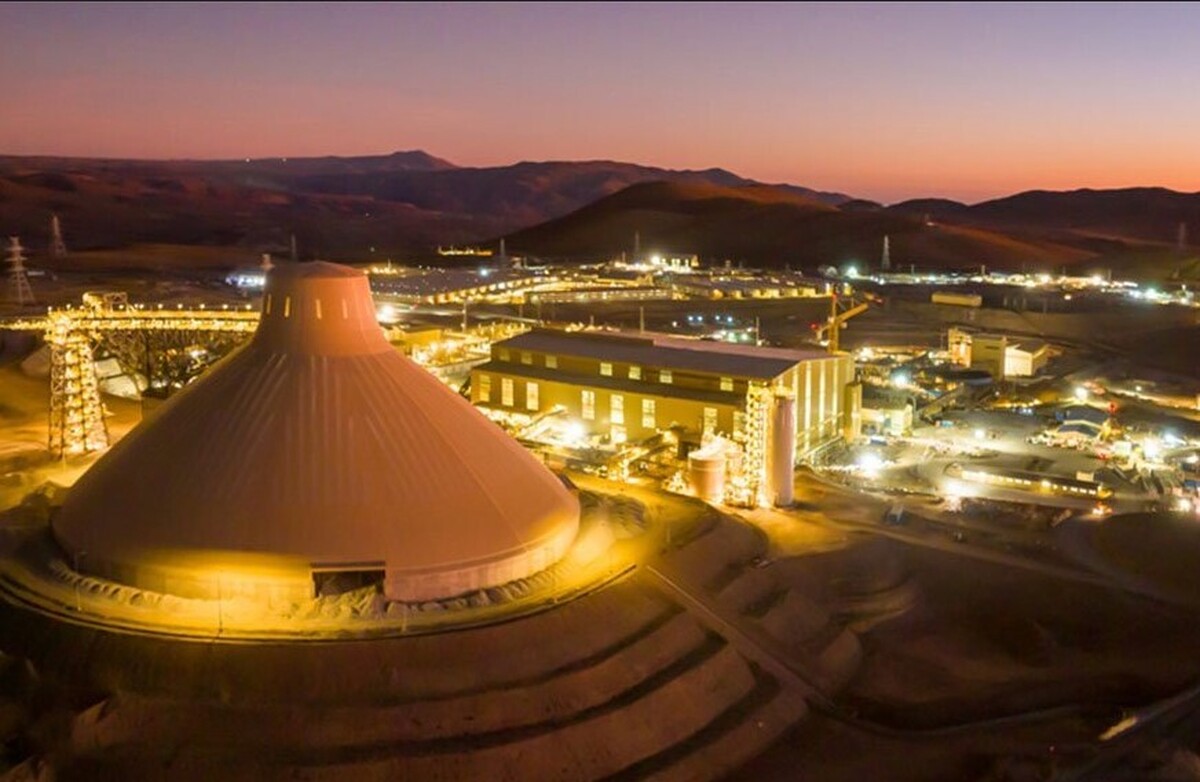

Copper price pulls back sharply ahead of US tariff deadline

According to me-metals cited from mining.com, The most active copper futures on the COMEX fell by nearly 3% to $5.613/lb., a sharp pullback following a record-setting rise last week that saw prices approach the $6/lb. level.

In London, the benchmark three-month copper contract was down more than 1% at $9769.50/t, having risen by 0.6% earlier to $$9,824.50/t.

The decline comes just days before the official implementation of a 50% US tariff on the industrial metal, the details of which remain unclear ahead of the planned start on August 1.

The Trump’s administration so far has yet to confirm the important aspects of the duties, including which products will be covered, whether supplies from all nations will be hit equally, or how metal already on its way to US shores will be treated.

In anticipation of the tariff deadline, global traders have been shipping massive amounts of copper to the US, triggering a last-minute scramble and a spike in prices earlier this month. While copper prices in the US are now much higher than those in London, they still do not fully reflect the 50% universal tariff rate.

Further important developments lie ahead this week, as the Federal Reserve is expect to keep rates unchanged at the conclusion of its policy meeting on Wednesday, but its commentary will be scrutinized for clues on what comes next.

source: mining.com

twenty-two Hours ago

twenty-two Hours ago

NexMetals receives EXIM letter for potential $150M loan

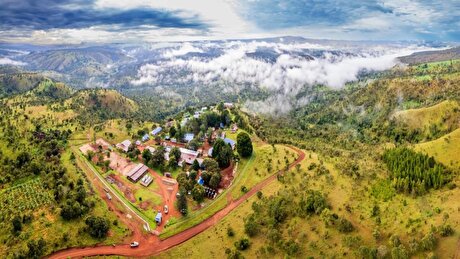

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

BHP delays Jansen potash mine, blows budget by 30%

BHP, Lundin JV extends useful life of Argentina copper mine

Gold price eases after Trump downplays clash with Fed chair Powell

KoBold signs Congo deal to boost US mineral supply

Teck approves $2.4B expansion of Highland Valley Copper

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Copper price pulls back sharply ahead of US tariff deadline

Teck approves $2.4B expansion of Highland Valley Copper

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell