Glencore to sell Philippine copper smelter to Villar family

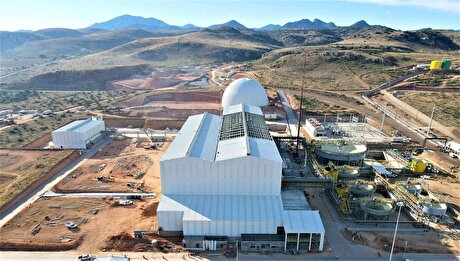

According to me-metals cited from mining.com, The asset in question, the Philippine Associated Smelting and Refining Corp. (Pasar), has long served as a key logistics hub for Glencore. Strategically located, it handles copper concentrate shipments from Australia and Indonesia, and occasionally distressed cargoes bound from South America to China.

But global copper smelters, including Pasar, have been hit hard by a steep drop in treatment and refining charges, driven by overcapacity and limited supply of mined ore. In February, Glencore placed Pasar on care and maintenance, part of a broader restructuring of its global smelting operations.

That overhaul includes consolidating its Canadian copper assets in Quebec and several recycling facilities in the United States into its global zinc smelting division. The move aims at cutting costs and streamlining operations.

The divestment marks another step in Glencore’s sweeping review of its copper and zinc assets, triggered by a sustained slump in profitability across the sector.

Villar, whose net worth is pegged at $17 billion by Forbes, controls the Philippines’ largest homebuilder. His business empire spans shopping malls, broadcast media, hardware retail and supermarkets.

Bloomberg first reported the sale, quoting people familiar to the matter, though details including the deal’s value remain undisclosed.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Pan American locks in $2.1B takeover of MAG Silver

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Nevada army depot to serve as base for first US strategic minerals stockpile

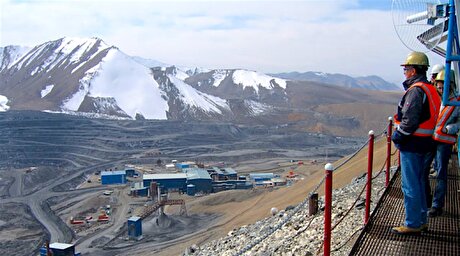

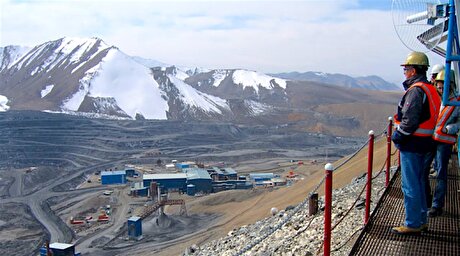

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook