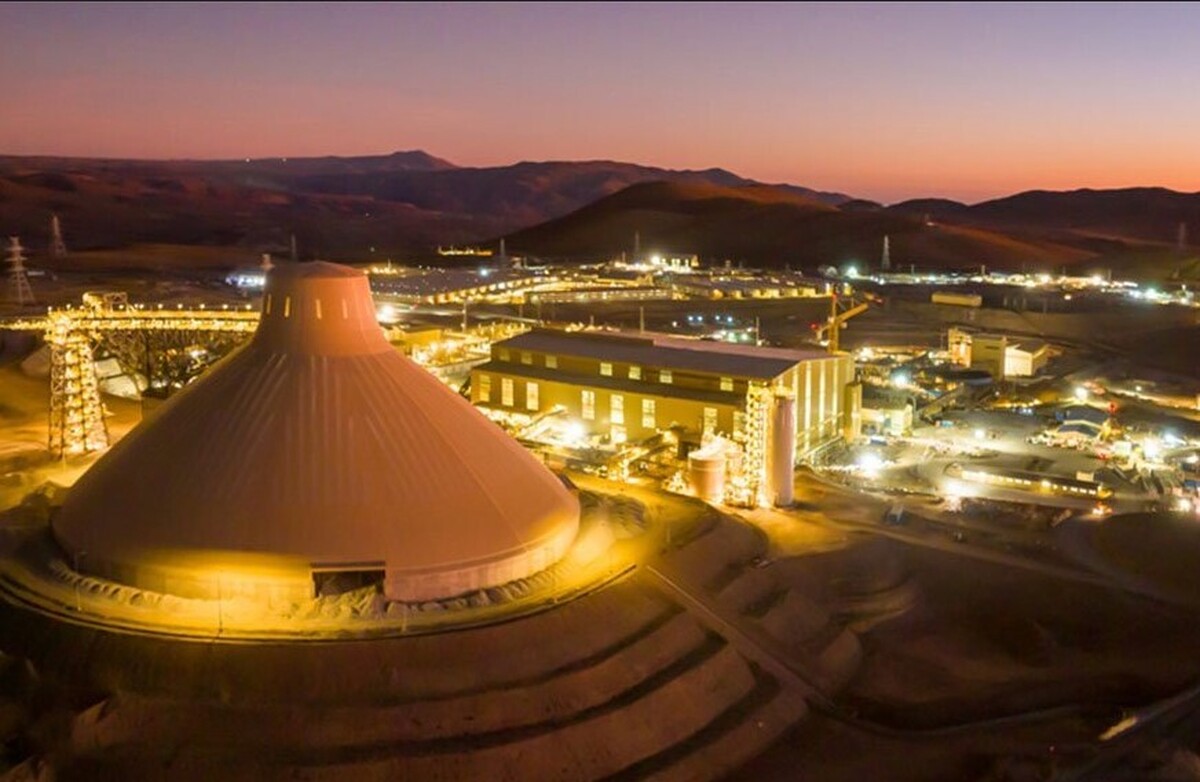

According to me-metals cited from mining.com, Output rose despite seismic challenges that disrupted operations earlier this year. The Canadian miner resumed operations in June and cut its 2025 production guidance by nearly 30% to between 370,000 tons and 420,000 tons.

“Ivanhoe’s rapid ramp-up and steady outlook underscore Kamoa-Kakula’s position as one of the lowest-cost, highest-margin copper producers globally,” said Zack Hartwanger, senior Africa commercial officer at commodity trader Open Mineral.

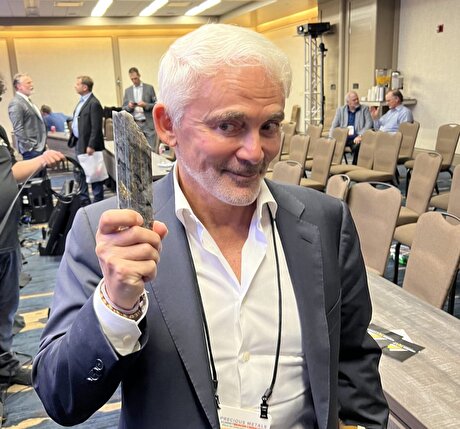

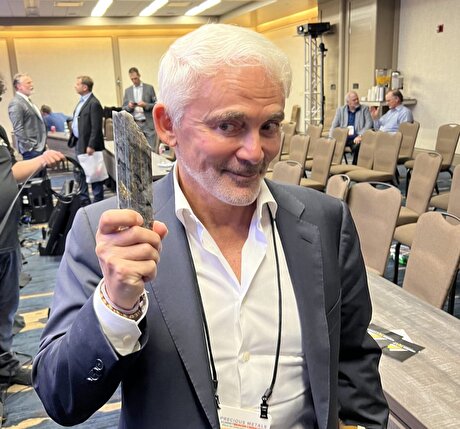

“Operational recovery plans are well underway at Kamoa-Kakula,” said Ivanhoe executive co-chairman Robert Friedland.

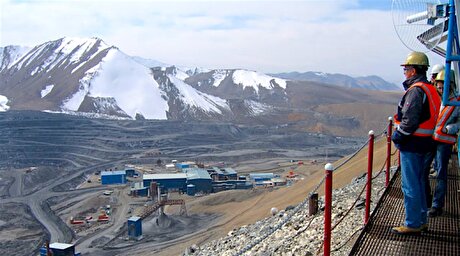

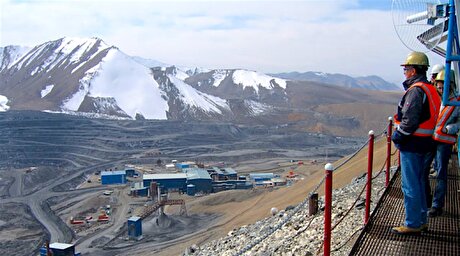

Ivanhoe has started mining lower-grade areas on the western side of Kakula and is currently producing ore containing 3-4% copper, while implementing a two-stage de-watering program to access flooded eastern sections.

Mining operations on the western side restarted in early June, ramping up to 300,000 tons per month by mid-June, according to the statement.

The company said it was investing $70 million in high-capacity de-watering infrastructure, with five submersible pumps arriving from China next month.

Mining in higher-grade areas of approximately 5% copper on the western side will resume by year-end, Ivanhoe said.

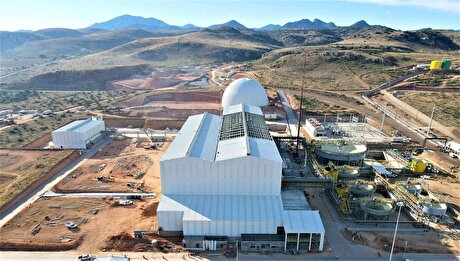

The operational turnaround comes as Kamoa-Kakula prepares for the September ramp up of its 500,000-ton-per-annum copper concentrate facility.

First anode production from the facility is expected in October. The facility will transform the operation from a concentrate exporter to a producer of 99.7% pure copper anodes, the company said.

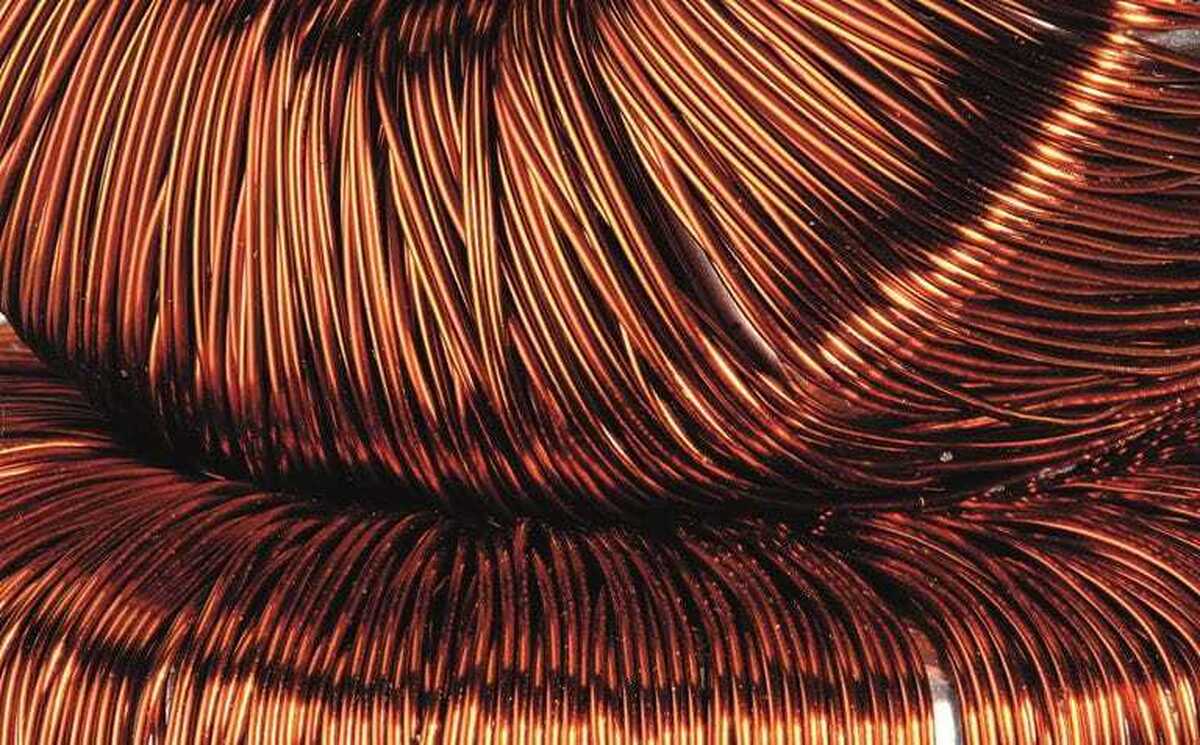

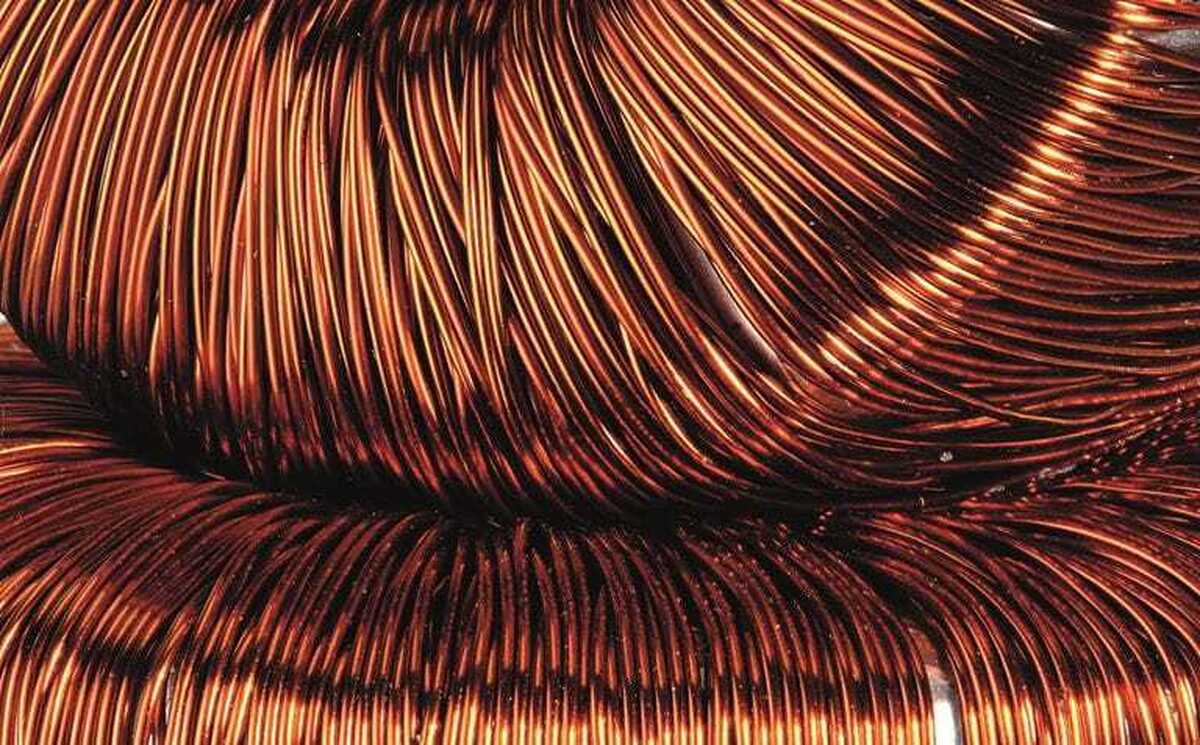

The Kamoa-Kakula complex is one of the world’s largest copper mines, crucial for global supply amid rising demand for the energy transition metal.

Copper prices have risen more than 8% so far this year compared to the same period last year.

source: mining.com

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Pan American locks in $2.1B takeover of MAG Silver

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Nevada army depot to serve as base for first US strategic minerals stockpile

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook